Indeependent

Diamond Member

- Nov 19, 2013

- 73,633

- 28,500

- 2,250

We told you he loves you.And yet, he is still YOUR PRESIDENT!Donald Trump has built an industry of manufacturing of lies and fake reality while accumulating the fare to this ride on the poop-chute of history.

Donald Trump and truth are mutually exclusive.

The only growth in manufacturing that has occurred during Trump's tenure is the manufacturing of lies and fake reality.

The current parlous state of US economic growth is fed by a burgeoning budget deficit.

The truth is that despite Trump's tax cuts for the wealthy, the US economy is running on credit and building up debt that may become unpayable if foreign investors pull out of US$ investments and bonds.

Trump Says U.S. Economy Is 'Best It Has Ever Been,' But Facts Tell A Different Story

Trump Says U.S. Economy Is 'Best It Has Ever Been,' But Facts Tell A Different Story

Yuwa Hedrick-Wong

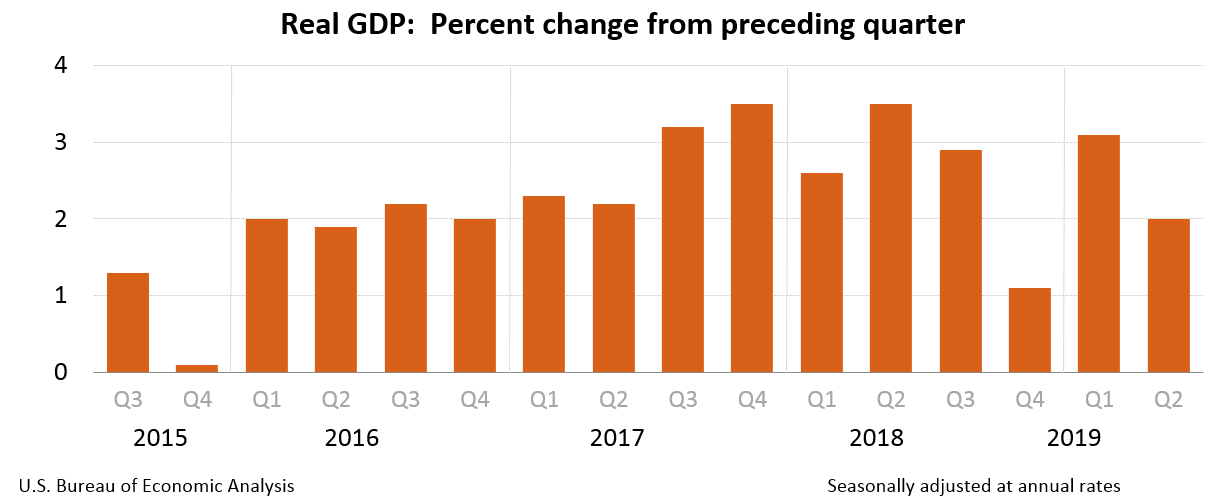

The current economic expansion in the U.S. is the longest uninterrupted period of growth in its modern recorded history. A development that President Trump has wasted few opportunities to highlight, tweeting just this week "our economy is the best it has ever been. Best employment and stock market numbers ever." Trump’s boasting, apart from the usual inaccuracy, is at odds with the reality of a surprisingly fragile U.S. economy.

To begin with, while the current expansion may be the longest on record, it is also the weakest. Since 2009, the economy has grown by only 25%, which compares poorly against the much shorter periods of expansion in the 1980s and the 1990s, which grew by 38% and 43% respectively. Even the record low unemployment rate is also not what it seems. One key reason for low unemployment is because people are dropping out of the labor force, according to the U.S. Department of Labor. This means that many American workers, chiefly the less educated and low skilled, have become so discouraged that they have simply given up looking for a job. The economy is not creating jobs that they can fill, while companies are complaining about shortages of skilled workers. As a result, households’ finance remains extremely precarious; a shocking four in ten American adults would not be able to cover an unexpected $400 expense with cash or saving, according to research by the Federal Reserve. As troubling as these economic findings are, the fragility of the U.S. economy runs even deeper.

Donald J. Trump

✔

@realDonaldTrump

Big Rally tonight in Greenville, North Carolina. Lots of great things to tell you about, including the fact that our Economy is the best it has ever been. Best Employment & Stock Market Numbers EVER. I’ll talk also about people who love, and hate, our Country (mostly love)! 7M

106K

7:46 PM - Jul 17, 2019

Twitter Ads info and privacy

42.3K people are talking about this

Today In: Asia

High debt and low investment are an albatross around the U.S. economy’s neck. Corporate debt in the U.S. has reached $9.4 trillion—equivalent to 46% of GDP, according to the Federal Reserve, which matches the previous peak set in 2007 just before the global financial crisis erupted. Business investment, on the other hand, has remained flat despite the Trump tax cuts, which between 2016 and 2018 roughly halved the effective tax rate for companies on the S&P 500.

PROMOTED

The Garmin Forerunner 645 Is Now $95 Off

Grads of Life BRANDVOICE

More Than What’s On Paper: The Power of Initiative

Grads of Life BRANDVOICE

More Than What’s On Paper: The Power of Initiative

More On Forbes: Global 2000: The World's Largest Public Companies 2019

This combination of rising debt and low investment is bewildering given the tremendous increase in cash flow to the corporate sector, which the IMF estimates has doubled in S&P 500 companies since 2010. What has corporate America done with its wave of incoming cash? Mostly buy back its own shares. The IMF estimates that S&P 500 companies’ spending on share buybacks as a percentage of assets is double what it was in 2010. Such unproductive spending props up equity valuations while doing nothing to improving economic dynamism.

Why would corporate America load up on debt even as its pockets bulge with cash? Why spend that cash on buying back stock instead of investing it? The answer lies in yet another unfortunate combination: extraordinarily loose monetary policy and declining business competition. Cheap credit has encouraged massive corporate borrowing. In the meantime, American industries have become increasingly dominated by a few large companies, leading to declining competition, as Jonathan Tepper and Denise Hearn documented in their 2018 book The Myth of Capitalism: Monopolies and the Death of Competition.

Many sectors in the American economy are showing oligopolistic or even monopolistic characteristics. Companies enjoying such market power become rent-seekers, not risk-takers.

More On Forbes: This Hedge Fund Superstar Thinks Climate Change Will Impact All Your Investments — And Soon

When they do spend, they splurge on share buybacks or on mergers and acquisitions that boost their market share by nipping potential competition in the bud. Cheap credit and a dearth of competition are in turn gumming up the machinery of the market economy.

The highly leveraged companies this creates have become one of the weakest links in the economy. Their debts have fed a fast-growing market for collateralized loan obligations, or CLOs—assets that package up the high-yielding loans taken on by companies with poor collateral and uncertain income. This bears an eerie resemblance to the collateralized debt obligations, or CDOs, blamed for triggering the global financial crisis.

Federal Reserve Chairman Jerome Powell, however, assured markets in May that the growth of CLOs isn’t a serious problem. At some point, however, America’s corporate sector will have to wean itself from its addiction to cheap credit. It’s then that the economy’s deep and surprising fragility will be fully exposed.

Not for long. His baggage of crimes and dirt is getting too heavy for him.

And yet, he is still YOUR PRESIDENT!

Donald Trump loves the uneducated.