- Mar 11, 2015

- 77,069

- 34,259

- 2,330

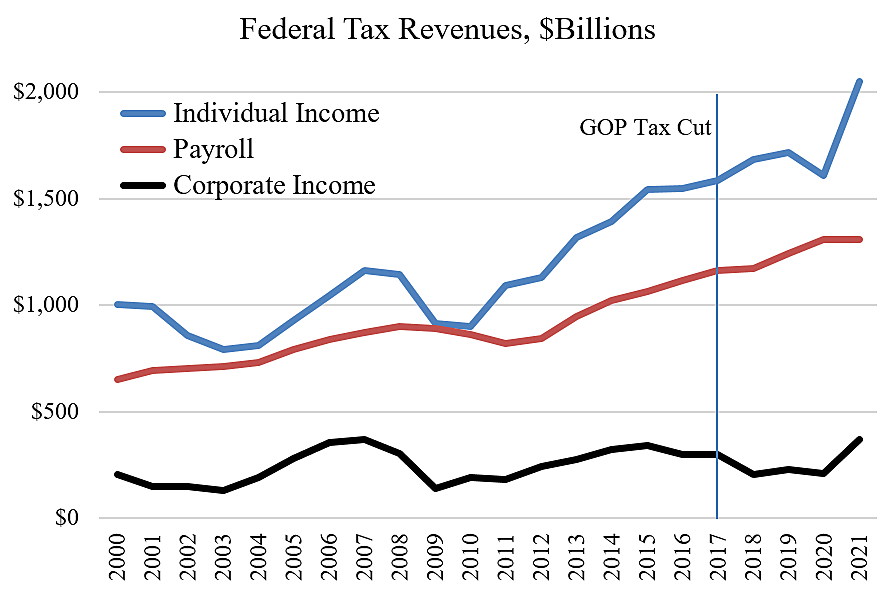

He made the tax cuts to end in 2025 because he thought he would get a second term. But now they about about to end.

When 2025 draws to a close, so will many of the sweeping Trump-era GOP tax breaks established by the Tax Cuts and Jobs Act (TCJA) of 2017. While the legislation made some tax cuts to corporate profit permanent, lowered individual tax rates will expire on Dec. 31, 2025, and will revert to pre-TCJA levels.

When 2025 draws to a close, so will many of the sweeping Trump-era GOP tax breaks established by the Tax Cuts and Jobs Act (TCJA) of 2017. While the legislation made some tax cuts to corporate profit permanent, lowered individual tax rates will expire on Dec. 31, 2025, and will revert to pre-TCJA levels.