- Mar 9, 2011

- 69,817

- 83,364

- 3,635

....why didn't President Biden roll them back when the Democrats had control of the House and Senate for two years? I mean, it's not like they didn't have the opportunity to do that. Pelosi was the House leader and Schumer was the Senate leader then, so they could have easily overturned the Trump tax cuts, but they didn't. In fact, they don't expire until 2025.

Remember all the wailing and gnashing of the teeth from the left, how the tax cuts only benefited the rich? Was that just another Democrat lie? Apparently it was just one more in a long string of Democrat lies.

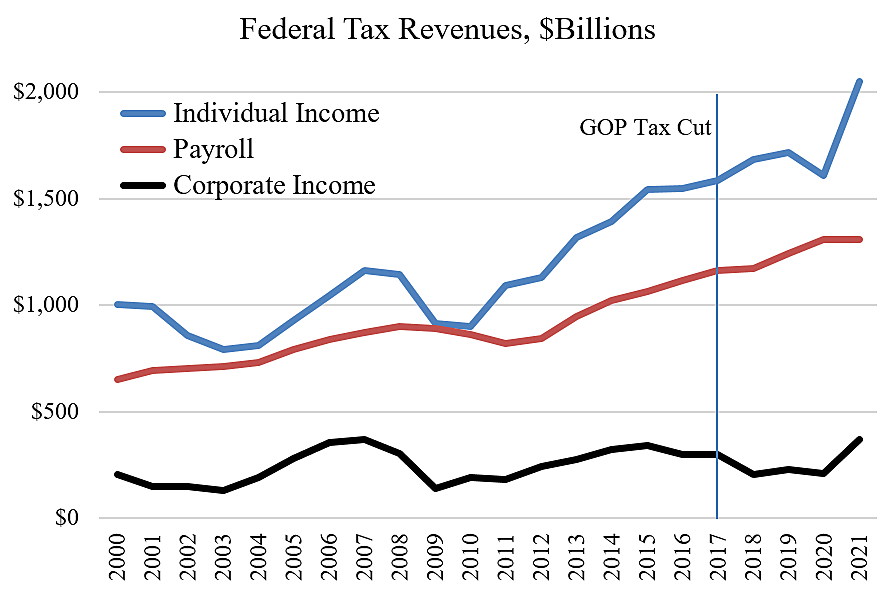

"Tax cuts signed into law in 2017 by then-President Donald Trump have raised revenues for the federal government over the last five years, despite concerns among Democrats and other critics that the cuts would be a fiscal nightmare only benefiting the rich.

The government collected a record $4.9 trillion in revenue last year, according to the latest report from the Congressional Budget Office, a nonpartisan federal agency. That's nearly $500 billion higher than what the CBO had projected.

Receipts from corporate income taxes, meanwhile, were $425 billion, exceeding CBO's projection by 25%, while receipts from individual income taxes were $2.6 trillion, exceeding CBO's projection by 11%.

Federal revenues are now up about $1.5 trillion, or roughly 40%, since the Trump tax cuts went into effect at the beginning of 2018. By comparison, the cuts were initially estimated to cost the government $1 trillion, according to the Joint Committee on Taxation."

Federal revenue continues to soar with Trump tax cuts, CBO report shows

"The reforms are set to expire – and certain provisions have already expired – in 2025. Unless the Congress moves to make the 2017 tax reforms permanent, Americans will suffer colossal tax increases crushing small businesses and family budgets.

The 2017 tax cuts delivered results for the American people, despite fierce opposition and false predictions of economic ruin. Opposition to the tax cut plan was intense. It was constant and well organized. At the time, many pundits – both on the right and left – predicted that the Republicans in Congress would cower and (former) President Trump would be forced to fold. It didn’t happen.

“We now have incontrovertible evidence that after five years since they took effect, the Trump tax rate cuts of 2017 raised revenues over this time period. The latest Congressional Budget Office report released earlier [in January] calculated that the federal government collected $4.9 trillion of federal revenue last year. This was up — ready for this? — almost $1.5 trillion since 2017, the year before the tax cuts became law. In other words, revenues were up 40% in five years. The evidence through the first three years of the tax cut finds that the share of taxes paid by the wealthiest 1% rose as well. So much for this being a tax giveaway for the rich.

Even with the Covid crisis and the pandemic lockdowns, the American economy experienced a ‘giant Laffer Curve’ effect from the 2017 tax cuts. In other words, Moore explains “we got higher growth and higher tax payments with lower tax rates.” The 2017 Tax Cuts and Jobs Act delivered good results for the American people."

Tax Armageddon Day Is Coming

Remember all the wailing and gnashing of the teeth from the left, how the tax cuts only benefited the rich? Was that just another Democrat lie? Apparently it was just one more in a long string of Democrat lies.

"Tax cuts signed into law in 2017 by then-President Donald Trump have raised revenues for the federal government over the last five years, despite concerns among Democrats and other critics that the cuts would be a fiscal nightmare only benefiting the rich.

The government collected a record $4.9 trillion in revenue last year, according to the latest report from the Congressional Budget Office, a nonpartisan federal agency. That's nearly $500 billion higher than what the CBO had projected.

Receipts from corporate income taxes, meanwhile, were $425 billion, exceeding CBO's projection by 25%, while receipts from individual income taxes were $2.6 trillion, exceeding CBO's projection by 11%.

Federal revenues are now up about $1.5 trillion, or roughly 40%, since the Trump tax cuts went into effect at the beginning of 2018. By comparison, the cuts were initially estimated to cost the government $1 trillion, according to the Joint Committee on Taxation."

Federal revenue continues to soar with Trump tax cuts, CBO report shows

"The reforms are set to expire – and certain provisions have already expired – in 2025. Unless the Congress moves to make the 2017 tax reforms permanent, Americans will suffer colossal tax increases crushing small businesses and family budgets.

The 2017 tax cuts delivered results for the American people, despite fierce opposition and false predictions of economic ruin. Opposition to the tax cut plan was intense. It was constant and well organized. At the time, many pundits – both on the right and left – predicted that the Republicans in Congress would cower and (former) President Trump would be forced to fold. It didn’t happen.

“We now have incontrovertible evidence that after five years since they took effect, the Trump tax rate cuts of 2017 raised revenues over this time period. The latest Congressional Budget Office report released earlier [in January] calculated that the federal government collected $4.9 trillion of federal revenue last year. This was up — ready for this? — almost $1.5 trillion since 2017, the year before the tax cuts became law. In other words, revenues were up 40% in five years. The evidence through the first three years of the tax cut finds that the share of taxes paid by the wealthiest 1% rose as well. So much for this being a tax giveaway for the rich.

Even with the Covid crisis and the pandemic lockdowns, the American economy experienced a ‘giant Laffer Curve’ effect from the 2017 tax cuts. In other words, Moore explains “we got higher growth and higher tax payments with lower tax rates.” The 2017 Tax Cuts and Jobs Act delivered good results for the American people."

Tax Armageddon Day Is Coming