Jarhead

Gold Member

- Jan 11, 2010

- 20,670

- 2,378

- 245

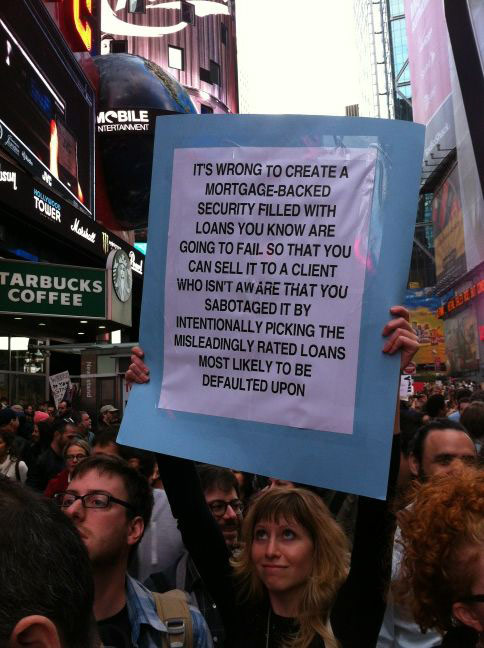

It probably should have read

. I did not read my contract and got a house way above what I can afford. Why dont you just forgive my loans so I can get this house for free

Or even better said...

"It is not my fault that you did not know that I lied on my mortgage application. It is not my fault that I signed that application once at the beginning and four more times at the closing of the loan and when I signed it there was a disclaimer that said that I was swearing to the accuracy of the information I offered to the best of my knowledge. And since it is not my fault that I lied and you believed me then you should go to jail and I should be considered a victim."