Second, Keynes economics has been proven false dozens of times. The great depression was preceded by a massive increase in government spending.

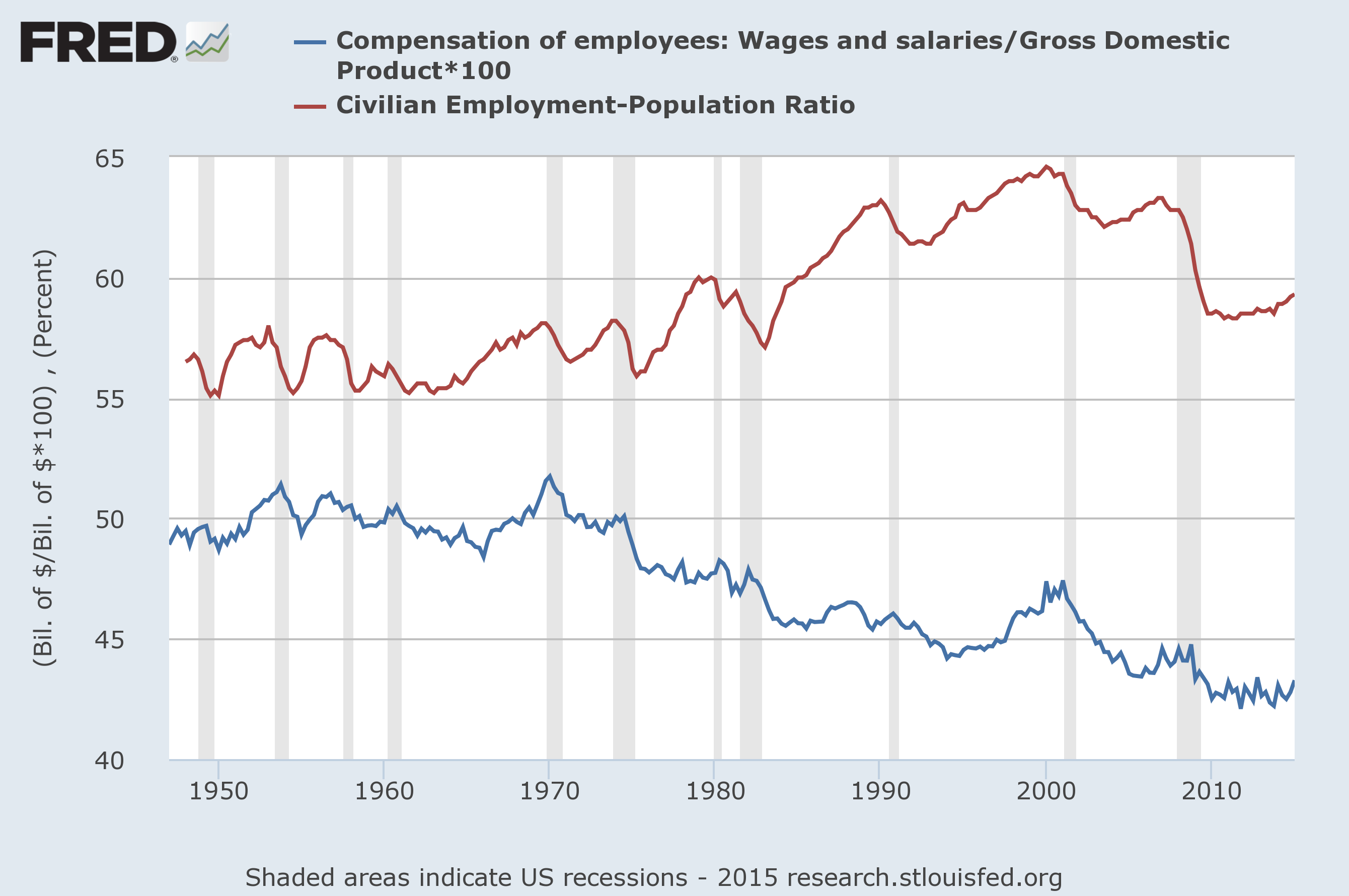

No. Not true, look at the chart. What exploded massively was private debt.

Your chart, does not contradict my statement, nor prove your claims. I'm not sure what you think it proves.

We already went over the fact that correlation, does not equal causation. And we already know that the government pushed sub-prime loans, which resulted in higher private debt.

The fact this X happened, and Y happened, doesn't mean X caused Y. And it certainly doesn't prove without private debt, the economy would have crashed.

Maybe , but then you can see the same happen in Japan, Spain and other countries.

Regardless that doesn't change the fact that money is created when debt is issued and that it slowly disapears when it starts to be repaid.

Then think about this formula:

Consumption = income + new debt - debt payments

That little formula is the proof.

That argument, I never contended with. I agree with that. It's all your other claims surround that, that I disagree with.