Idiot, fear mongering Pubs have power even when not controlling Congress. They had lots of money and fear mongering talking heads then too. Isolation, "common sense" austerity- Pfffft!!

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Top 3 Myths About the Great Depression and the New Deal

- Thread starter bigrebnc1775

- Start date

Bfgrn

Gold Member

- Apr 4, 2009

- 16,829

- 2,492

- 245

They only like right wing rewrites of history

1929-1933 Fed strangles the US Economy nearly to death by decreasing money supply by 1/3, they stopped in 1933.

What a coinkydink!

The Mellon Doctrine

Mr. Mellon had only one formula: Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.

The Federal Reserve took almost no steps to halt the slide into the Great Depression over 192933. Instead, the Federal Reserve acted as if appropriate policy was not to try to avoid the oncoming Great Depression, but to allow it to run its course and liquidate the unprofitable portions of the private economy.

In adopting such liquidationist policies, the Federal Reserve was merely following the recommendations provided by an economic theory of depressions that was in fact common before the Keynesian Revolution and was held by economists like Friedrich Hayek, Lionel Robbins, and Joseph Schumpeter.

FireFly

Bright F**ker

- Oct 17, 2009

- 1,287

- 576

- 263

Unemployment benefits & welfare do not create jobs. They increase unemployment & government dependency.

You are correct sir. Paying able bodied workers to sit idle losing their skills further destroys the economy. The Work Projects Administration (WPA) was far better than the Obamacrats extended unemployment & welfare stupidity. Between 1935 and 1943, the WPA provided almost eight million jobs. It tried to provide one paid job for all families where the breadwinner suffered long-term unemployment.

- Apr 1, 2011

- 169,983

- 47,197

- 2,180

A turn to austerity to "balence the budget" because Rs were saying it was it was more important than recovery

When the economy is propped up with artificial means like the "stimulus" it immediately collapses when those props are yanked away. Government intervention has never worked and it never will.

- Thread starter

- #45

It is a RIGHT WING THINK TANK

Pure Horse shit, It's a pretty Middle of the Road Think Tank. I know, to you anything short of Marxist, is "right wing"

thas about it what I was getting around too.

- Thread starter

- #46

How people get sucked into believing this shit works is beyond me

your right how dopes obama's shit work? I haven't seen anything to show that it has.

- Thread starter

- #47

How people get sucked into believing this shit works is beyond me

What year did the FDR Depression end?

The experts now say around 1947

- Thread starter

- #48

A turn to austerity to "balence the budget" because Rs were saying it was it was more important than recovery

Republicans controlled how much of Congress in 1937?

Take your time.

still waiting

still waiting- Thread starter

- #49

Idiot, fear mongering Pubs have power even when not controlling Congress. They had lots of money and fear mongering talking heads then too. Isolation, "common sense" austerity- Pfffft!!

if only FDR would have done he job instead of being a dictator the economy would have strengthen.

Wry Catcher

Diamond Member

- Banned

- #50

I'm wondering why it was updated in 2010?

They only like right wing rewrites of history

1929-1933 Fed strangles the US Economy nearly to death by decreasing money supply by 1/3, they stopped in 1933.

What a coinkydink!

^^^^^^^^^^^^^

This.

bump

- Banned

- #53

So, the depression was more created for Hoover than by him, huh?They only like right wing rewrites of history

1929-1933 Fed strangles the US Economy nearly to death by decreasing money supply by 1/3, they stopped in 1933.

What a coinkydink!

^^^^^^^^^^^^^

This.

Bfgrn

Gold Member

- Apr 4, 2009

- 16,829

- 2,492

- 245

So, the depression was more created for Hoover than by him, huh?1929-1933 Fed strangles the US Economy nearly to death by decreasing money supply by 1/3, they stopped in 1933.

What a coinkydink!

^^^^^^^^^^^^^

This.

The Mellon Doctrine

Mr. Mellon had only one formula: Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.

The Federal Reserve took almost no steps to halt the slide into the Great Depression over 192933. Instead, the Federal Reserve acted as if appropriate policy was not to try to avoid the oncoming Great Depression, but to allow it to run its course and liquidate the unprofitable portions of the private economy.

In adopting such liquidationist policies, the Federal Reserve was merely following the recommendations provided by an economic theory of depressions that was in fact common before the Keynesian Revolution and was held by economists like Friedrich Hayek, Lionel Robbins, and Joseph Schumpeter.

Hey Jethro, NOW we know what country used Austrian economics...It was the BIGGEST disaster in HISTORY!!!

Bfgrn

Gold Member

- Apr 4, 2009

- 16,829

- 2,492

- 245

Economic Policy Under Hoover

Throughout this declinewhich carried real GNP per worker down to a level 40 percent below that which it had attained in 1929, and which saw the unemployment rise to take in more than a quarter of the labor forcethe government did not try to prop up aggregate demand. The only expansionary fiscal policy action undertaken was the Veterans Bonus, passed over President Hoovers veto. That aside, the full employment budget surplus did not fall over 192933.

The Federal Reserve did not use open market operations to keep the nominal money supply from falling. Instead, its only significant systematic use of open market operations was in the other direction: to raise interest rates and discourage gold outflows after the United Kingdom abandoned the gold standard in the fall of 1931.

This inaction did not come about because they did not understand the tools of monetary policy. This inaction did not come about because the Federal Reserve was constrained by the necessity of defending the gold standard. The Federal Reserve knew what it was doing: it was letting the private sector handle the Depression in its own fashion. It saw the private sectors task as the liquidation of the American economy. It feared that expansionary monetary policy would impede the necessary private-sector process of readjustment.

Contemplating in retrospect the wreck of his countrys economy and his own presidency, Herbert Hoover wrote bitterly in his memoirs about those who had advised inaction during the downslide:

The leave-it-alone liquidationists headed by Secretary of the

Treasury Mellon felt that government must keep its hands off and

let the slump liquidate itself. Mr. Mellon had only one formula:

Liquidate labor, liquidate stocks, liquidate the farmers, liquidate

real estate. He held that even panic was not altogether a bad

thing. He said: It will purge the rottenness out of the system. High

costs of living and high living will come down. People will work

harder, live a more moral life. Values will be adjusted, and

enterprising people will pick up the wrecks from less competent

people.

Throughout this declinewhich carried real GNP per worker down to a level 40 percent below that which it had attained in 1929, and which saw the unemployment rise to take in more than a quarter of the labor forcethe government did not try to prop up aggregate demand. The only expansionary fiscal policy action undertaken was the Veterans Bonus, passed over President Hoovers veto. That aside, the full employment budget surplus did not fall over 192933.

The Federal Reserve did not use open market operations to keep the nominal money supply from falling. Instead, its only significant systematic use of open market operations was in the other direction: to raise interest rates and discourage gold outflows after the United Kingdom abandoned the gold standard in the fall of 1931.

This inaction did not come about because they did not understand the tools of monetary policy. This inaction did not come about because the Federal Reserve was constrained by the necessity of defending the gold standard. The Federal Reserve knew what it was doing: it was letting the private sector handle the Depression in its own fashion. It saw the private sectors task as the liquidation of the American economy. It feared that expansionary monetary policy would impede the necessary private-sector process of readjustment.

Contemplating in retrospect the wreck of his countrys economy and his own presidency, Herbert Hoover wrote bitterly in his memoirs about those who had advised inaction during the downslide:

The leave-it-alone liquidationists headed by Secretary of the

Treasury Mellon felt that government must keep its hands off and

let the slump liquidate itself. Mr. Mellon had only one formula:

Liquidate labor, liquidate stocks, liquidate the farmers, liquidate

real estate. He held that even panic was not altogether a bad

thing. He said: It will purge the rottenness out of the system. High

costs of living and high living will come down. People will work

harder, live a more moral life. Values will be adjusted, and

enterprising people will pick up the wrecks from less competent

people.

- Thread starter

- #56

Economic Policy Under Hoover

Throughout this declinewhich carried real GNP per worker down to a level 40 percent below that which it had attained in 1929, and which saw the unemployment rise to take in more than a quarter of the labor forcethe government did not try to prop up aggregate demand. The only expansionary fiscal policy action undertaken was the Veterans Bonus, passed over President Hoovers veto. That aside, the full employment budget surplus did not fall over 192933.

The Federal Reserve did not use open market operations to keep the nominal money supply from falling. Instead, its only significant systematic use of open market operations was in the other direction: to raise interest rates and discourage gold outflows after the United Kingdom abandoned the gold standard in the fall of 1931.

This inaction did not come about because they did not understand the tools of monetary policy. This inaction did not come about because the Federal Reserve was constrained by the necessity of defending the gold standard. The Federal Reserve knew what it was doing: it was letting the private sector handle the Depression in its own fashion. It saw the private sectors task as the liquidation of the American economy. It feared that expansionary monetary policy would impede the necessary private-sector process of readjustment.

Contemplating in retrospect the wreck of his countrys economy and his own presidency, Herbert Hoover wrote bitterly in his memoirs about those who had advised inaction during the downslide:

The leave-it-alone liquidationists headed by Secretary of the

Treasury Mellon felt that government must keep its hands off and

let the slump liquidate itself. Mr. Mellon had only one formula:

Liquidate labor, liquidate stocks, liquidate the farmers, liquidate

real estate. He held that even panic was not altogether a bad

thing. He said: It will purge the rottenness out of the system. High

costs of living and high living will come down. People will work

harder, live a more moral life. Values will be adjusted, and

enterprising people will pick up the wrecks from less competent

people.

Care to explain why other countries were coming out of the depression whil the U.S. continued years into it? It is your task if you choose, to show that what FDR did help to strengthen the economy, and to show tat WWII got us out of the depression. Real wealth not inflated wealth. As was mentioned in the vido by definitionwars do not create real wealth it destroies it.

Old Rocks

Diamond Member

Obama's Director of the White House National Economic Council & Clinton's Secretary of the Treasury Lawrence Summers at 22:00 in video

"If Hitler had not come along, Franklin Roosevelt would have left office in the beginning of 1941 with an unemployment rate in excess of 15% and an economic recovery strategy that had basically failed."

Democrat's hero John Maynard Keynes

"Nor should the argument seem strange that taxation may be so high as to defeat its object, and that, given sufficient time to gather the fruits, a reduction of taxation will run a better chance than an increase of balancing the budget."

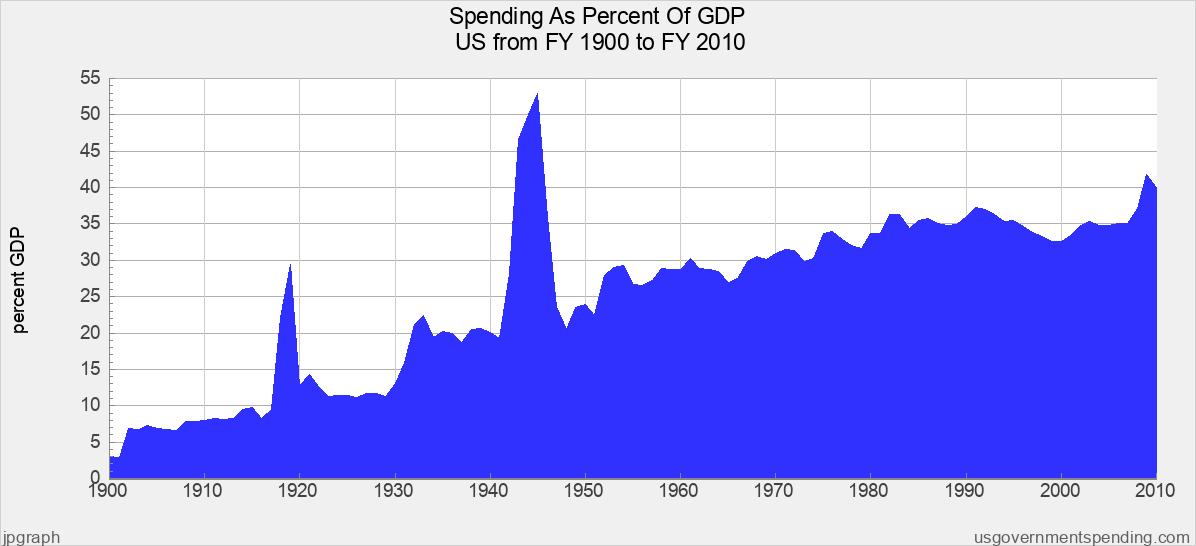

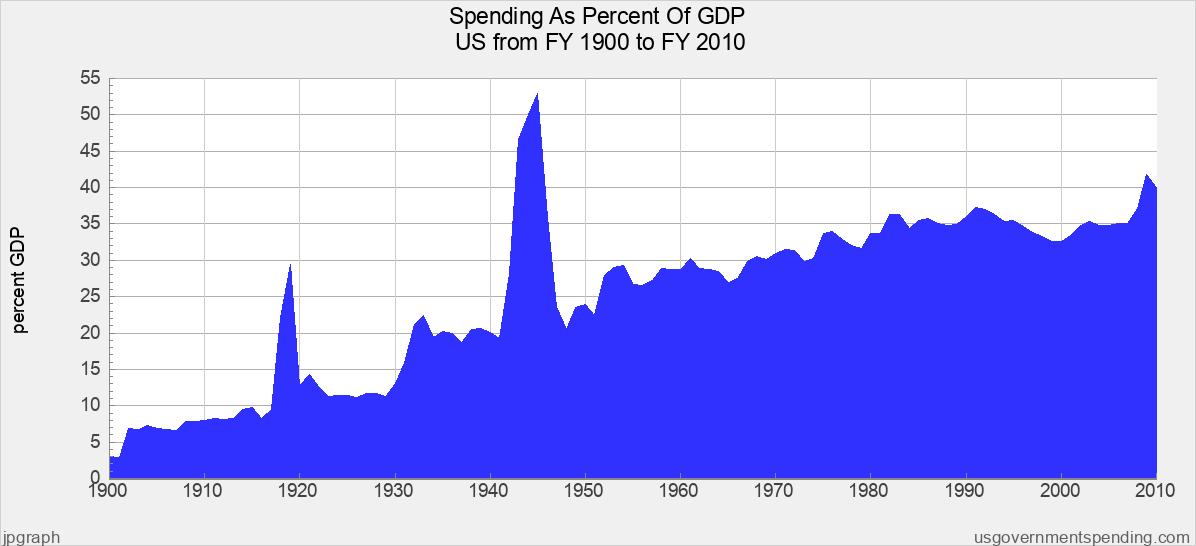

Government spending is now 47% of GDP & growing. In 2000 it was only 36.14% of GDP. We are now just 3% away from being a government controlled economy. That is the level we spiked to during WWII at the end of the great depression. Now government just remains at depression era spending levels & the economy is tanking.

Democrats scream that government has been cut to the bone over the last 20 years since Regan but the fact is government spending as percent of GDP rose under Regan, Bush & Bush. It only fell under Clinton.

It fell under Kennedy. Look at the graph.

- Thread starter

- #58

Obama's Director of the White House National Economic Council & Clinton's Secretary of the Treasury Lawrence Summers at 22:00 in video

"If Hitler had not come along, Franklin Roosevelt would have left office in the beginning of 1941 with an unemployment rate in excess of 15% and an economic recovery strategy that had basically failed."

Democrat's hero John Maynard Keynes

"Nor should the argument seem strange that taxation may be so high as to defeat its object, and that, given sufficient time to gather the fruits, a reduction of taxation will run a better chance than an increase of balancing the budget."

Government spending is now 47% of GDP & growing. In 2000 it was only 36.14% of GDP. We are now just 3% away from being a government controlled economy. That is the level we spiked to during WWII at the end of the great depression. Now government just remains at depression era spending levels & the economy is tanking.

Democrats scream that government has been cut to the bone over the last 20 years since Regan but the fact is government spending as percent of GDP rose under Regan, Bush & Bush. It only fell under Clinton.

It fell under Kennedy. Look at the graph.

Historians would disagree with your opinion on why you negged me. No rewriting of history on my part maybe a coverup of the truth and failure of FDR.

Old Rocks

Diamond Member

Well, I happen to trust real historians rather more than a dingbat rightwing nut on a message board concerning the effects of the actions of a past President. Also the opinions of my Grandfathers, both of whom lived through the Great Depression.

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

er, FDR saved America from the Great Depression...er, Hoover's Laisse Faire policies killed the economy...um FDR's Make Work Plans saved or created tens of million of jobs and kept unemployment low.

....er......the #1 thing, about The Depression was it's CAUSE; Corporate America was allowed to RUN WILD....we allowed The Marketplace to REGULATE ITSELF!!!!

[ame=http://www.youtube.com/watch?v=w6whSWn1RRM]Great Depression - YouTube[/ame]

(Note: This info not presently-available in Texas-approved History text-books.)

[ame=http://www.youtube.com/watch?v=w6whSWn1RRM]Great Depression - YouTube[/ame]

(Note: This info not presently-available in Texas-approved History text-books.)

Similar threads

- Replies

- 40

- Views

- 417

- Replies

- 83

- Views

- 631

- Replies

- 25

- Views

- 536

Latest Discussions

- Replies

- 75

- Views

- 343

- Replies

- 142

- Views

- 1K

- Replies

- 33

- Views

- 99

- Replies

- 226

- Views

- 904

Forum List

-

-

-

-

-

Political Satire 8037

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-