basquebromance

Diamond Member

- Nov 26, 2015

- 109,396

- 27,005

- 2,220

- Banned

- #1

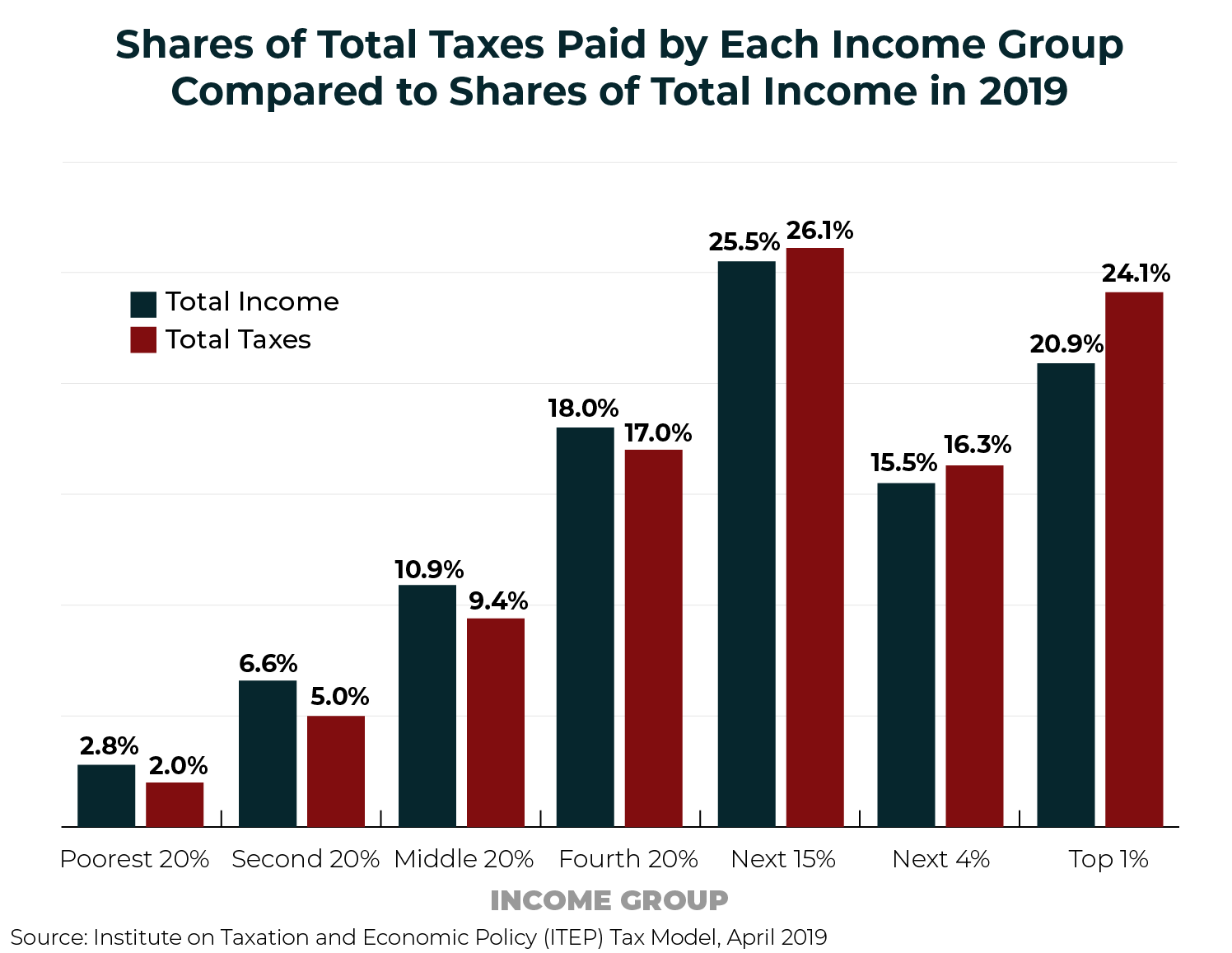

there are the makers and the takers. the middle class are the makers, and the rich and poor are the takers who get a free ride, while the middle class get a lousy MAGA hat, which they can't wear now that Trump is out of office

www.foreignaffairs.com

www.foreignaffairs.com

edition.cnn.com

edition.cnn.com

America's Misguided Approach to Social Welfare

The amount of resources the American public and private sectors commit to all forms of welfare is massive -- the fifth highest outlay in the world. Yet the American way of distributing that money does less to reduce poverty and inequality than that of virtually any other rich democracy. The...

Why you pay taxes, and rich Americans -- like Donald Trump -- don't always have to

How is it that a millionaire can pay hardly any income taxes -- or none at all -- while most people, earning far less, owe more?