Both sides accuse the other.

The Democrats accuse the Republicans of irresponsibly cutting taxes and spending but massively increasing the national debt.

The Republicans accuse the Democrats of irresponsibly increasing taxes and spending and massively increasing the national debt.

So which is it? Does cutting taxes and spending increase the debt? Or does more taxes and spending increase the debt?

And what is most important? Spending on what is considered important? Or the debt?

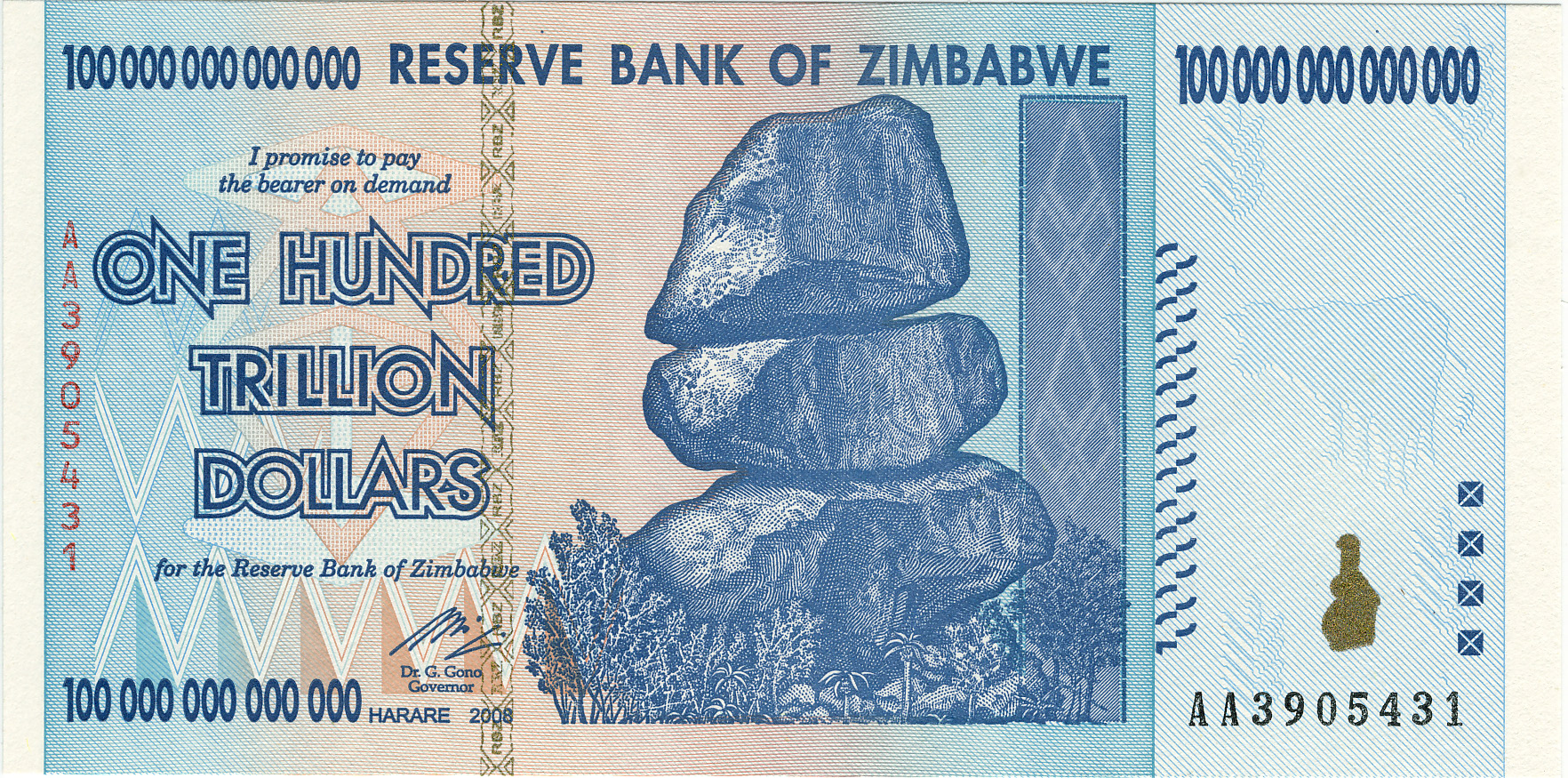

How much national debt can we stand?

And what, if anything, should be done about it? Can be done about it?

The Democrats accuse the Republicans of irresponsibly cutting taxes and spending but massively increasing the national debt.

The Republicans accuse the Democrats of irresponsibly increasing taxes and spending and massively increasing the national debt.

So which is it? Does cutting taxes and spending increase the debt? Or does more taxes and spending increase the debt?

And what is most important? Spending on what is considered important? Or the debt?

How much national debt can we stand?

And what, if anything, should be done about it? Can be done about it?