Truthmatters

Diamond Member

- May 10, 2007

- 80,182

- 2,272

- 1,283

- Banned

- #381

even laffer would be laughing at you

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

What an idiotic observation.And sure, in nominal figures, it increased 76%. That's less than Clinton"s 86% and more than Bush41's 20%, Bush43's 25% and Obamas 10%

Note that in your data that those who had tax cuts tended to have higher revenue growth and the ones who didn't had the lowest. Obama has had the highest tax increases and is at the bottom of revenue growth. And he even started at the bottom of a depression.

Dude, you're obliterating the left's lie that tax cuts reduce revenue and tax increases raise revenue, well done!

Care to back that up with data?anyone who thinks tax cuts ALWAYS bring in more revenue if insane

I don't know where you get 7.9% from? Perhaps it was a typo? The unemployment rate is currently 7.0% and new figures are due to be released in 2 daysMany of you believe The Recovery Act was a failure simply because it fell short of expectations, but that does not mean it was a failure - not by a long shot. Here is a non partisan article that examines the pros and cons of the stimulus and why, for the most part, it was a success. A success that indisputably saved our economy.

Articles debating the successes or failures of President Obamas stimulus package should be of interest to NPQ Newswire readers, given that nonprofits were among the most important intermediaries for and deliverers of stimulus programs. In the upcoming issue of Foreign Policy, TIME Magazines Michael Grunwald suggests that the stimulus was certainly a political failure, but there is voluminous evidence that the stimulus did provide real stimulus, helping to stop a terrifying free-fall, avert a second Depression, and end a brutal recession. Grunwalds long article addresses the pros and cons of the stimulus, some of which is presented below.

PROS:

CONS:

The jobless rate is still over eight percent, the longest run of unemployment over eight percent since the Depression.

Was the Obama Stimulus a Success or a Failure? - NPQ - Nonprofit Quarterly

So essentially what this article is saying that even though the stimulus fell short of expectations, it was still a success. Why? Because it turned our economy free fall (that began with Bush) into JOB GROWTH within months. It is the reason we are even in a recovery. What was the biggest flaw in it? IT WAS TOO SMALL which is actually just more proof that government can and does create jobs. It is also further proof Republicanism is ruining our country. They are reason it was too small!

Is the unemployment rate still high? Of course, how do we fix it? More DEMAND side economic policies like The Recovery Act. Supply side has proven to be a failure. Tax cuts do more harm than good.

What success??

The economy still sucks and UE is at 7.9%.

That might look successfull to you, an Obamabot, but to me, a real person, it sucks.

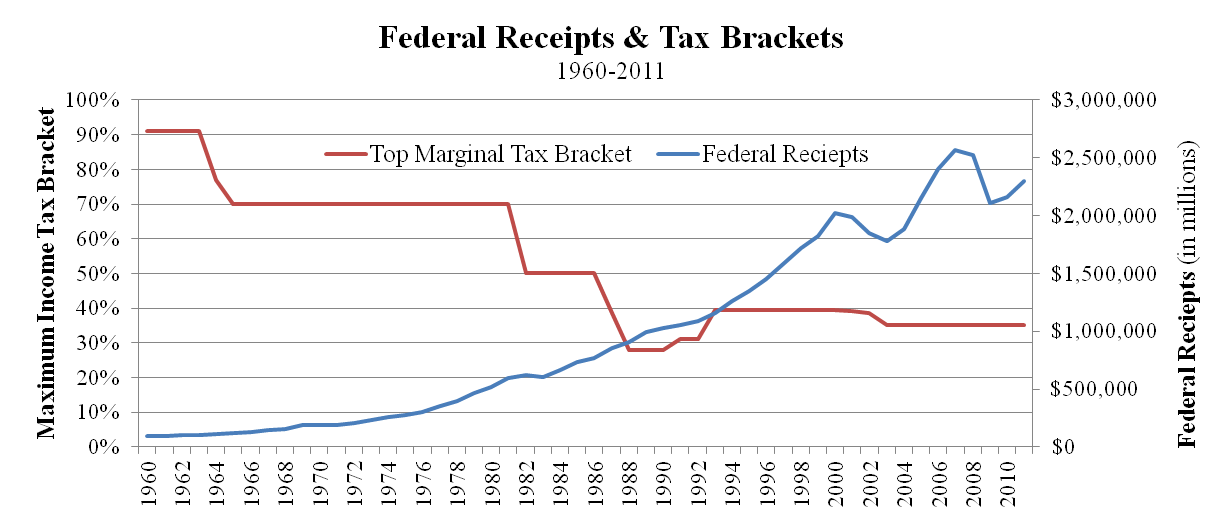

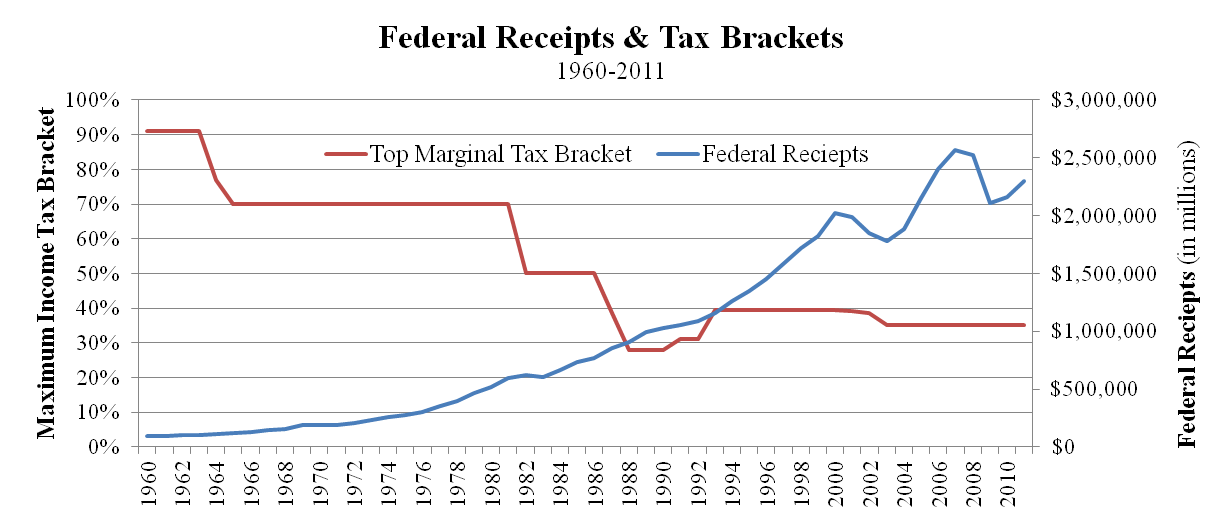

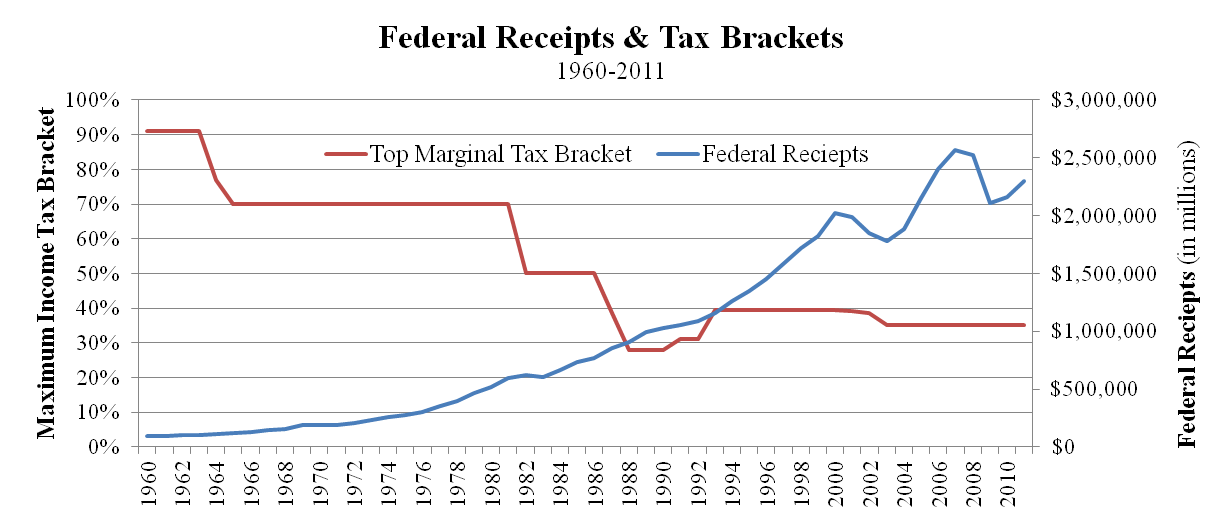

That chart dies not make your point. It's void of cause & effect as It shows revenue increasing whether taxes were lowered, raised, or left alone. It does show a decrease in the year following Reagan's Tax cut as well as during Bush's cuts in 2001, 2002 and 2003. The chart also ignores other taxes beyond income taxes, like the ones Reagan increased; as well as other contributing factors.Care to back that up with data?anyone who thinks tax cuts ALWAYS bring in more revenue if insane

And what is wrong with letting people keep what they've earned? And to hear people like you, you'd think all property belongs to Gubmint...and by their good graces they let YOU keep some of it...

YOU should have never come back...still stupid as ever.

Do Tax Cuts Increase Government Revenue? - Forbes

Um okay what variables? What forces were at work that turned the economy exactly? Explain it.

Let's see....

We can start with the fact that there are several "economies" within an economy.

Next, if I tried to answer that question I'd be guilty of the same thing you are...trying to say what caused the economy to come out of a freefall. I've maintained all along, no one knows and saying the stimulus "did it" is bogus. Nobody really knows.

Why don't you start by looking at the fact that one of the reasons the economy was in freefall was the lack of credit and that our efforts to stop that were relatively unsuccessful.

Government takeover of banks hurt the speed at which things could have recovered (again, we'll never know just how much or how little).

There are about six dozen other key factors that also have an impact.

So stimulus added to our GDP by two percentage points and saved or created 2.5 million jobs but it has nothing to do with the recovery?

This "no one knows" crap you are spewing is ridiculous. This is economics we're talking about, not theoretical physics.

93% of economists say the stim worked.

conversation over

Translation: "I didn't READ the article..." Typical.That chart dies not make your point. It's void of cause & effect as It shows revenue increasing whether taxes were lowered, raised, or left alone. It does show a decrease in the year following Reagan's Tax cut as well as during Bush's cuts in 2001, 2002 and 2003. The chart also ignores other taxes beyond income taxes, like the ones Reagan increased; as well as other contributing factors.Care to back that up with data?anyone who thinks tax cuts ALWAYS bring in more revenue if insane

And what is wrong with letting people keep what they've earned? And to hear people like you, you'd think all property belongs to Gubmint...and by their good graces they let YOU keep some of it...

YOU should have never come back...still stupid as ever.

Do Tax Cuts Increase Government Revenue? - Forbes

Lemme guess ... that chart was put out by the Heritage Foundation?

I don't know where you get 7.9% from? Perhaps it was a typo? The unemployment rate is currently 7.0% and new figures are due to be released in 2 daysMany of you believe The Recovery Act was a failure simply because it fell short of expectations, but that does not mean it was a failure - not by a long shot. Here is a non partisan article that examines the pros and cons of the stimulus and why, for the most part, it was a success. A success that indisputably saved our economy.

PROS:

CONS:

Was the Obama Stimulus a Success or a Failure? - NPQ - Nonprofit Quarterly

So essentially what this article is saying that even though the stimulus fell short of expectations, it was still a success. Why? Because it turned our economy free fall (that began with Bush) into JOB GROWTH within months. It is the reason we are even in a recovery. What was the biggest flaw in it? IT WAS TOO SMALL which is actually just more proof that government can and does create jobs. It is also further proof Republicanism is ruining our country. They are reason it was too small!

Is the unemployment rate still high? Of course, how do we fix it? More DEMAND side economic policies like The Recovery Act. Supply side has proven to be a failure. Tax cuts do more harm than good.

What success??

The economy still sucks and UE is at 7.9%.

That might look successfull to you, an Obamabot, but to me, a real person, it sucks.

What an idiotic observation.And sure, in nominal figures, it increased 76%. That's less than Clinton"s 86% and more than Bush41's 20%, Bush43's 25% and Obamas 10%

Note that in your data that those who had tax cuts tended to have higher revenue growth and the ones who didn't had the lowest. Obama has had the highest tax increases and is at the bottom of revenue growth. And he even started at the bottom of a depression.

Dude, you're obliterating the left's lie that tax cuts reduce revenue and tax increases raise revenue, well done!

The biggest revenues came under Clinton and he raised taxes. As far as Obamas tax increase, that went into effect just a year ago. Prior to Obamas increase, and while still operating under Bush's tax cuts, revenue fell 9%. In just one year alone since the tax increase, revenue is up 10% (in real numbers).

If anything, tax increases appear to bolster revenue increases.

What an idiotic observation.Note that in your data that those who had tax cuts tended to have higher revenue growth and the ones who didn't had the lowest. Obama has had the highest tax increases and is at the bottom of revenue growth. And he even started at the bottom of a depression.

Dude, you're obliterating the left's lie that tax cuts reduce revenue and tax increases raise revenue, well done!

The biggest revenues came under Clinton and he raised taxes. As far as Obamas tax increase, that went into effect just a year ago. Prior to Obamas increase, and while still operating under Bush's tax cuts, revenue fell 9%. In just one year alone since the tax increase, revenue is up 10% (in real numbers).

If anything, tax increases appear to bolster revenue increases.

What an idiotic observation.

Obama's tax increases did not take affect a year ago, he ended the tax cuts for job producers early in his administration and has endlessly increased taxes through his administration. A year ago he did it again. He started at the bottom of a recession when tax revenues were at their lowest. Yet another failure.

As for Clinton, he says personally that he raised taxes too much and it harmed the economy. Then he had several tax cuts.

Your conclusion tax increases raised revenue from this data is comical, it shows the complete reverse. The field of economics also contradicts that tax increases raise revenue in the long run as well. But what do facts have to do with the liberal religion?

What an idiotic observation.

The biggest revenues came under Clinton and he raised taxes. As far as Obama’s tax increase, that went into effect just a year ago. Prior to Obama’s increase, and while still operating under Bush's tax cuts, revenue fell 9%. In just one year alone since the tax increase, revenue is up 10% (in real numbers).

If anything, tax increases appear to bolster revenue increases.

What an idiotic observation.

Obama's tax increases did not take affect a year ago, he ended the tax cuts for job producers early in his administration and has endlessly increased taxes through his administration. A year ago he did it again. He started at the bottom of a recession when tax revenues were at their lowest. Yet another failure.

As for Clinton, he says personally that he raised taxes too much and it harmed the economy. Then he had several tax cuts.

Your conclusion tax increases raised revenue from this data is comical, it shows the complete reverse. The field of economics also contradicts that tax increases raise revenue in the long run as well. But what do facts have to do with the liberal religion?

Tax increases do raise revenues to a point. It's a relative issue, not an absolute one. And it depends on the tax.

Income tax cuts from levels that are not extremely high, ie 70%, lowers tax revenues than otherwise would have been.

[MENTION=21524]oldfart[/MENTION]

Greg Mankiw, who worked for Bush, concluded in his work that every $1 in tax cuts reduced tax revenues by 85 cents. What this means is that marginal levels of economic activity are higher with tax cuts, meaning the economy is bigger with the cut, but absolute levels of revenues are lower.

And now the game is over. The great American Consumer is Dead. His job is in China, and his country is owned by a very small group of corporations (and their investors) who fund elections, staff government and control Washington.

Ford's U.S. sales jumped 11 percent in 2013 to nearly 2.5 million a six-year high as a stronger economy boosted pickup truck sales.

The Dearborn, MIch., company sold 763,402 F-Series pickups last year, up 18 percent over 2012. One in every three vehicles Ford sold in the U.S. was an F-Series.

93% of economists say the stim worked.

conversation over

What do they mean by worked?

I don't know where you get 7.9% from? Perhaps it was a typo? The unemployment rate is currently 7.0% and new figures are due to be released in 2 daysWhat success??

The economy still sucks and UE is at 7.9%.

That might look successfull to you, an Obamabot, but to me, a real person, it sucks.

Your right. Typo.

7% is nothing to write home about any more that 7.9% is.

Nope. I'd say the economy is still in the tank and that 7% is reality is around 14%.

Not anything I'd be bragging about if I were Barry and the Dems.

Umm, what tax cuts did Obama end early in his presidency??What an idiotic observation.Note that in your data that those who had tax cuts tended to have higher revenue growth and the ones who didn't had the lowest. Obama has had the highest tax increases and is at the bottom of revenue growth. And he even started at the bottom of a depression.

Dude, you're obliterating the left's lie that tax cuts reduce revenue and tax increases raise revenue, well done!

The biggest revenues came under Clinton and he raised taxes. As far as Obamas tax increase, that went into effect just a year ago. Prior to Obamas increase, and while still operating under Bush's tax cuts, revenue fell 9%. In just one year alone since the tax increase, revenue is up 10% (in real numbers).

If anything, tax increases appear to bolster revenue increases.

What an idiotic observation.

Obama's tax increases did not take affect a year ago, he ended the tax cuts for job producers early in his administration and has endlessly increased taxes through his administration. A year ago he did it again. He started at the bottom of a recession when tax revenues were at their lowest. Yet another failure.

As for Clinton, he says personally that he raised taxes too much and it harmed the economy. Then he had several tax cuts.

Your conclusion tax increases raised revenue from this data is comical, it shows the complete reverse. The field of economics also contradicts that tax increases raise revenue in the long run as well. But what do facts have to do with the liberal religion?