Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A no BS, non partisan examination of the success of Obama's stimulus package

- Thread starter Billy000

- Start date

- Thread starter

- #402

What an idiotic observation.Note that in your data that those who had tax cuts tended to have higher revenue growth and the ones who didn't had the lowest. Obama has had the highest tax increases and is at the bottom of revenue growth. And he even started at the bottom of a depression.

Dude, you're obliterating the left's lie that tax cuts reduce revenue and tax increases raise revenue, well done!

The biggest revenues came under Clinton and he raised taxes. As far as Obamas tax increase, that went into effect just a year ago. Prior to Obamas increase, and while still operating under Bush's tax cuts, revenue fell 9%. In just one year alone since the tax increase, revenue is up 10% (in real numbers).

If anything, tax increases appear to bolster revenue increases.

What an idiotic observation.

Obama's tax increases did not take affect a year ago, he ended the tax cuts for job producers early in his administration and has endlessly increased taxes through his administration. A year ago he did it again. He started at the bottom of a recession when tax revenues were at their lowest. Yet another failure.

As for Clinton, he says personally that he raised taxes too much and it harmed the economy. Then he had several tax cuts.

Your conclusion tax increases raised revenue from this data is comical, it shows the complete reverse. The field of economics also contradicts that tax increases raise revenue in the long run as well. But what do facts have to do with the liberal religion?

Obama extended the Bush tax cuts and is responsible for the biggest tax cut for the middle class since Reagan.

Quantum Windbag

Gold Member

- May 9, 2010

- 58,308

- 5,100

- 245

Umm, what tax cuts did Obama end early in his presidency??What an idiotic observation.

The biggest revenues came under Clinton and he raised taxes. As far as Obamas tax increase, that went into effect just a year ago. Prior to Obamas increase, and while still operating under Bush's tax cuts, revenue fell 9%. In just one year alone since the tax increase, revenue is up 10% (in real numbers).

If anything, tax increases appear to bolster revenue increases.

What an idiotic observation.

Obama's tax increases did not take affect a year ago, he ended the tax cuts for job producers early in his administration and has endlessly increased taxes through his administration. A year ago he did it again. He started at the bottom of a recession when tax revenues were at their lowest. Yet another failure.

As for Clinton, he says personally that he raised taxes too much and it harmed the economy. Then he had several tax cuts.

Your conclusion tax increases raised revenue from this data is comical, it shows the complete reverse. The field of economics also contradicts that tax increases raise revenue in the long run as well. But what do facts have to do with the liberal religion?

He let the Bush tax cuts expire one year ago. And since that time, revenue is up 10%.

And no one brought in more revenue than Clinton. And he raised taxes right after taking office -- which came on the heels of Bush41 raising taxes. The tax cuts under Clinton you're talking about didn't occur until 1997 and was a cut in capital gains taxes from 28% to 20%. By that time, there was already a 23% gain in revenue; compared to Reagan who saw only 25% in 8 years.

Umm, he actually signed a law that made most of the Bush tax cuts permanent.

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

Seems you didn't read the article...Translation: "I didn't READ the article..." Typical.That chart dies not make your point. It's void of cause & effect as It shows revenue increasing whether taxes were lowered, raised, or left alone. It does show a decrease in the year following Reagan's Tax cut as well as during Bush's cuts in 2001, 2002 and 2003. The chart also ignores other taxes beyond income taxes, like the ones Reagan increased; as well as other contributing factors.Care to back that up with data?

And what is wrong with letting people keep what they've earned? And to hear people like you, you'd think all property belongs to Gubmint...and by their good graces they let YOU keep some of it...

YOU should have never come back...still stupid as ever.

Do Tax Cuts Increase Government Revenue? - Forbes

Lemme guess ... that chart was put out by the Heritage Foundation?

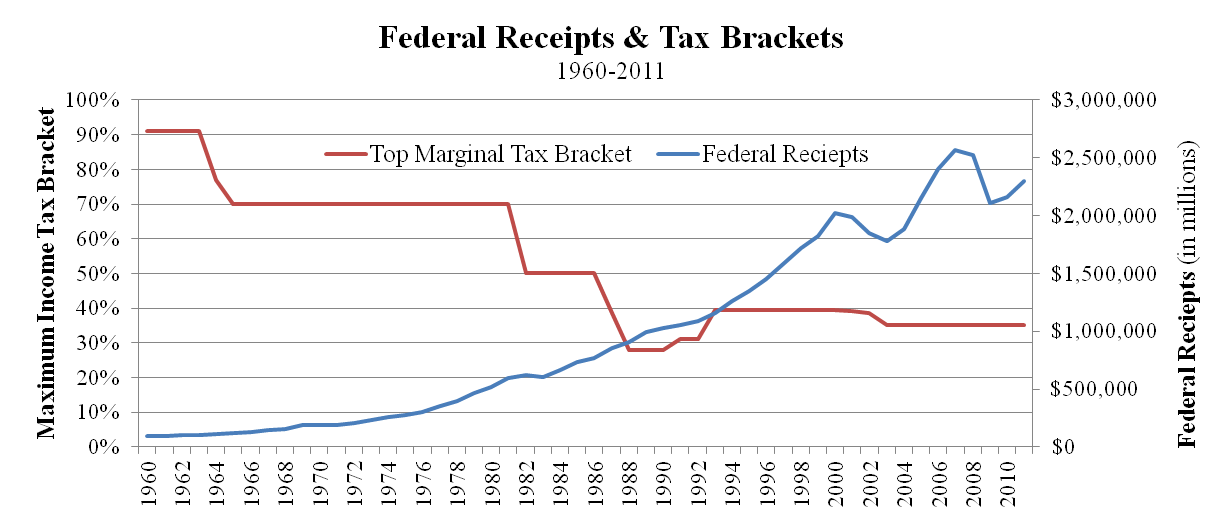

The following graph clearly reveals the answer. The red line represents the top marginal tax bracket while the blue line shows the total amount of Federal government revenue each year. There are two salient points here. First, as the graph illustrates, as tax rates declined, government revenue increased. Second, there is a strong negative correlation between the two.

There is no negative correlation between the two nor is one established simply because the author of that article says so (without evidence, no less), Secondly, as I pointed out (even though the article you linked deliberately omits it, revenue did not increase as tax rates were cut. You can see for yourself that with the exception of 3 periods (1983, 2001-2003, 2008-2009) revenue always increased; even though there were periods during that time when taxes were raised or remained flat. And the points in that graph where the biggest ascensions began were in 1976 (top tax rates had been at 70% for more than a decade at that point, so you can't credit tax cuts), 1993 (following a tax hike), 1999 (top tax rates had been at 39.5% for 6 years at that point but most of the increase in revenue was from the skyrocketing tech bubble), and 2005, which did follow tax hikes but was increased by the skyrocketing housing bubble)So there is no correlation. And as if that wasn't enough to destroy that graph, two more points completely sink it (and the article).

1) The article cherry picks the data as it starts in 1960. But if you go back even further, you see that revenue growth actually took off around WWII and with a sharp increase in 1950, with a top bracket of 90%. The article doesn't show that because it doesn't fit in with the agenda.

2) which is the most egregious error made in that article ... as I mentioned earlier, with very few exceptions, federal revenue almost always increased since WWII, no matter what was done with taxes. The reason you see that in the chart you posted ... ? Is because the creator of that chart idiotically used nominal figures. Nominal figures across a time span like that are completely meaningless and anyone writing an article like that should know that. The reason that article used nominal figures instead of real ones was to promote the idiotic (and unprovable) notion that tax cuts increase tax revenues so fucking retards will buy into it. Looking at real figures shows the increase of revenue actually was going back to WWII, and continued increasing during that entire period no matter what the tax rate was and not matter if the tax rates were cut or raised.

Last edited:

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

Umm, what tax cuts did Obama end early in his presidency??What an idiotic observation.

Obama's tax increases did not take affect a year ago, he ended the tax cuts for job producers early in his administration and has endlessly increased taxes through his administration. A year ago he did it again. He started at the bottom of a recession when tax revenues were at their lowest. Yet another failure.

As for Clinton, he says personally that he raised taxes too much and it harmed the economy. Then he had several tax cuts.

Your conclusion tax increases raised revenue from this data is comical, it shows the complete reverse. The field of economics also contradicts that tax increases raise revenue in the long run as well. But what do facts have to do with the liberal religion?

He let the Bush tax cuts expire one year ago. And since that time, revenue is up 10%.

And no one brought in more revenue than Clinton. And he raised taxes right after taking office -- which came on the heels of Bush41 raising taxes. The tax cuts under Clinton you're talking about didn't occur until 1997 and was a cut in capital gains taxes from 28% to 20%. By that time, there was already a 23% gain in revenue; compared to Reagan who saw only 25% in 8 years.

Umm, he actually signed a law that made most of the Bush tax cuts permanent.

It still raised taxes on roughly 30 percent of tax revenue. At any rate, kaz made the claim that Obama ended tax cuts early in his presidency. I'm not sure what she's talking about ... do you?

thereisnospoon

Gold Member

Many of you believe The Recovery Act was a failure simply because it fell short of expectations, but that does not mean it was a failure - not by a long shot. Here is a non partisan article that examines the pros and cons of the stimulus and why, for the most part, it was a success. A success that indisputably saved our economy.

Articles debating the successes or failures of President Obamas stimulus package should be of interest to NPQ Newswire readers, given that nonprofits were among the most important intermediaries for and deliverers of stimulus programs. In the upcoming issue of Foreign Policy, TIME Magazines Michael Grunwald suggests that the stimulus was certainly a political failure, but there is voluminous evidence that the stimulus did provide real stimulus, helping to stop a terrifying free-fall, avert a second Depression, and end a brutal recession. Grunwalds long article addresses the pros and cons of the stimulus, some of which is presented below.

PROS:

According to the Moodys website Economy.com, JPMorgan Chase, and the Congressional Budget Office, the stimulus increased GDP at least 2 percentage points, the difference between contraction and growth, and saved or created about 2.5 million jobs.

[Solyndra is] supposedly a case study in ineptitude, cronyism, and the failure of green industrial policy. Republicans investigated for a year, held more than a dozen hearings, and subpoenaed hundreds of thousands of documents, but they uncovered no evidence of wrongdoing .Solyndra was a start-up that failed. It happens.

CONS:

The jobless rate is still over eight percent, the longest run of unemployment over eight percent since the Depression.

Was the Obama Stimulus a Success or a Failure? - NPQ - Nonprofit Quarterly

So essentially what this article is saying that even though the stimulus fell short of expectations, it was still a success. Why? Because it turned our economy free fall (that began with Bush) into JOB GROWTH within months. It is the reason we are even in a recovery. What was the biggest flaw in it? IT WAS TOO SMALL which is actually just more proof that government can and does create jobs. It is also further proof Republicanism is ruining our country. They are reason it was too small!

Is the unemployment rate still high? Of course, how do we fix it? More DEMAND side economic policies like The Recovery Act. Supply side has proven to be a failure. Tax cuts do more harm than good.

So why is the U-6 ( actual percentage of unemployed) 13.6%....Why is the unemployment rate among people under the age of 25 a staggering 20%? And why is the unemployment rate of blacks near 30%.

Why is there a need for another extension of federal unemployment insurance benefits?

Why has GDP growth not exceeded 1.7% in any one quarter since Obama was immaculated?

Federal spending does not create jobs. Federal spending removes capital from the private sector and the result is crony capitalism.

Growth of government is economic POISON.

thereisnospoon

Gold Member

When the money is paid back with interest, you will have the total equation. It is only then that you can debate it's merits.

Bush's tax cuts were more expensive than the Recovery Act. When will see that money back?

No they weren't. The economy did not falter until the democrats took the majority of both houses of Congress.

When the GOP had the majority, dems screamed that wanted bipartisanship.

They yowled like feral cats in heat about deficit spending. Even though most of that spending was on social programs.

When the dems took the majority in 2006, Barney Frank was quoted as saying "we had to get over our fear of deficit spending"...

And "there are a lot of rich (wealthy) people we can recover this money from".

You people are in fear of losing the Senate this year. Hence the reason for all these back timed attacks on the GOP...

With you dems, it's never about what your side will do. It's about "the other side sucks. So vote for us"

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

Many of you believe The Recovery Act was a failure simply because it fell short of expectations, but that does not mean it was a failure - not by a long shot. Here is a non partisan article that examines the pros and cons of the stimulus and why, for the most part, it was a success. A success that indisputably saved our economy.

Articles debating the successes or failures of President Obama’s stimulus package should be of interest to NPQ Newswire readers, given that nonprofits were among the most important intermediaries for and deliverers of stimulus programs. In the upcoming issue of Foreign Policy, TIME Magazine’s Michael Grunwald suggests that the stimulus was “certainly a political failure,” but “there is voluminous evidence that the stimulus did provide real stimulus, helping to stop a terrifying free-fall, avert a second Depression, and end a brutal recession.” Grunwald’s long article addresses the pros and cons of the stimulus, some of which is presented below.

PROS:

CONS:

The jobless rate is still over eight percent, the longest run of unemployment over eight percent since the Depression.

Was the Obama Stimulus a Success or a Failure? - NPQ - Nonprofit Quarterly

So essentially what this article is saying that even though the stimulus fell short of expectations, it was still a success. Why? Because it turned our economy free fall (that began with Bush) into JOB GROWTH within months. It is the reason we are even in a recovery. What was the biggest flaw in it? IT WAS TOO SMALL which is actually just more proof that government can and does create jobs. It is also further proof Republicanism is ruining our country. They are reason it was too small!

Is the unemployment rate still high? Of course, how do we fix it? More DEMAND side economic policies like The Recovery Act. Supply side has proven to be a failure. Tax cuts do more harm than good.

So why is the U-6 ( actual percentage of unemployed) 13.6%....Why is the unemployment rate among people under the age of 25 a staggering 20%? And why is the unemployment rate of blacks near 30%.

Why is there a need for another extension of federal unemployment insurance benefits?

Why has GDP growth not exceeded 1.7% in any one quarter since Obama was immaculated?

Federal spending does not create jobs. Federal spending removes capital from the private sector and the result is crony capitalism.

Growth of government is economic POISON.

Who knows where you get your numbers from? Suffice it to say, when you post bullshit numbers, your message is lost.

Actual numbers:

Unemployment Rate - 16-24 yrs: 14.1%, not 20% (lower than when Obama became president)

Bureau of Labor Statistics Data

Unemployment Rate - Black or African American: 12.5%, not 30% (lower than when Obama became president)

Bureau of Labor Statistics Data

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

When the money is paid back with interest, you will have the total equation. It is only then that you can debate it's merits.

Bush's tax cuts were more expensive than the Recovery Act. When will see that money back?

No they weren't. The economy did not falter until the democrats took the majority of both houses of Congress.

When the GOP had the majority, dems screamed that wanted bipartisanship.

They yowled like feral cats in heat about deficit spending. Even though most of that spending was on social programs.

When the dems took the majority in 2006, Barney Frank was quoted as saying "we had to get over our fear of deficit spending"...

And "there are a lot of rich (wealthy) people we can recover this money from".

You people are in fear of losing the Senate this year. Hence the reason for all these back timed attacks on the GOP...

With you dems, it's never about what your side will do. It's about "the other side sucks. So vote for us"

The causes of the economy collapsing started years before 2008.

thereisnospoon

Gold Member

Many of you believe The Recovery Act was a failure simply because it fell short of expectations, but that does not mean it was a failure - not by a long shot. Here is a non partisan article that examines the pros and cons of the stimulus and why, for the most part, it was a success. A success that indisputably saved our economy.

PROS:

CONS:

Was the Obama Stimulus a Success or a Failure? - NPQ - Nonprofit Quarterly

So essentially what this article is saying that even though the stimulus fell short of expectations, it was still a success. Why? Because it turned our economy free fall (that began with Bush) into JOB GROWTH within months. It is the reason we are even in a recovery. What was the biggest flaw in it? IT WAS TOO SMALL which is actually just more proof that government can and does create jobs. It is also further proof Republicanism is ruining our country. They are reason it was too small!

Is the unemployment rate still high? Of course, how do we fix it? More DEMAND side economic policies like The Recovery Act. Supply side has proven to be a failure. Tax cuts do more harm than good.

So why is the U-6 ( actual percentage of unemployed) 13.6%....Why is the unemployment rate among people under the age of 25 a staggering 20%? And why is the unemployment rate of blacks near 30%.

Why is there a need for another extension of federal unemployment insurance benefits?

Why has GDP growth not exceeded 1.7% in any one quarter since Obama was immaculated?

Federal spending does not create jobs. Federal spending removes capital from the private sector and the result is crony capitalism.

Growth of government is economic POISON.

Who knows where you get your numbers from? Suffice it to say, when you post bullshit numbers, your message is lost.

Actual numbers:

Unemployment Rate - 16-24 yrs: 14.1%, not 20% (lower than when Obama became president)

Bureau of Labor Statistics Data

Unemployment Rate - Black or African American: 12.5%, not 30% (lower than when Obama became president)

Bureau of Labor Statistics Data

WRONG....Those are not participation numbers. Those reflect only those collecting unemployment insurance benefits.

Here's your BLS...

Table A-15. Alternative measures of labor underutilization..

Note the participation unemployment rate...U-6....

Have a nice day.

Two trillion dollars...Not much to show for it.

Oh, that figure of 2.5 million new jobs? Horseshit....At one time the Obama admin and the minions had that as high as 7 million. The accepted figure from the White House was 5 million new stimulus jobs created...

If that is so, then why is the unemployment rate still over 7%( U-3)....

Let's face facts. This admin is no more interested in job creation than the man in the moon.

Quantum Windbag

Gold Member

- May 9, 2010

- 58,308

- 5,100

- 245

Umm, what tax cuts did Obama end early in his presidency??

He let the Bush tax cuts expire one year ago. And since that time, revenue is up 10%.

And no one brought in more revenue than Clinton. And he raised taxes right after taking office -- which came on the heels of Bush41 raising taxes. The tax cuts under Clinton you're talking about didn't occur until 1997 and was a cut in capital gains taxes from 28% to 20%. By that time, there was already a 23% gain in revenue; compared to Reagan who saw only 25% in 8 years.

Umm, he actually signed a law that made most of the Bush tax cuts permanent.

It still raised taxes on roughly 30 percent of tax revenue. At any rate, kaz made the claim that Obama ended tax cuts early in his presidency. I'm not sure what she's talking about ... do you?

I have no idea how to address what you are saying because it doesn't even make sense. How the fuck do you raise taxes on taxes?

Last edited:

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

If you idiotically think the unemployment rate for 16-24 year olds is 20% -- prove it with a link to the BLS showing that.So why is the U-6 ( actual percentage of unemployed) 13.6%....Why is the unemployment rate among people under the age of 25 a staggering 20%? And why is the unemployment rate of blacks near 30%.

Why is there a need for another extension of federal unemployment insurance benefits?

Why has GDP growth not exceeded 1.7% in any one quarter since Obama was immaculated?

Federal spending does not create jobs. Federal spending removes capital from the private sector and the result is crony capitalism.

Growth of government is economic POISON.

Who knows where you get your numbers from? Suffice it to say, when you post bullshit numbers, your message is lost.

Actual numbers:

Unemployment Rate - 16-24 yrs: 14.1%, not 20% (lower than when Obama became president)

Bureau of Labor Statistics Data

Unemployment Rate - Black or African American: 12.5%, not 30% (lower than when Obama became president)

Bureau of Labor Statistics Data

WRONG....Those are not participation numbers. Those reflect only those collecting unemployment insurance benefits.

Here's your BLS...

Table A-15. Alternative measures of labor underutilization..

Note the participation unemployment rate...U-6....

Have a nice day.

Two trillion dollars...Not much to show for it.

Oh, that figure of 2.5 million new jobs? Horseshit....At one time the Obama admin and the minions had that as high as 7 million. The accepted figure from the White House was 5 million new stimulus jobs created...

If that is so, then why is the unemployment rate still over 7%( U-3)....

Let's face facts. This admin is no more interested in job creation than the man in the moon.

If you idiotically think the unemployment rate for blacks is 30% -- prove it with a link to the BLS showing that.

As it stands now, all you have to show are your delusions -- and it ain't a pretty sight. Meanwhile, the BLS indicates you're insane as it shows those numbers to be 14.1% and 12.5% respectively.

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

Umm, he actually signed a law that made most of the Bush tax cuts permanent.

It still raised taxes on roughly 30 percent of tax revenue. At any rate, kaz made the claim that Obama ended tax cuts early in his presidency. I'm not sure what she's talking about ... do you?

I have no idea how to address what you are saying because it doesn't even make sense. How the fuck do you raise taxes on taxes?

Taxes were raised on the top 1% income earners. The folks who contribute about 1/3rd of tax revenue.

Better?

Quantum Windbag

Gold Member

- May 9, 2010

- 58,308

- 5,100

- 245

It still raised taxes on roughly 30 percent of tax revenue. At any rate, kaz made the claim that Obama ended tax cuts early in his presidency. I'm not sure what she's talking about ... do you?

I have no idea how to address what you are saying because it doesn't even make sense. How the fuck do you raise taxes on taxes?

Taxes were raised on the top 1% income earners. The folks who contribute about 1/3rd of tax revenue.

Better?

At least that makes sense, even if it doesn't mean what you think it does.

pinqy

Gold Member

Nope, BLS doesn't get their data from UI claims..never has.So why is the U-6 ( actual percentage of unemployed) 13.6%....Why is the unemployment rate among people under the age of 25 a staggering 20%? And why is the unemployment rate of blacks near 30%.

Why is there a need for another extension of federal unemployment insurance benefits?

Why has GDP growth not exceeded 1.7% in any one quarter since Obama was immaculated?

Federal spending does not create jobs. Federal spending removes capital from the private sector and the result is crony capitalism.

Growth of government is economic POISON.

Who knows where you get your numbers from? Suffice it to say, when you post bullshit numbers, your message is lost.

Actual numbers:

Unemployment Rate - 16-24 yrs: 14.1%, not 20% (lower than when Obama became president)

Bureau of Labor Statistics Data

Unemployment Rate - Black or African American: 12.5%, not 30% (lower than when Obama became president)

Bureau of Labor Statistics Data

WRONG....Those are not participation numbers. Those reflect only those collecting unemployment insurance benefits.

[quite]Here's your BLS...

Table A-15. Alternative measures of labor underutilization..

Note the participation unemployment rate...U-6....[/quote]"participation unemployment rate?" Where the fuck did you get that phrase from? Unemployed are those willing, avaiaible, and actively looking for work (last 4 weeks) as a percent of employed plus unemployed (the labor force).The U6 is unemployed plus marginally attached (willing, available looked in last 12 months but not last 4 weeks) plus part time for economic reasons (willing and available for full time but working part time due to slow business or can't find full time work) as a percent of the labor force plus marginally attached. The marginally attached are NOT participating in the labor market.

And in any case, the U6 is not broken down by age or ethnicity, so it's not the source of your claims.

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

"participation unemployment rate?" Where the fuck did you get that phrase from? Unemployed are those willing, avaiaible, and actively looking for work (last 4 weeks) as a percent of employed plus unemployed (the labor force).The U6 is unemployed plus marginally attached (willing, available looked in last 12 months but not last 4 weeks) plus part time for economic reasons (willing and available for full time but working part time due to slow business or can't find full time work) as a percent of the labor force plus marginally attached. The marginally attached are NOT participating in the labor market.Nope, BLS doesn't get their data from UI claims..never has.Who knows where you get your numbers from? Suffice it to say, when you post bullshit numbers, your message is lost.

Actual numbers:

Unemployment Rate - 16-24 yrs: 14.1%, not 20% (lower than when Obama became president)

Bureau of Labor Statistics Data

Unemployment Rate - Black or African American: 12.5%, not 30% (lower than when Obama became president)

Bureau of Labor Statistics Data

WRONG....Those are not participation numbers. Those reflect only those collecting unemployment insurance benefits.

[quite]Here's your BLS...

Table A-15. Alternative measures of labor underutilization..

Note the participation unemployment rate...U-6....

And in any case, the U6 is not broken down by age or ethnicity, so it's not the source of your claims.[/QUOTE]

No, the source of his numbers is his ass -- that's where he's plucking his bullshit numbers from.

Umm, what tax cuts did Obama end early in his presidency??

He let the Bush tax cuts expire one year ago. And since that time, revenue is up 10%.

And no one brought in more revenue than Clinton. And he raised taxes right after taking office -- which came on the heels of Bush41 raising taxes. The tax cuts under Clinton you're talking about didn't occur until 1997 and was a cut in capital gains taxes from 28% to 20%. By that time, there was already a 23% gain in revenue; compared to Reagan who saw only 25% in 8 years.

Umm, he actually signed a law that made most of the Bush tax cuts permanent.

It still raised taxes on roughly 30 percent of tax revenue. At any rate, kaz made the claim that Obama ended tax cuts early in his presidency. I'm not sure what she's talking about ... do you?

I meant that there have been steady tax increases through his term and then he had the tax increase on job producers by letting the Bush cuts for them "expire" once again showing his contempt for workers in this country who actually want jobs.

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

Again, the Bush tax cuts expired only 1 year ago. And since then, real revenue increased 10%.Umm, he actually signed a law that made most of the Bush tax cuts permanent.

It still raised taxes on roughly 30 percent of tax revenue. At any rate, kaz made the claim that Obama ended tax cuts early in his presidency. I'm not sure what she's talking about ... do you?

I meant that there have been steady tax increases through his term and then he had the tax increase on job producers by letting the Bush cuts for them "expire" once again showing his contempt for workers in this country who actually want jobs.

Listening

Gold Member

- Aug 27, 2011

- 14,989

- 1,650

- 260

Again, the Bush tax cuts expired only 1 year ago. And since then, real revenue increased 10%.It still raised taxes on roughly 30 percent of tax revenue. At any rate, kaz made the claim that Obama ended tax cuts early in his presidency. I'm not sure what she's talking about ... do you?

I meant that there have been steady tax increases through his term and then he had the tax increase on job producers by letting the Bush cuts for them "expire" once again showing his contempt for workers in this country who actually want jobs.

Please don't tell me you are suggesting they are connected.

Faun

Diamond Member

- Nov 14, 2011

- 124,452

- 82,195

- 2,635

Again, the Bush tax cuts expired only 1 year ago. And since then, real revenue increased 10%.I meant that there have been steady tax increases through his term and then he had the tax increase on job producers by letting the Bush cuts for them "expire" once again showing his contempt for workers in this country who actually want jobs.

Please don't tell me you are suggesting they are connected.

Of course they're connected. I'm not saying raising those taxes accounts for the entire 10%, but it's undeniable the increase in taxes contributed to it.

Taxes were increased 13% on the top 1% income earners. They contribute 1/3rd of the taxes paid. You can't increase 1/3rd of taxes by 13% without increasing revenue.

Similar threads

- Replies

- 114

- Views

- 1K

- Replies

- 5

- Views

- 87

- Replies

- 334

- Views

- 6K

Latest Discussions

- Replies

- 65

- Views

- 292

- Replies

- 5

- Views

- 10

Forum List

-

-

-

-

-

Political Satire 8541

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 485

-

-

-

-

-

-

-

-

-

-