Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Work Until Youre Dead?

- Thread starter Kimura

- Start date

Kimura

VIP Member

- Thread starter

- #82

I wonder how Kimura can say this. All the things you support like high spending, regulation, deficits, ultra low interests, govt welfareprograms etc. are at the highest of the millenium. Yet things are not good because... there should be even more spending?

Yeah, we should spend more, obviously, since aggregate demand is in the toilet. The $$$$ needs to spent on education, health care, transportation, rail, infrastructure, nuclear power, etc. We should not have bailed out these useless institutions on Wall Street. They don't even serve a social or public purpose.

- Apr 12, 2011

- 3,815

- 761

- 130

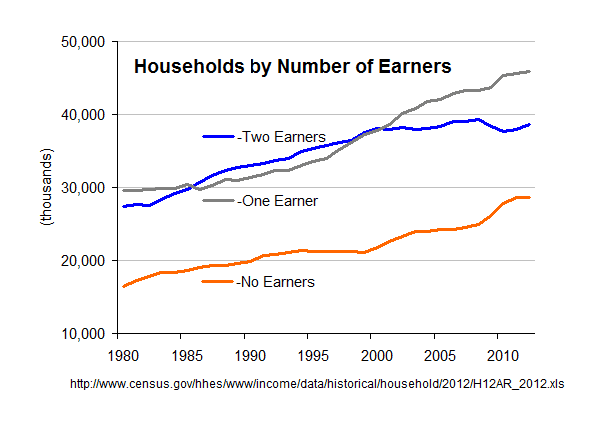

That may be story we can get from our freinds at Bloomberg, but I've learned that it's always best to check whatever they come up with. Here are the actual Census.gov numbers where Bloomberg said they got their info--...two-income families have replaced single-earner ones...

--and what we know is that the "two-replaced-one" song was only true for the '90's and it ended when G.W.Bush took office. What is new that we need to pay attention to is the big change since '09 --the big surge in the 'no-earner' households.

- Apr 12, 2011

- 3,815

- 761

- 130

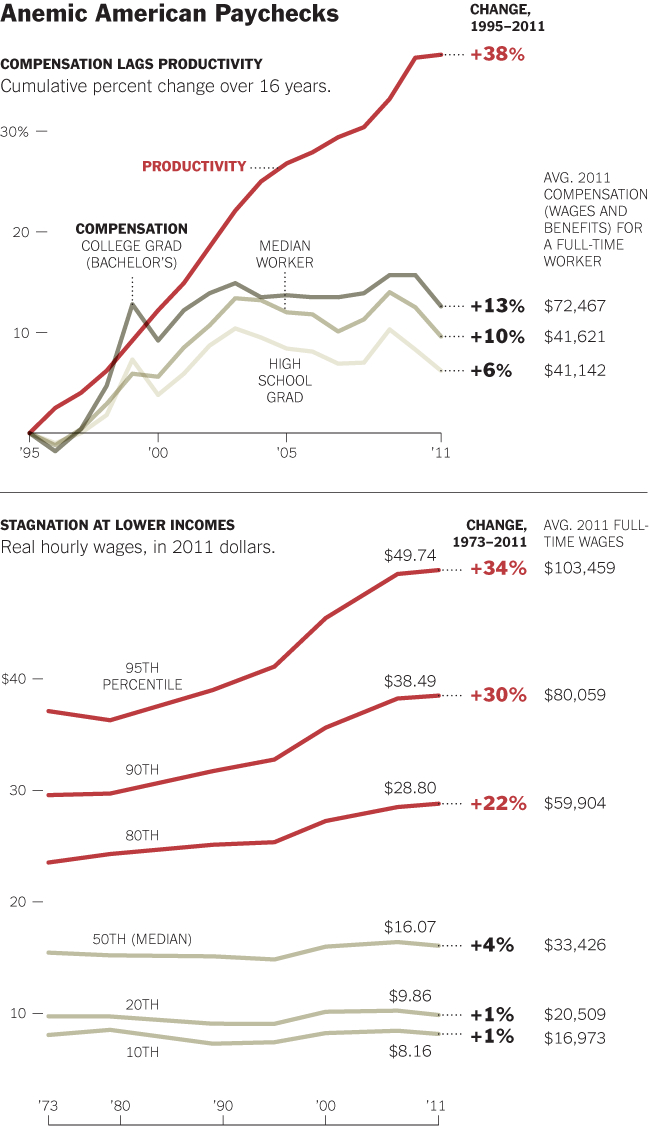

Interesting. Your own graph shows that most real household incomes have increased by over four thousand dollars, and then you turn right around and repeat the looney-lefty line about 'stagnant incomes'. Please help me out; I know you're not a loony-lefty. What am I missing?...Three decades worth of increases in productivity and stagnant wages...

Last edited:

- May 23, 2012

- 10,511

- 2,333

- 280

Only the poor and lower end of the middle class retires. The very weathy work until they drop on the job. The upper middle class retires into second careers.

The idea of retirement into idleness was always silly.

Retirement doesn't necessarily have to be "silly" idleness. Some retirees are doing what they didn't have the time to do when they were working and raising families. Travel, learning piano, trying to become a chess master, whatever. I hope everyone has a few years of this wonderful idleness after decades of work.

Kimura

VIP Member

- Thread starter

- #86

Interesting. Your own graph shows that most real household incomes have increased by over four thousand dollars, and then you turn right around and repeat the looney-lefty line about 'stagnant incomes'. Please help me out; I know you're not a loony-lefty. What am I missing?...Three decades worth of increases in productivity and stagnant wages...

Here's what those graphs demonstrate: when productivity increases, it doesn't benefit everyone. Productivity has increased, the economic pie has gotten larger, but the vast majority don't benefit from this gain in productivity.

There's a huge difference between economic growth and prosperity. When we talk about growth in economics, it's in absolute terms, but prosperity is always relative to distribution. The increasing inequality in this country is ample evidence of decreasing levels of prosperity, even though we have increased growth. These increases in productivity aren't being distributed but concentrated at the top.

The challenge of macroeconomics is to apply public policy is such as way so we achieve increased national growth and national prosperity. I give the United States an F in this regard.

Last edited:

- Apr 12, 2011

- 3,815

- 761

- 130

Ah, we went from all "wages" to merely "the vast majority". We're making progress in the right direction but your own numbers still show median incomes rising by ten percent and real median wages increasing by four percent (total incomes > total wages = increased worker benefit compensation). iow, the "vast majority" did in fact see a gain according to your own numbers that you selected from David F. Ruccio--...the vast majority don't benefit from this gain in productivity...Interesting. Your own graph shows that most real household incomes have increased by over four thousand dollars, and then you turn right around and repeat the looney-lefty line about 'stagnant incomes'. Please help me out; I know you're not a loony-lefty. What am I missing?...Three decades worth of increases in productivity and stagnant wages...

--but let's set aside Marxist numbers and use Federal Reserve data--http://www.amazon.com/dp/0415772265/?tag=ff0d01-20 Development and Globalization: A Marxian Class Analysis (Economics as Social Theory) by David F. Ruccio (Nov 6, 2010)

--and starts using--Kobalt 15-in Aggress Saw $9.98

--somebody had to cough up the money to pay for the power tools. Either the investment gets a return or there's no money for capital investment. OK, I know that Marxists (like the guy who gave you your numbers) would disagree, but productivity increases from capital must be paid for just like those from labor.DEWALT 10-in 15 Amp Dual Bevel Slide Compound Miter Saw $449.00

Even though the extreme left says there are some who favor capital over labor, it's a lie. There is nobody who says that they favor capital over labor. There are however, the extreme loony left that think that labor should get all the benefits from productivity that resulted from both labor and capital.

Kimura

VIP Member

- Thread starter

- #88

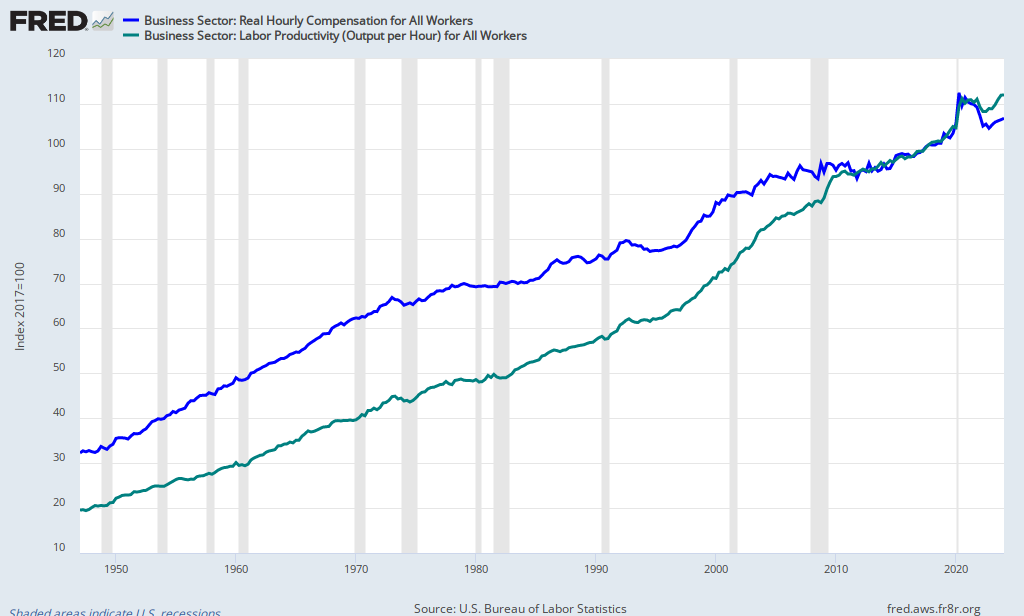

Ah, we went from all "wages" to merely "the vast majority". We're making progress in the right direction but your own numbers still show median incomes rising by ten percent and real median wages increasing by four percent (total incomes > total wages = increased worker benefit compensation). iow, the "vast majority" did in fact see a gain according to your own numbers that you selected from David F. Ruccio----but let's set aside Marxist numbers and use Federal Reserve data--...the vast majority don't benefit from this gain in productivity...Interesting. Your own graph shows that most real household incomes have increased by over four thousand dollars, and then you turn right around and repeat the looney-lefty line about 'stagnant incomes'. Please help me out; I know you're not a loony-lefty. What am I missing?

--that show a 300% gain since '47. Annual increases for productivity of 2.5% have made possible 1.7% increases yearly for employee compensation. Labor receives some benefit from productivity and does not receive all the benefit. That's because when say, a wood cutter worker switches from---- --and starts using--Kobalt 15-in Aggress Saw $9.98

--and starts using--Kobalt 15-in Aggress Saw $9.98

--somebody had to cough up the money to pay for the power tools. Either the investment gets a return or there's no money for capital investment. OK, I know that Marxists (like the guy who gave you your numbers) would disagree, but productivity increases from capital must be paid for just like those from labor.DEWALT 10-in 15 Amp Dual Bevel Slide Compound Miter Saw $449.00

Even though the extreme left says there are some who favor capital over labor, it's a lie. There is nobody who says that they favor capital over labor. There are however, the extreme loony left that think that labor should get all the benefits from productivity that resulted from both labor and capital.

That's good read, the one you linked, and all of his data is correct. You also can't get published in the journals by fudging numbers, or your academic career will be finished, unless your Reinhart and Rogoff.

Here's a book I recommend by Prof. Ruccio:

Postmodern Moments in Modern Economics

Let's first define labor productivity. It's output that must be adjusted for changes in prices then divided by total hours worked in all jobs. The United States nonfarm sector increased roughly 2.2% annually over the past sixty seven years, but we had noticeable slowdown from 1973-1995.

We also have real hourly compensation (for teh people in internet land) which we can define as the hourly costs to firms which has to be adjusted for changes in price to benefits, salaries, and wages paid to workers. As your FRED data clearly demonstrates, and which I checked myself, real hourly compensation has indeed grown at a rate of 1.7% annually over the past sixty seven years. However, since the 1970s, real hourly compensation has lagged behind productivity.

Here are the facts:

A) The total increase of productivity and real hourly compensation was strong until roughly 1973 when we saw a decline in both.

B) Real hourly compensation has simply failed to keep up with increased productivity growth during the past thirty years, and we see a sizable gap between productivity growth and compensation growth.

*RHC (Real Hourly Compensation)

*PG (Productivity Growth)

I figure acronyms make our life easier.

We have two reason why we have a such a gap between RHC and PG. The main one is the how price indexes are utilized to incorporate inflation in the BLS hourly compensation and productivity metrics. The second reason is labor share.

Before the year 2000, more or less, the space between the growth rates of the IPD and CPI was sufficient enough to explain the gaps during this time period. If we look at the years from 2000-2009, however, you will notice a decline in labor share was directly responsible for a large portion of the gap.

Last edited:

Similar threads

- Replies

- 115

- Views

- 1K

- Replies

- 7

- Views

- 396

- Replies

- 445

- Views

- 4K

- Replies

- 9

- Views

- 728

- Replies

- 75

- Views

- 1K

Latest Discussions

- Replies

- 29

- Views

- 151

- Replies

- 420

- Views

- 5K

- Replies

- 11

- Views

- 56

Forum List

-

-

-

-

-

Political Satire 8069

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-