- Feb 12, 2007

- 59,384

- 24,018

- 2,290

Some basic personal finance skills would go a long way for many of the people who are 60 years old and realize they have no savings.

We're dealing with stagnant wages, increased housing costs, increased health care costs, skyrocketing college tuition costs, high unemployment rates, and whole host of other issues. It's more complicated than tightening one's belt.

No it's not.

Buy smaller houses, buy less crap, go to college part time while you are working and take 6 or 8 years to get a degree

I'm sick and tired of people whining that they have no money while they are driving a new car or worse a leased car, sipping on a 5 dollar coffee, have HBO Showtime, Cinemax and all the pay sports channels, eat out 5 or 6 times a week pay 200 a month for a stupid cell phone etc etc etc.

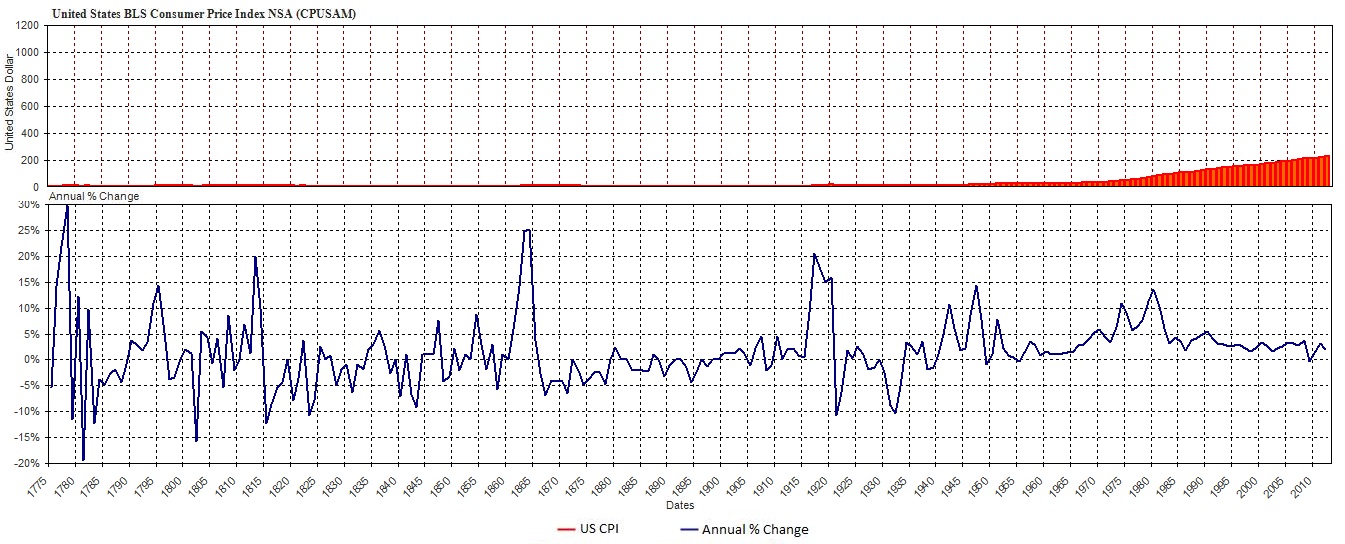

It's very liberating to live below one's means and to pay off debt and to save. Although these days, savings are not what they used to be due to ZIRP...so one is forced into the stock market if one wishes to preserve some purchasing power.