Magnus

Diamond Member

- Jun 22, 2020

- 10,958

- 8,316

- 2,138

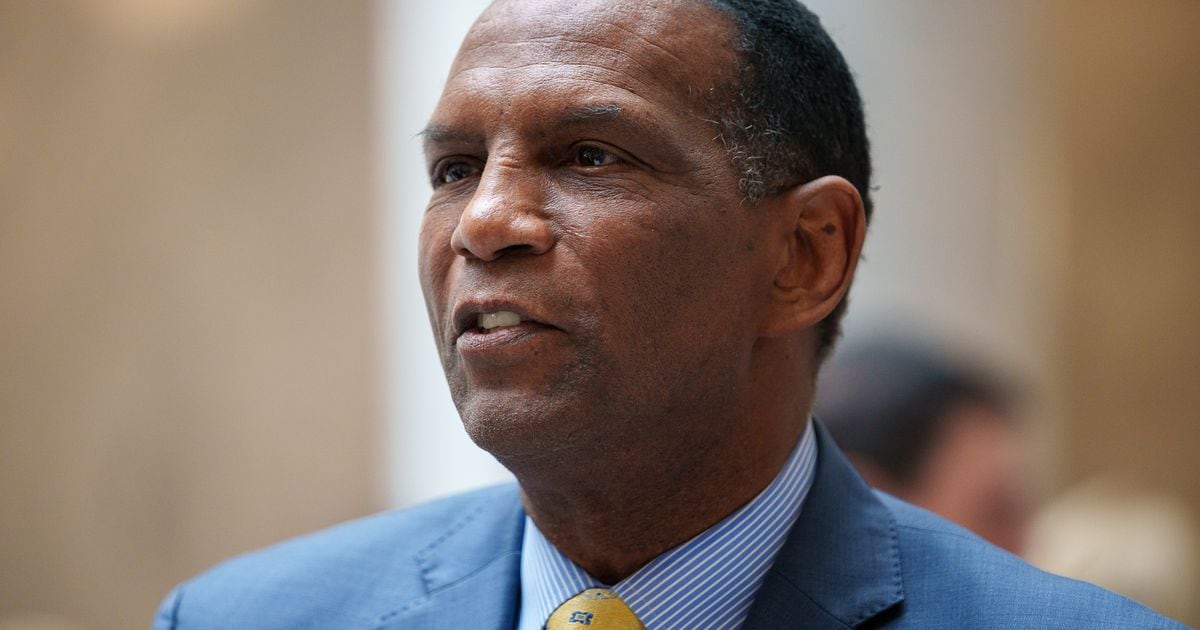

Rep. Burgess Owens to lead congressional hearing on ‘unlawful’ student loan forgiveness program

Utah’s Rep. Burgess Owens will chair a congressional hearing on the Biden administration’s student loan forgiveness plan later this week.The program, which cancels up to $20,000 of student loan debt for tens of millions of borrowers, is currently on hold pending a ruling from the Supreme Court.

In a press release, Owens telegraphed how the hearing would play out, arguing that President Joe Biden has no authority to cancel student debt unilaterally.

“Debt cannot be canceled, only transferred from those who borrowed to those who did not,” Owens said. “Creating an offramp for responsibility, driving up college costs, disincentivizing real loan reform, and forcing hard-working American taxpayers to pay for someone else’s loans is nothing more than a backdoor attempt at free college with abysmal implications for students, taxpayers, and our economy.”

During his first campaign in 2020, Owens was dogged by claims that he had filed for bankruptcy protection multiple times. Federal court records show Owens filed for bankruptcy five times. In 1991, Owens filed for Chapter 7 bankruptcy protection in New York. No court documents were available for this claim. In 2005, Owens again filed for Chapter 7 protection in Pennsylvania with creditors claiming $1.7 million in debts owed. The case was discharged in 2005 after over $200,000 was paid. The remaining three Chapter 13 filings by Owens were dismissed.

Rep. Burgess Owens to lead congressional hearing on ‘unlawful’ student loan forgiveness program

Rep. Burgess Owens is set to lead a congressional hearing on President Joe Biden's student loan forgiveness program.