BrokeLoser

Diamond Member

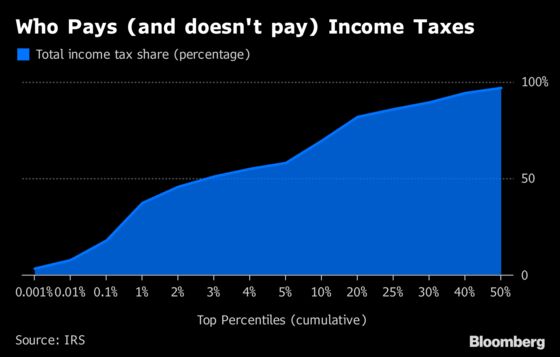

No, let the poor get a higher paying job, then they will pay higher taxes.raise the minimum wage until the poor pay enough in taxes.Well we know its not 47% of the populationThat top three pays about 60% of the taxes paid.

If it weren't for them I wonder who everyone thinks would be paying those taxes.

-Geaux

-Geaux

WTF?...who is not letting people get a better paying job?

But intill they do get one, minimum wage ensures they are minimaly compensated for their labor.

29 million filthy, low iQ, illiterate wetbacks that can’t speak the native language and have zero communication skills fuck shit all up don’t they?