- Banned

- #441

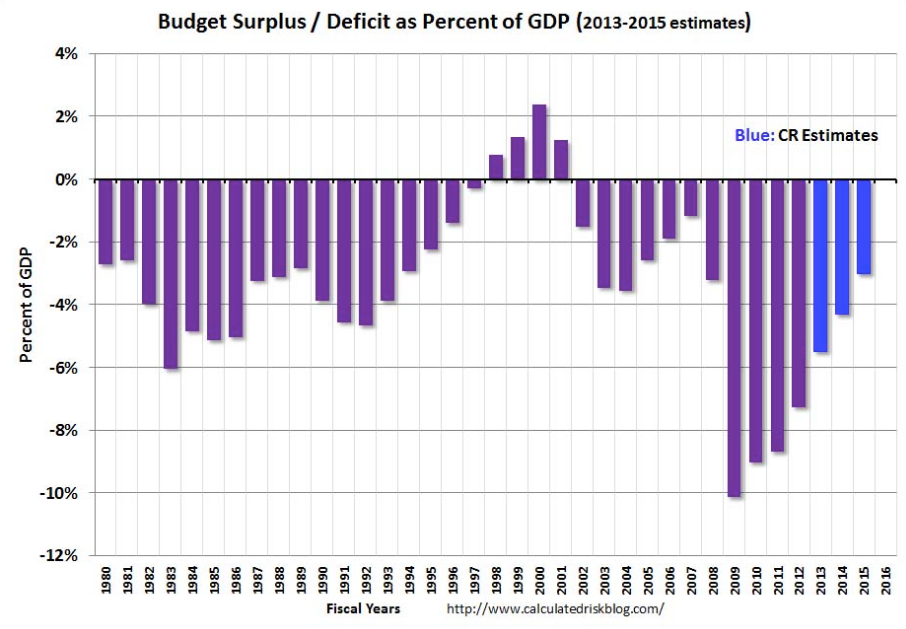

It's about damn time some cutting is being done. 20 trillion dollars in debt? It's time to get it done

I agree. 20 Trillion is too much.

Let's make the rich pay their fair share and put and end to corporate welfare and expensive weapons systems we don't need.

If you take all the money "the rich" have it would pay for the bloated amount of spending that Obama did for about six months.

I know you Moon Bats never took a course in economics or know your ass from a hole in the ground about fiscal responsibility but don't you think that the best way to deal with massive deficits is not to tax more but to simply spend less? Did you ever think of that Moon Bat?