View attachment 764357

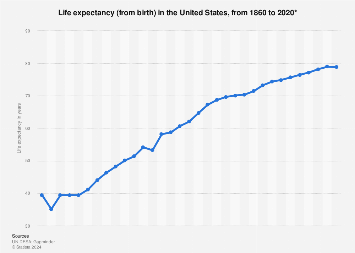

You aren't using a good metric. You base assumption on Average Life Expectancy (ALE). Now according to ALE we are living decades longer, but why?

The answer is that one of the major factors lowering ALE a century ago were high infant and children mortality rates. Infants and children werer dying young, which lowered the over all ALE. As mortality rates plummeted, ALE rose. However infants and children don't pay into social security. So their lives impacted ALE, but they didn't pay into SS.

The better metric is average months of receiving benefits. You can see from the table above the average in 1940 was about 13 years, the average in 1990 was about 17 years. A difference of only 4 years.

Averages haven't changed a lot since 1990 and in the early 80's the Full Retirement Age was changed (incrementally) to 67 which further muddies the waters because it it is delaying benefits for those retiring now. Meaning 2

LESS years of benefit payments before death for those retiring now.

WW