" Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch)" - Lehman Brothers - Wikipedia, the free encyclopedia

"Lehman Brothers was founded in 1850 by two cotton brokers in Montgomery, Ala. The firm moved to New York City after the Civil War and grew into one of Wall Street's investment giants. On Sept. 14, 2008, the investment bank announced that it would file for liquidation after huge losses in the mortgage market and a loss of investor confidence crippled it and it was unable to find a buyer." - Lehman Brothers Holdings Inc. News - The New York Times

"A year ago today, the venerable investment-banking firm Lehman Brothers filed for bankruptcy protection" - Three Lessons of the Lehman Brothers Collapse - TIME

Those are just the first three links on google you fucking idiot. Lehmans was a investment bank you moron.

Are you fucking serious? Your hanging up on the word deposits? Jesus i was trying to make this easier for you.

The principal of leverage and how that applies to liquidation is absolutely no different. If you liquidate any sort of bank, and lehman brothers is an investment bank, you wont recovery some of that wealth.

You are a fucking ignoramus of continental proportions.

Just because you insult someone with big words doesnt mean your actually intelligent. Seriously? You've just been perpetually wrong

Wow. Just wow. You have been totally humiliated here, proving you don't have a clue what you are talking about. And now you want to compound that by showing that you cannot distinguish an "investment bank" from a commercial bank. Then you want to claim that the leverage is "no different."

So we're back to "depositors were wiped out" which is your absurd claim. There were no depositors. Only investors were wiped out, which is fine. That's capitalism.

Ive been humiliated?? You didnt even know lehmans was an investment bank you fucking idiot.

The point is that liquidation doesnt recovery all the wealth that the investors thought they had invested with the bank....Thats been my claim from the beginning.

I used deposits to simplify you. Do you not remember me pointing out to you like 3 pages back the investment banks dont take deposits? Jesus christ i try to simplify things for you and then somehow im wrong because of it. OMfg.[/QUOTE]

So you didnt write this:

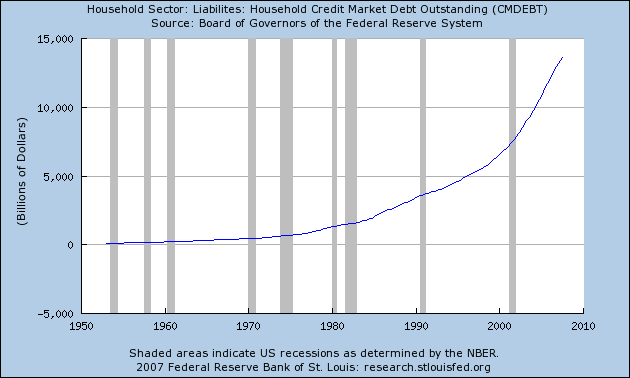

?f you simply allow collapses you lose real wealth. Do you know anything about fractional banking? A bank leverages its assets. Letting a bank collapse and then liquidating its assets will cause a loss in real wealth because the amount of its assets are less than the amount people have in checking accounts there, this is the difference between M0 and M1.

"The amount that people have in checking accounts" sure sounds like they take deposits. Lehmann Bros did not take deposits. Because they weren't a fucking bank.

Investors lose money when investments fail. So what? That's the risk of investment.

You are trying to crabwalk your way out of this and proving yourself one sorry motherfucker.