cbirch2

Active Member

- Jul 9, 2011

- 1,394

- 49

- 36

A lost decade can be looked at two different ways. If you have near zero growth in a ten year period then yes, that could be a lost decade, but that scenario seems somewhat unlikely to me.

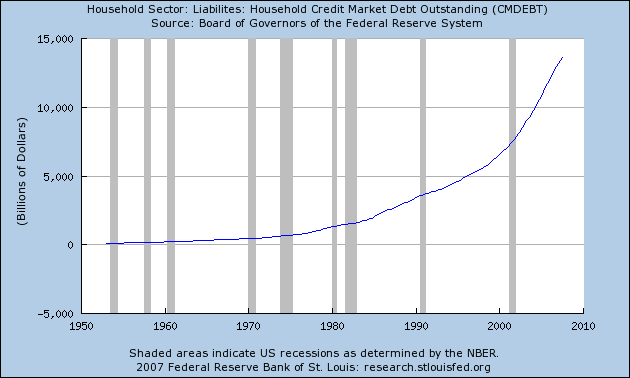

However, if you consider the past ten years and exclude the growth we had towards the middle of the decade that later got wiped out. If you consider the fact that today the stock market is at the same level as a decade ago, that home prices are down to their 2000 level, that non-farm payrolls are at the same level as ten years ago - then we've already had a lost decade in a sense.

Then again, if we get to 2016 or 2017 and the economy is still slow then we really would have had a lost decade similar to the first case that I mentioned above.

You could definitely say that.

Weve already lost a decade. Anything else is just icing on the cake.