Does it bother you lefties that most of Obama's stimulus and spending has gone to the the big corps?

I doubt it does because "the one" did it.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Does it bother you lefties that most of Obama's stimulus and spending has gone to the the big corps?

LOL, really? Nobody forced the banks to make risky loans.

SO are you thanking Obama for making the rich, richer & the middle-class poor? What about all those unemployed who are now really poor? Yeah! - Obama!

Obviously you missed a part. Here, I highlighted it for you. Feel better?

Total BS.They left because of cheap labor & more customers. They were leaving even faster when Democrats took over in 2006. Obama also lost them faster than Bush at first until our dollar tanked to much that our labor got cheaper.

American net worth is up $9 trillion dollars since the stimulus

Thanks, President Obama....

http://research.stlouisfed.org/fred2/data/TNWBSHNO.txt

Thanks for the link showing your numbers, pointing out that--

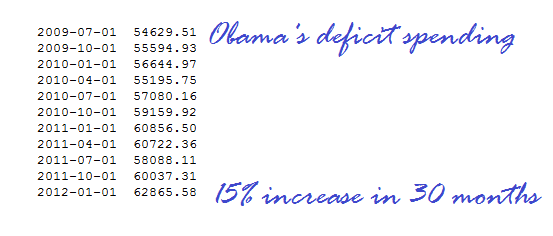

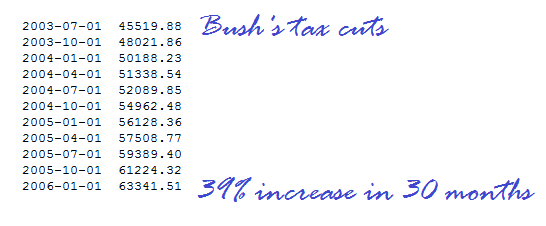

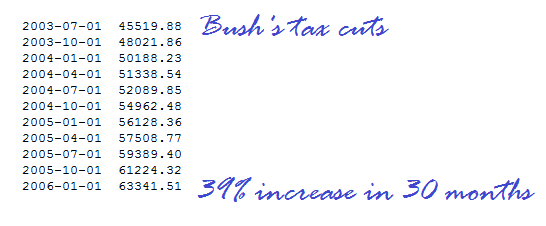

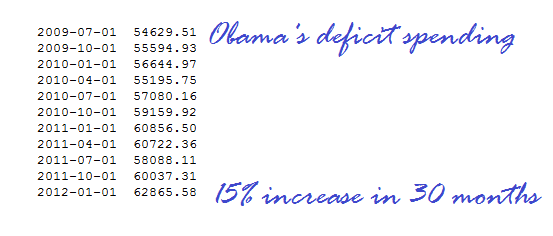

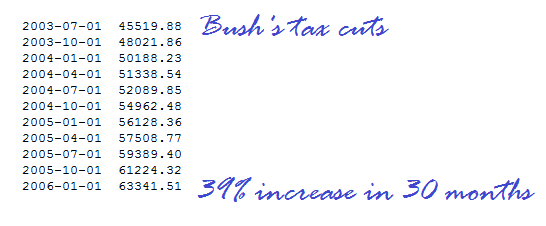

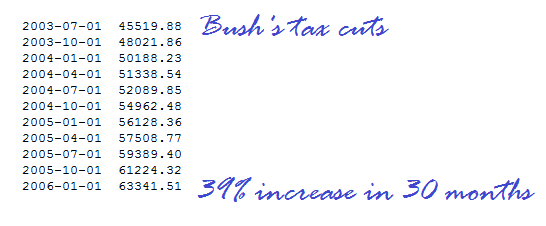

--Obama's signature policy response gave us a 15% increase in wealth in just 30 months. Comparing that to Bush's tax cuts--

--we get more than twice the increase.

I like tax cuts more than deficit spending.

There is no such thing as a tax cut if it adds to the deficit. You will just be paying it as an inflation tax. The idea of starving the beast is stupid. All that happens is interest rates climb along with inflation. Stop the spending instead of cutting taxes. Government services may drowned in the bathtub but you will still be paying even more because of the debt & inflation.

LOL, really? Nobody forced the banks to make risky loans.

Absolutely false. The federal government has indeed forced them to do that. Now, you can certainly argue that it was a minor factor in the crash, but don't say they have never been forced to make risky loans because that is factually wrong.

Ah, changing the subject away from Obama's failed policy. Smart move; glad we agree on it though.There is no such thing as a tax cut if it adds to the deficit...--Obama's signature policy response gave us a 15% increase in wealth in just 30 months. Comparing that to Bush's tax cuts--

--we get more than twice the increase. I like tax cuts more than deficit spending.

American net worth is up $9 trillion dollars since the stimulus

Thanks, President Obama....

http://research.stlouisfed.org/fred2/data/TNWBSHNO.txt

Thanks for the link showing your numbers, pointing out that--

--Obama's signature policy response gave us a 15% increase in wealth in just 30 months. Comparing that to Bush's tax cuts--

--we get more than twice the increase.

I like tax cuts more than deficit spending.

There is no such thing as a tax cut if it adds to the deficit. You will just be paying it as an inflation tax. The idea of starving the beast is stupid. All that happens is interest rates climb along with inflation. Stop the spending instead of cutting taxes. Government services may drowned in the bathtub but you will still be paying even more because of the debt & inflation.

It is impossible for a tax cut to add to the deficit.

Ah, changing the subject away from Obama's failed policy. Smart move; glad we agree on it though.There is no such thing as a tax cut if it adds to the deficit...--Obama's signature policy response gave us a 15% increase in wealth in just 30 months. Comparing that to Bush's tax cuts--

--we get more than twice the increase. I like tax cuts more than deficit spending.

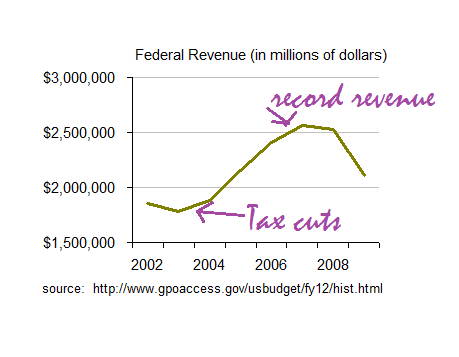

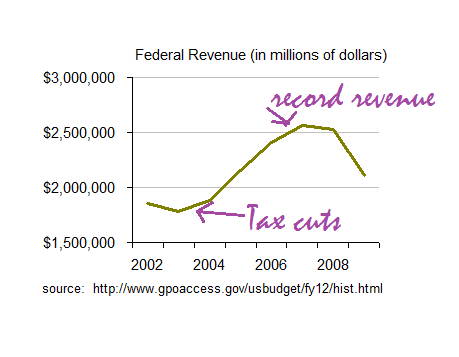

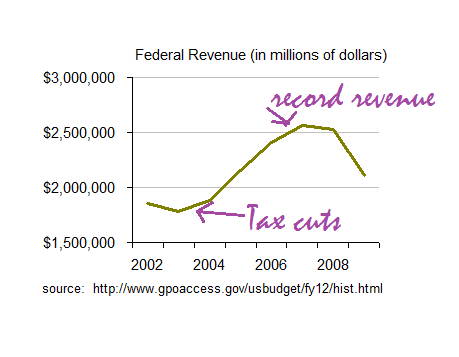

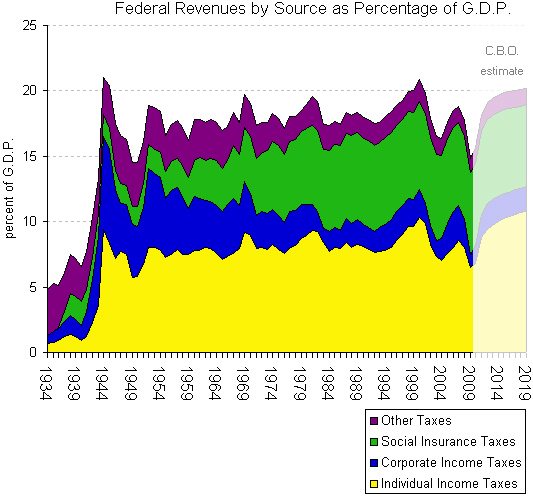

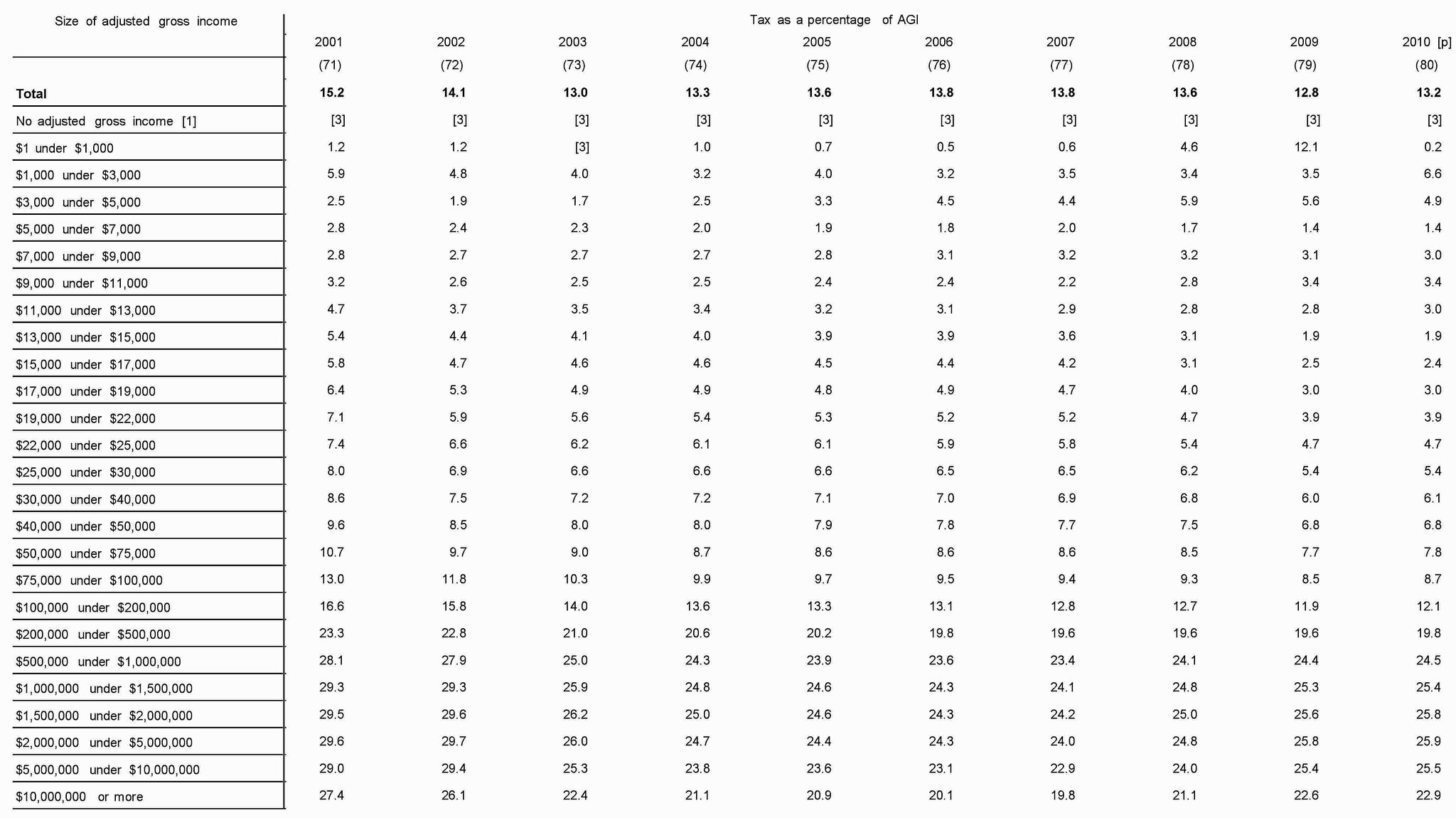

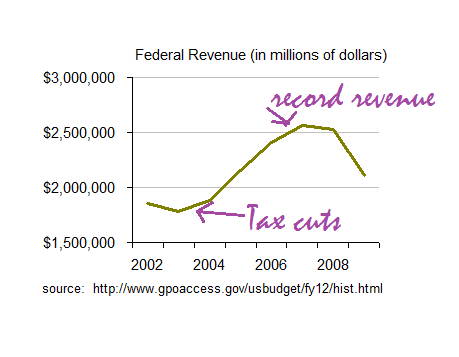

The tax cuts did not reduce revenue. In fact, annual revenue had been falling before the cuts and soared after. Revenue is still higher than it was before the cuts. The deficits were caused by spending which had increased more than revenue, but without the tax-cut's revenue increases the deficits would have been far worse.

Right? About what?OMG, I thought I had seen it all but really?

America's Average Net worth is DOWN by 40%.

What a fucking loser.

You're right. But so is Chris. Let's be honest, at least.

Millions? Have you been rubbing your Cialis on your head?Yes and no.

Yes, American corporations are making historic profits. They are sitting on trillions. Wall Street has made historic profits. Oil companies have never made so much. The number one US export is gasoline. Taxes for corporations are at historic lows. US oil production has never been so high. So in that regard, America's net worth is up "Trillions". No news here. It's something reported in every business publication for the last year.

Now about the Middle Class:

In 2007, the average wealth for a middle class homeowner was around $122,000.00. But at the end of the Republican economic recession in 2010, that number dropped to about $77,000.00. Pensions destroyed. Retirement accounts raided. From 2001 to 2008 millions of jobs were moved to China. Part of that move was paid for by the Bush/Republican tax cuts. Tens of thousands of factories closed and people making tens of millions of dollars are paying less than %15 in taxes. The wealth of the nation has been "redistributed" upward to the top 1%.

So over all, the nation has gotten richer. But not the "middle class".

SO are you thanking Obama for making the rich, richer & the middle-class poor? What about all those unemployed who are now really poor? Yeah! - Obama!

Obviously you missed a part. Here, I highlighted it for you. Feel better?

Right? About what?OMG, I thought I had seen it all but really?

America's Average Net worth is DOWN by 40%.

What a fucking loser.

You're right. But so is Chris. Let's be honest, at least.

Your post last night came out a bit hard to follow. I'm having to guess as to what the "ignorance" was that you were referring to and which subject was represented by your pronoun "it". Let's clean this up.Ignorance. It was the Bush Tax Cuts AND deficit defense spending vs the extension of the Bush Tax Cuts and whatever deficit spending Obama has done....I like tax cuts more than deficit spending.

We may be going wrong by not understanding the fact that the tax-rate cuts of 2003 were followed by revenue increases. Here are the historical revenue amounts as reported by the Obama Whitehouse:... This is really simple

Surplus ( - deficit) = Revenues - Outlays.

Revenues are, of course, taxes...

Funny. None ended up in my pocket.

We may be going wrong by not understanding the fact that the tax-rate cuts of 2003 were followed by revenue increases. Here are the historical revenue amounts as reported by the Obama Whitehouse:... This is really simple

Surplus ( - deficit) = Revenues - Outlays.

Revenues are, of course, taxes...

Revenue had been falling before the rate cuts, and revenue soared to an all time high afterward. The deficits would have been far worse if revenue had continued to fall without the rate cuts.

We may be going wrong by not understanding the fact that the tax-rate cuts of 2003 were followed by revenue increases. Here are the historical revenue amounts as reported by the Obama Whitehouse:... This is really simple

Surplus ( - deficit) = Revenues - Outlays.

Revenues are, of course, taxes...

Revenue had been falling before the rate cuts, and revenue soared to an all time high afterward. The deficits would have been far worse if revenue had continued to fall without the rate cuts.

Let's look at this better. Changing spending on defense (or anything else) does not change what the revenue is. Are we still together here?Yep and you have left out the increase in defense spending that began in 2001....Revenue had been falling before the rate cuts, and revenue soared to an all time high afterward. The deficits would have been far worse if revenue had continued to fall without the rate cuts.

We may be going wrong by not understanding the fact that the tax-rate cuts of 2003 were followed by revenue increases. Here are the historical revenue amounts as reported by the Obama Whitehouse:... This is really simple

Surplus ( - deficit) = Revenues - Outlays.

Revenues are, of course, taxes...

Revenue had been falling before the rate cuts, and revenue soared to an all time high afterward. The deficits would have been far worse if revenue had continued to fall without the rate cuts.