percysunshine

Diamond Member

Why do some people not understand the concept of printing money?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Yes and no.

Yes, American corporations are making historic profits. They are sitting on trillions. Wall Street has made historic profits. Oil companies have never made so much. The number one US export is gasoline. Taxes for corporations are at historic lows. US oil production has never been so high. So in that regard, America's net worth is up "Trillions". No news here. It's something reported in every business publication for the last year.

Now about the Middle Class:

In 2007, the average wealth for a middle class homeowner was around $122,000.00. But at the end of the Republican economic recession in 2010, that number dropped to about $77,000.00. Pensions destroyed. Retirement accounts raided. From 2001 to 2008 millions of jobs were moved to China. Part of that move was paid for by the Bush/Republican tax cuts. Tens of thousands of factories closed and people making tens of millions of dollars are paying less than %15 in taxes. The wealth of the nation has been "redistributed" upward to the top 1%.

So over all, the nation has gotten richer. But not the "middle class".

OMG, I thought I had seen it all but really?

America's Average Net worth is DOWN by 40%.

What a fucking loser.

You are correct....Americans lost a fortune under Republican leadership

Frankie your slipping......you forgot to mention 9/11......and Frankie?.....4.2 million new jobs?....were the fuck are they?....the biggest economy in the country is at 11% unemployment....Thanks for the Depression, Pubs/dupes. Lost 7 million jobs, 40% of wealth- no typical Pub recession! Now 4.2 million new jobs and 9 trillion rebound in wealth since the stimulus stopped the bleeding, despite nonstop Pub noncooperation and BS fearmongering....You and your party are a disgrace...

Yes and no.

Yes, American corporations are making historic profits. They are sitting on trillions. Wall Street has made historic profits. Oil companies have never made so much. The number one US export is gasoline. Taxes for corporations are at historic lows. US oil production has never been so high. So in that regard, America's net worth is up "Trillions". No news here. It's something reported in every business publication for the last year.

Now about the Middle Class:

In 2007, the average wealth for a middle class homeowner was around $122,000.00. But at the end of the Republican economic recession in 2010, that number dropped to about $77,000.00. Pensions destroyed. Retirement accounts raided. From 2001 to 2008 millions of jobs were moved to China. Part of that move was paid for by the Bush/Republican tax cuts. Tens of thousands of factories closed and people making tens of millions of dollars are paying less than %15 in taxes. The wealth of the nation has been "redistributed" upward to the top 1%.

So over all, the nation has gotten richer. But not the "middle class".

SO are you thanking Obama for making the rich, richer & the middle-class poor? What about all those unemployed who are now really poor? Yeah! - Obama!

Frankie your slipping......you forgot to mention 9/11......and Frankie?.....4.2 million new jobs?....were the fuck are they?....the biggest economy in the country is at 11% unemployment....Thanks for the Depression, Pubs/dupes. Lost 7 million jobs, 40% of wealth- no typical Pub recession! Now 4.2 million new jobs and 9 trillion rebound in wealth since the stimulus stopped the bleeding, despite nonstop Pub noncooperation and BS fearmongering....You and your party are a disgrace...

Yes and no.

Yes, American corporations are making historic profits. They are sitting on trillions. Wall Street has made historic profits. Oil companies have never made so much. The number one US export is gasoline. Taxes for corporations are at historic lows. US oil production has never been so high. So in that regard, America's net worth is up "Trillions". No news here. It's something reported in every business publication for the last year.

Now about the Middle Class:

In 2007, the average wealth for a middle class homeowner was around $122,000.00. But at the end of the Republican economic recession in 2010, that number dropped to about $77,000.00. Pensions destroyed. Retirement accounts raided. From 2001 to 2008 millions of jobs were moved to China. Part of that move was paid for by the Bush/Republican tax cuts. Tens of thousands of factories closed and people making tens of millions of dollars are paying less than %15 in taxes. The wealth of the nation has been "redistributed" upward to the top 1%.

So over all, the nation has gotten richer. But not the "middle class".

SO are you thanking Obama for making the rich, richer & the middle-class poor? What about all those unemployed who are now really poor? Yeah! - Obama!

Obviously you missed a part. Here, I highlighted it for you. Feel better?

They left because of cheap labor & more customers. They were leaving even faster when Democrats took over in 2006. Obama also lost them faster than Bush at first until our dollar tanked to much that our labor got cheaper.

They left because of cheap labor & more customers. They were leaving even faster when Democrats took over in 2006. Obama also lost them faster than Bush at first until our dollar tanked to much that our labor got cheaper.CaféAuLait;5444694 said:OMG, I thought I had seen it all but really?

America's Average Net worth is DOWN by 40%.

What a fucking loser.

You are correct....Americans lost a fortune under Republican leadership

Republican leadership? Which party has control of the Senate since 2007? Which had control of the House from 2007 until 2011? So the democrats and things like Frank/Dodd garbage did not add to such loss?

CaféAuLait;5444694 said:You are correct....Americans lost a fortune under Republican leadership

Republican leadership? Which party has control of the Senate since 2007? Which had control of the House from 2007 until 2011? So the democrats and things like Frank/Dodd garbage did not add to such loss?

Show us specific legislation passed by the Democratic congress

The source of the housing bubble was a socialist policy that encouraged, and even demanded, lending money to people who neither would nor could pay it back.

Get over it already.

LOL, really? Nobody forced the banks to make risky loans. Nobody forced banks like Countrywide or Ameriquest to engage in predatory practices.

Actually not true but as a liberal you won't have the IQ to understand.

The Fed had a policy of printing money and giving it to the banks at little interest. They do this because it makes banks lend more.

If one bank does not lend it gets dwarfed by its competitors.

Imagine if the government gave cars to all the dealerships and one refused to push them out the door to new customers.

Chuch Prince of Citibank famously described it this way, "we had to keep dancing until the music stopped.

And then of course there was Fanny who bought all the loans so the banks who made them did not carry them and so expose themselves to any potential risk.

American net worth is up $9 trillion dollars since the stimulus

Thanks, President Obama....

http://research.stlouisfed.org/fred2/data/TNWBSHNO.txt

American net worth is up $9 trillion dollars since the stimulus

Thanks, President Obama....

http://research.stlouisfed.org/fred2/data/TNWBSHNO.txt

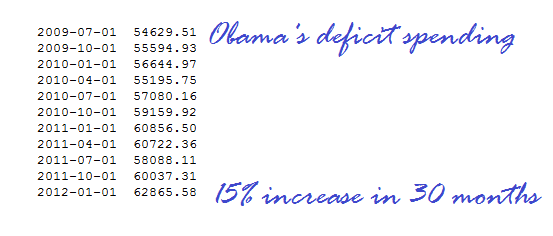

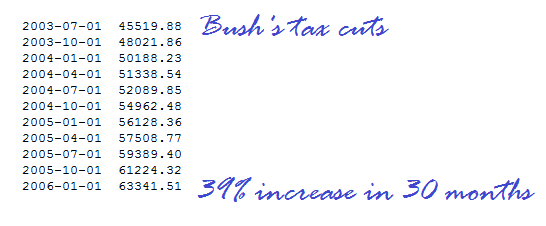

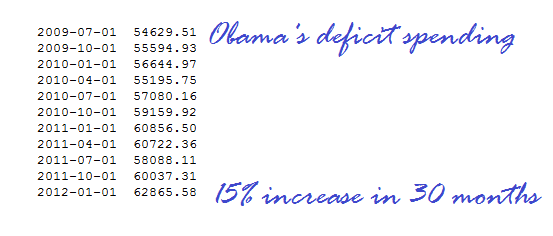

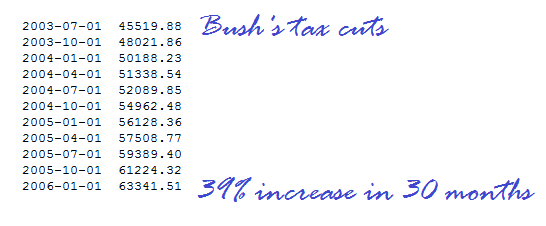

Thanks for the link showing your numbers, pointing out that--

--Obama's signature policy response gave us a 15% increase in wealth in just 30 months. Comparing that to Bush's tax cuts--

--we get more than twice the increase.

I like tax cuts more than deficit spending.

OMG, I thought I had seen it all but really?

America's Average Net worth is DOWN by 40%.

What a fucking loser.

You are correct....Americans lost a fortune under Republican leadership

Nobody makes banks lend more. Banks choose to do it on their own.

That's called a free market, not socialism.

First of all, that's a False parallel. Selling cars is not the same as lending money,

Second, you're still talking about dealerships that choose to sell their own cars.

And that's a bunch of BS.

Actually, Fanny Mae and Freddie Mac loans fared much better in the bubble burst than did private sector loans.

Frankie your slipping......you forgot to mention 9/11......and Frankie?.....4.2 million new jobs?....were the fuck are they?....the biggest economy in the country is at 11% unemployment....Thanks for the Depression, Pubs/dupes. Lost 7 million jobs, 40% of wealth- no typical Pub recession! Now 4.2 million new jobs and 9 trillion rebound in wealth since the stimulus stopped the bleeding, despite nonstop Pub noncooperation and BS fearmongering....You and your party are a disgrace...

So what did Iraq, the Bush tax cuts, moving jobs to China and the "drugs for votes" bill have to do with 9/11?