Toro

Diamond Member

Sealybobo and Terral and a few others seem to believe that the Federal Reserve has "spent" $9 trillion. They have concluded this because of a youtube video.

[youtube]WcZH9G8S9iQ[/youtube]

In this video, the congressman asks for an accounting of all the guarantees the Fed has undertaken since the financial crisis began. He asks about the Fed expanding its balance sheet by over $1 trillion. Here is the Fed's balance sheet. You can see the $1 trillion expansion.

FRB: H.4.1 Release--Factors Affecting Reserve Balances--June 18, 2009

He then asks about the $9 trillion in "off balance sheet transactions." Off balance sheet transactions are

off-balance sheet transactions - Definition of off-balance sheet transactions at YourDictionary.com

They are balance sheet items. A balance sheet is a snapshot of all assets and liabilities. If you own a house, spent $100,000 on your house, put 20% down and financed the rest with a mortgage, you have a balance sheet. You balance sheet would look like this.

Assets

House $100,000

Liabilities

Mortgage $80,000

Equity $20,000

Now, let's say you agree to guarantee your buddy's car purchase. He purchases a car for $10,000 using an $8,000 loan and you guarantee to the bank that you will pay the car loan if your buddy defaults. If your buddy defaults, then you get the car but are required to keep paying the mortgage. But you don't tell your wife.

That is an "off balance sheet transaction."

Now, if your buddy defaults, you get the car but have to pay off the car loan. You have not "spent" $10,000. You have taken a car (an asset at cost worth $10,000) and are now paying the debt (a liability of $8,000). Now, you decide to sell the car. If you can sell the car for $10,000, you have made $2,000. If can sell the car for only $5,000, you have lost $3,000.

This is what the Fed has done. They are you and the financial system is your buddy. If your buddy pays off the loan, then you are not effected one iota. If your buddy fails to do so, you now own his car. Your profit or loss will depend on what you can sell the car for after you pay off the car loan.

The Fed has swapped Treasury bills for lower-rated securities. It has expanded its balance sheet by offering to guarantee a wide variety of financial products, instruments and even markets. What it has not done is "spend" that money.

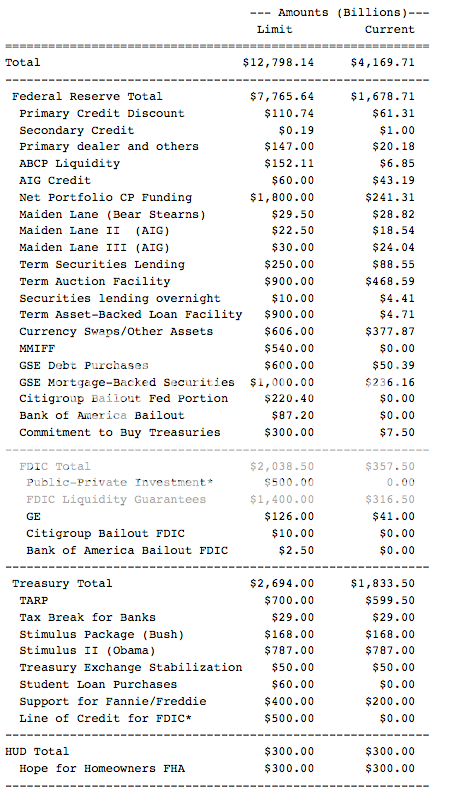

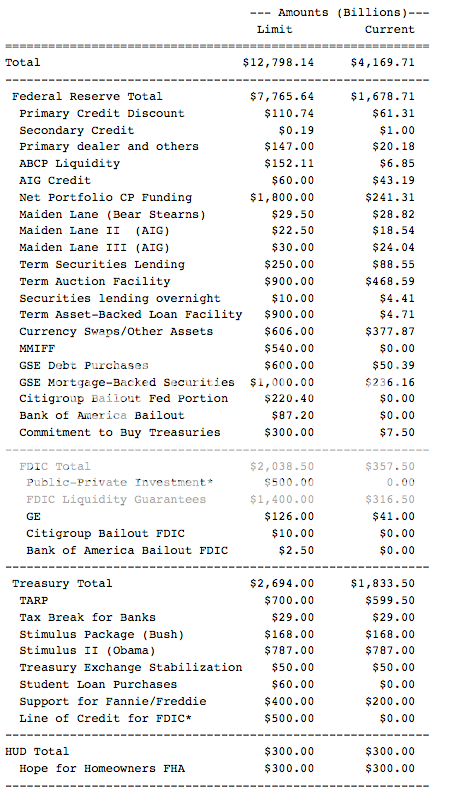

We have an idea what the Fed has guaranteed. In fact, the number is much larger. Including the US Treasury the guarantees are nearly $13 trillion.

Financial Rescue Nears GDP as Pledges Top $12.8 Trillion (Update1) - Bloomberg.com

This is a mind-boggling sum, no doubt about it. The US government is essentially guaranteeing the entire value of the economy. But $12.8 trillion has not been "spent."

Here are all the guarantees by the Federal Reserve and the Treasury.

[youtube]WcZH9G8S9iQ[/youtube]

In this video, the congressman asks for an accounting of all the guarantees the Fed has undertaken since the financial crisis began. He asks about the Fed expanding its balance sheet by over $1 trillion. Here is the Fed's balance sheet. You can see the $1 trillion expansion.

FRB: H.4.1 Release--Factors Affecting Reserve Balances--June 18, 2009

He then asks about the $9 trillion in "off balance sheet transactions." Off balance sheet transactions are

Financial deals and arrangements that can have a material affect on a company but are structured in such a way that they do not show up on a companyÂ’s balance sheet and do not affect a companyÂ’s borrowing capacity.

off-balance sheet transactions - Definition of off-balance sheet transactions at YourDictionary.com

They are balance sheet items. A balance sheet is a snapshot of all assets and liabilities. If you own a house, spent $100,000 on your house, put 20% down and financed the rest with a mortgage, you have a balance sheet. You balance sheet would look like this.

Assets

House $100,000

Liabilities

Mortgage $80,000

Equity $20,000

Now, let's say you agree to guarantee your buddy's car purchase. He purchases a car for $10,000 using an $8,000 loan and you guarantee to the bank that you will pay the car loan if your buddy defaults. If your buddy defaults, then you get the car but are required to keep paying the mortgage. But you don't tell your wife.

That is an "off balance sheet transaction."

Now, if your buddy defaults, you get the car but have to pay off the car loan. You have not "spent" $10,000. You have taken a car (an asset at cost worth $10,000) and are now paying the debt (a liability of $8,000). Now, you decide to sell the car. If you can sell the car for $10,000, you have made $2,000. If can sell the car for only $5,000, you have lost $3,000.

This is what the Fed has done. They are you and the financial system is your buddy. If your buddy pays off the loan, then you are not effected one iota. If your buddy fails to do so, you now own his car. Your profit or loss will depend on what you can sell the car for after you pay off the car loan.

The Fed has swapped Treasury bills for lower-rated securities. It has expanded its balance sheet by offering to guarantee a wide variety of financial products, instruments and even markets. What it has not done is "spend" that money.

We have an idea what the Fed has guaranteed. In fact, the number is much larger. Including the US Treasury the guarantees are nearly $13 trillion.

Financial Rescue Nears GDP as Pledges Top $12.8 Trillion (Update1) - Bloomberg.com

This is a mind-boggling sum, no doubt about it. The US government is essentially guaranteeing the entire value of the economy. But $12.8 trillion has not been "spent."

Here are all the guarantees by the Federal Reserve and the Treasury.

Last edited: