Don't take my word for it, plug in your income in 2000.

Put that same number in for 2003. Let us know how much you saved.

LOL! Dude, you realize of course that by using this argument you are arguing in support of deficits, right? You are arguing that tax cuts

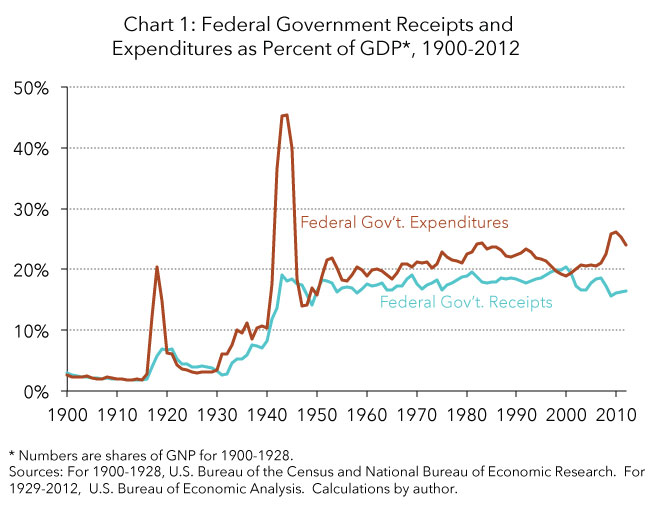

create deficits because I can do your exercise, but what I can also do is look at the federal deficit over the same period:

Deficit/Surplus

2000: $236B surplus

2001: $128B surplus (Bush Tax Cuts passed)

2002: $158B deficit

2003: $377B deficit (Record high)

2004: $412B deficit (Record high, start of mortgage bubble)

2005: $318B deficit

2006: $248B deficit

2007: $160B deficit (Mortgage bubble pops)

2008: $458B deficit (Record high)

2009: $1.4T deficit (All-time record high)

And did those tax cuts do anything to help the economy? NOPE!

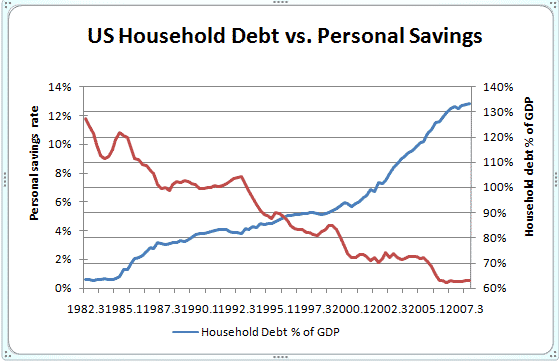

And what about household debt? What happened then? Well, it shot up from around 90% of GDP up to about 130% of GDP. That's not indicative of economic growth, it's indicative of debt growth. Which seems to be the only growth tax cuts produce. So you're right in a sense that tax cuts produce growth, you're just wrong about what it is that grows.

Notice those spikes in the early 00's? What's that all about? Tax cuts creating growth? What about jobs, did the tax cuts create jobs? NOPE!

Bush lost net 841,000 private sector jobs in his first four years. If tax cuts create growth, then there shouldn't have been any job loss! But OK, let's say for the sake of your weak argument that the tax cuts didn't really start until they were accelerated in 2003. So what's the net job gain/loss from then?

Negative 460,000. So at no point did Bush ever net out positive job growth that wasn't due to MEW's or the housing bubble. So the claim that tax cuts create growth is supported by what? Nothing. No jobs = no growth.

The Bush tax cuts caused medical bills? Are you drunk?

Come on now, you're being deliberately obtuse for no good reason. It wasn't just Bush the Dumber who cut taxes, many states did as well. Those states that cut taxes ended up raising health care costs because of a lack of funding. So your co-pays, co-insurances, deductibles, drug costs (something Bush the Dumber and the Conservatives actually did cause to rise with their Medicare Part-D they all supported at the time, but strangely don't today). It's no coincidence that after the ACA, medical bankruptcies drop like a rock as the uninsured rate plummets to an all-time low. Bush and the COnservatives in DC may not have cut spending when they cut taxes, but all they did was transfer that burden on the states and onto the federal deficit, which Conservatives were strangely silent about for 8 years as Bush ran up four record deficits and erased a surplus in that time

while doubling the debt.

So it wasn't some dramatic increase in the tax rate, was it?

Well, I guess you could claim taking 67% more out of my paycheck wasn't dramatic.

I'd have to disagree.

So right here is what I'm talking about when I say you're being dishonest! The marginal rate is

not 67%. The marginal rate increased

by 67% from (what?) to (what?) I've asked you for what those rates are three times now, and three times you avoided answering. I'm willing to give you the benefit of the doubt that you didn't mean the marginal rate was raised to 67%, but you meant the rate was raised

by 67% to

(insert actual rate here). One word makes

alllllll the difference to your post. Like I said, I know mistakes happen so I'm going to go against my better instincts and give you the benefit of the doubt and an opportunity to correct what you meant. I don't do that for just anyone.

Obama raised taxes and cut them.

When he cut taxes, he said that would help the economy and jobs. Was he a dirty liar?

Well, if you listen to Conservatives he was because they all claim no jobs were created by the payroll tax cut Obama passed. And let's be clear, it was a payroll tax cut, not an income tax cut. So you're conflating tax cuts together. But the result of the payroll tax cut was "the worst recovery in 80 years" according to you guys. So doesn't that just then prove what I'm saying? BTW - I thought then and still believe today that Obama never should have cut the payroll tax, even temporarily, because it takes from earned benefits.

I'll end your suspense. The Dems hiked taxes by 67% to fix those problems, the problems got worse.

First of all, I never claimed raising taxes fixes anything. I am only claiming cutting them doesn't. Secondly, the tax hike expired in 2015, and yet, you all are bleating about IL's

current fiscal troubles. So letting the tax hike expire didn't seem to solve any of the state's fiscal troubles, did it? That's why you all continue to invoke IL today, so your argument kind of eats itself. Well not kind of, it definitely does. You argue that lower taxes somehow results in less debt, yet Conservatives are screeching about IL's fiscal troubles, even after the tax hike expired as you say. So what does that mean? That letting the tax hike expire did nothing to change the fiscal outlook for the state. So why would lowering the taxes further have any different effect?

The fiscal picture of IL has little bearing on IL's economic performance.

That's funny. And wrong.

No, it's 100% correct. We just went through this 7 years ago with Rogoff/Reinhart's "Growth in the Time of Debt" paper. That paper concluded that once debt reaches 90% of GDP the economy "falls off a cliff". Paul Ryan even cited that paper in his Roadmap to Nowhere budgets that all Conservatives voted to support and approve. Only thing is, that study

is a load of shit. Why is it a load of shit? Multiple reasons, but the most predominant three were that 1) It deliberately omitted data that disproved the preconceived conclusion, 2) It had "spreadsheet errors" by Harvard economists who should know how to use Excel since they're, you know, Harvard economists, and 3) It wasn't peer-reviewed (which would have caught #'s 1 and 2). That paper was the only thing Conservatives were using to argue that high debt has a negative effect on growth. Without it, what do you have? Nothing. Hence, why we are where we are in this debate.

They don't need to cut their debt.

Tax cuts that give people more money causes their debt to increase but tax hikes don't cause their fees, tuition or debt to decrease?

So I don't know if you're playing at being obtuse or what, but I was referring to the State cutting its debt, not individuals. And IL's Household debt

did decrease during the period of its tax hike! I posted a chart that showed that very thing happening in Post #818. Maybe you missed it? No, cause you responded to it. So did you forget about it?

No, debt figures declined because citizens didn't have to go into debt to afford expenses like health care or education.

The problem with your claim is that while taxes rose, so did health care and education expenses.

Ah, but the State could better fund it with higher taxes, which meant folks didn't have to fork out as much, or borrow as much.

Funny how you completely ignore the fact that the dotcom bubble

Dotcom bubble? We were talking about your claim that the tax cut didn't "pay for itself".

Usually that means that revenues fall after a cut. Clearly they rose. Clearly, your claim was wrong.

Since the end result of the tax cut is a bubble burst and recession, then it doesn't pay for itself at all. How you can ignore the consequences of that is just wilfull ignorance at this point. What do you think caused the dotcom bubble? Because

Business Insider, and

NYU researchers Zhonglan Dai, Douglas A. Shackelford and Harold H. Zhang say it was the Capital Gains Tax Cut of 1997. The chickens came home to roost, it just took a few years for them to get there. But they got there. Do you think the dotcom bubble burst happened in a vacuum outside the Capital Gains Tax Cut? That the two had nothing to do with one another? Is that really the position you want to stake?

which was caused by that tax cut, popped in 2000.

So much for Bubba's surpluses that were gonna eliminate the debt, eh?

Well, hold on a second. You posted that the Capital Gains Tax Cut produced the following revenue:

1997-$79.3 billion

1998-$86.1 billion

1999-$111.8 billion

2000-$127.3 billion

And here are the surpluses with and without those revenues:

1997 - $21B deficit ($100B deficit w/o CGTR)

1998 - $69.3B surplus ($23B deficit w/o CGTR)

1999 - $125.6B surplus ($14B surplus w/o CGTR)

2000 - $236.2B surplus ($109B surplus w/o CGTR)

So they didn't really do a whole lot. Clinton still ran surpluses in his final two years without the Capital Gains Tax Cut Revenue.

So everything you're posting here amounts to shit because it was all wiped out when the bubble burst.

When the bubble burst, the government returned all those cap gains revenues? I don't believe you.

No, it means the revenues from the tax cut were from the bubble created by the Capital Gains Tax Cut. And bubbles pop.