My debt went down after every tax cut.

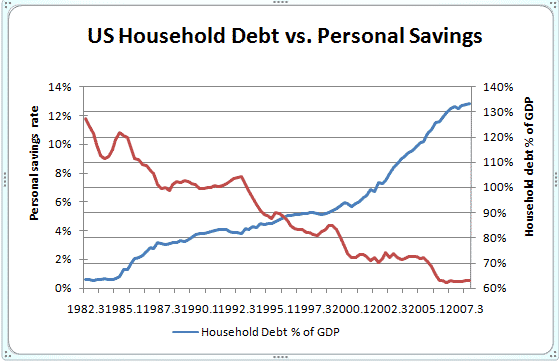

OK, but you realize this isn't about just you, right? That you do not exist in a vacuum, and just because something didn't affect you personally, doesn't mean it didn't affect a whole lot more people to a greater degree. When I say that people go into debt after a tax cut, that is supported by the increased household debt that spikes every time taxes are cut. We see here that household debt grew about 40% from the time Bush cut taxes in 2001 to the collapse in 200 going from about 90% of GDP up to above 130% by 2007:

Have to?Tax cuts help the economy grow, help employment grow.

Yes, have to. Which is what we saw during Bush the Dumber. An no, they do not help the economy grow, clearly:

No, they don't.Obama disagrees.

Obama's not President. And Obama raised taxes on the wealthy several times.

IL hiked taxes in 2011. Our growth rate must have been awesome, eh?

It was better than Kansas, which did the opposite.

Our debt and pension issues must have improved, right?

Debt and pension issues have nothing to do with economic growth. Those are fiscal issues, not economic ones. So far, you have been completely unable to make a connection between poor economic growth, and high debt. You will never be able to because the last time Conservatives tried to make that argument, they were exposed as lying frauds. It was a whole thing. Rogoff/Reinhart's "Growth in the Time of Debt". That paper, which served as the basis for austerity arguments, was rife with "spreadsheet errors" (from Harvard economists? Yeah, right), deliberate data omissions, and wasn't peer reviewed (with good reason). So if you guys were bullshitting about debt's affect on the economy in 2010, why wouldn't you be bullshitting about that same topic today?

And with a 67% rate hike on individuals, individual debt must have improved as well.

LOL! So you are trying to make it sound like the tax rate is 67%. That's not true, is it? What was the tax rate

before the hike and what was the tax rate

after the hike. Because a 67% increase can mean the marginal rate going from 3% to 5%. That is a 67% increase, is it not? Also, IL's household debt figures have

declined following the tax hike:

Let me know if you find any evidence of improvements in Illinois after the hike. Thanks!

See above. You're welcome.

So in what world is what you're saying true?

LBJ and Reagan passed large tax cuts, growth increased.

Bush passed a tax cut, growth increased.

LBJ and Reagan also increased spending dramatically. For LBJ, he increased government spending by nearly 50% from 1964-1968. Reagan did the same thing, increasing government spending 69% from 1981-1989. Bush didn't see growth after the tax cuts. The only growth was due to the housing bubble and people using their homes as ATMs, which you would argue they wouldn't have to do because they got more money back on the tax cut. Well if that's the case, how come MEW's made up the bulk of GDP growth during Bush? These are facts, not up for dispute. Facts that seem to undercut your argument completely.

When the state cuts spending, that results in higher costs for citizens.

I could cut government employment in Illinois by 30% and it wouldn't cost the average citizen a dime.

Now you're just spinning your wheels. This answer of yours does nothing to address what I was saying. When the state cuts spending, citizens bear higher costs because of it. This happened in Kansas, when the KS State Board of Regents had to increase tuition in order to make up for the funding gap from the state. So the state cut taxes, which cut tax revenue, which unbalanced the budget, which led to spending cuts, which led to less money for KS colleges and universities, which forced them to raise tuition, which forced students to borrow more, which puts them in debt, which delays them starting a family and buying a home. That's how tax cuts cost us. And where's the growth? Nowhere to be found.

Always. Tax cuts do not, have not, and will never pay for themselves.

Clinton's cap gains tax cut "paid for itself".

No it didn't!

The Capital Gains Tax Cut of 1997 is the reason the dotcom bubble burst by 2000.