40%? Link pleaseGee…..did they drop prices when Trump cut their taxes by 40 percent?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Psaki: ‘Unfair and Absurd’ To Say Companies Would Raise Prices in Response to Tax Increases

- Thread starter Weatherman2020

- Start date

Is the so called libertarian candidate in the Virginia governor race there to stop a Republican from winning it? McCaullife is corrupted to the bone. It was known a couple of decades ago. Killing him and his family is what things like this only understand. It won't happen though.Winner, winner, chicken dinner!!!

True, demand is a key component. It wouldn't work for all businesses...especially those with no existing future, for lack of consumer demand.Ask them.

You're saying raising them will create jobs and that's not any more correct

..................

what would be ideal is;

If corporations took a tax cut savings, and reduced their wholesale prices with the savings, demand would increase with a lower wholesale and retail price for consumers, which in turn... Increases the manufacture's demand, growth.

But that's not what the corporations did....

ColonelAngus

Diamond Member

- Feb 25, 2015

- 52,233

- 52,196

- 3,615

Actually, higher taxes forces corporations to operate more efficiently and effectively, and encourages reinvestment in their own business.

Whatever they reinvest in their company is tax deductible or a tax write off.. Give raises to employees, or hire more... all a tax write off....expand your inventory, or build additional retail stores or office space, all a tax write off....

These type of things are done, to avoid owing higher taxes from a higher tax rate....and to avoid having to raise the price of goods higher than the market is willing to pay....

What is the perfect % for the corporate tax rate?

- Oct 12, 2009

- 7,701

- 7,216

- 1,985

A tax hike, encourages them to create jobs, which is tax free spending....really low taxes encourages nothing, but pocketing the money, in most cases.

Fair enough. But why don't democrats apply this same thinking and cut spending to things like government welfare programs to encourage people to get jobs, or NATO/UN funding to encourage other countries to invest in their own security and pay their fair share?

Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

- 1,530

The ideal has never existed and never will.True, demand is a key component. It wouldn't work for all businesses...especially those with no existing future, for lack of consumer demand.

..................

what would be ideal is;

If corporations took a tax cut savings, and reduced their wholesale prices with the savings, demand would increase with a lower wholesale and retail price for consumers, which in turn... Increases the manufacture's demand, growth.

But that's not what the corporations did....

There is no tax scheme that will ever be accepted by everyone and that isn't unfair to someone.

Income taxes are the worst of all IMO.

- Oct 12, 2009

- 7,701

- 7,216

- 1,985

Cutting taxes will not create jobs

If you sell 1000 widgets a month, lower taxes will increase your profit not allow you to increase your workforce.

Unless you can expand the market for your widgets, you will not sell more

Um, in many cases you might have been able to sell 1500 widgets a month if you had more employees.

Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

- 1,530

The middle class is where the money is.Biden doesn't really want to raise taxes on the rich and his plan doesn't. His plan puts a disproportionate burden on the middle and lower classes who will be hit the hardest by the skyrocketing prices his plan is, and will continue to cause. It'll be his fault but he'll let the media put the blame elsewhere.

The income tax takes advantage of this because people in the middle 30% of earners will have the longest working careers and will bring in the most aggregate income to be taxed.

That's why the middle income brackets hardly ever change and only the lowest and highest get tinkered with

- Aug 4, 2009

- 281,359

- 142,369

- 2,615

If there was a market for an additional 500 widgets, you would already be filling it regardless of the taxesUm, in many cases you might have been able to sell 1500 widgets a month if you had more employees.

- Aug 4, 2009

- 281,359

- 142,369

- 2,615

The middle class is where income is actually reported. They have little opportunity to hide income.The middle class is where the money is.

The income tax takes advantage of this because people in the middle 30% of earners will have the longest working careers and will bring in the most aggregate income to be taxed.

That's why the middle income brackets hardly ever change and only the lowest and highest get tinkered with

The wealthy know better than to report income and they have an army of lawyers and accountants to hide it.

Most of our nations wealth (almost 2/3) resides with our wealthiest 5 percent

- Oct 12, 2009

- 7,701

- 7,216

- 1,985

If there was a market for an additional 500 widgets, you would already be filling it regardless of the taxes

A bakery makes cookies that sell out every day with people bagging for more, but the bakery can only make so many cookies a day because they can only afford a staff of 4 people. If they hired 2 more people to work after closing making cookies they could have more to sell.

Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

- 1,530

The wealthy don't really have W2 income.The middle class is where income is actually reported. They have little opportunity to hide income.

The wealthy know better than to report income and they have an army of lawyers and accountants to hide it.

Most of our nations wealth resides with our wealthiest 5 percent

It is nearly impossible to hide income from capital gains.

And there is a reason we don't have a "wealth tax" it's because the income of the middle class will always always always be larger in the aggregate than all the net worth of the wealthy combined.

Which is why the income tax is the worst tax of all for the working class

Last edited:

- Aug 4, 2009

- 281,359

- 142,369

- 2,615

Additional taxes will only apply to increased profit.A bakery makes cookies that sell out every day with people bagging for more, but the bakery can only make so many cookies a day because they can only afford a staff of 4 people. If they hired 2 more people to work after closing making cookies they could have more to sell.

If those 2 employees will increase your profit, you will hire them.

You will not hire more employees just because your taxes decreased. You have to have a market.

And all 43 Biden supporters nod in agreement.

Psaki: 'Unfair and Absurd' To Say Companies Would Raise Prices in Response to Tax Increases

White House press secretary Jen Psaki on Monday defended House Democrats' tax plan in the face of criticism that the legislation would see taxes and consumer prices rise for many Americans. Psaki insisted President Joe Biden is committed to keeping taxes the same for anyone making less than...freebeacon.com

Psaki isn't lying. You are. But that's typical for you. I did find this. They funded the Steele Dossier:

"From October 2015 to May 2016, the Washington Free Beacon hired Fusion GPS to conduct opposition research on “multiple candidates” during the 2016 presidential election, including Donald Trump. The Free Beacon stopped funding this research when Donald Trump had clinched the Republican nomination."

Washington Free Beacon - Bias and Credibility

RIGHT BIAS These media sources are moderately to strongly biased toward conservative causes through story selection and/or political affiliation. They may

mediabiasfactcheck.com

mediabiasfactcheck.com

If prices go up or down depending on the tax rate, why didn't prices go down when the government cut taxes in 2017? Since prices didn't go down when Trump cut taxes, why would they go up if taxes are raised by 5%. Trump cut taxes by 12%. The proposed tax increase still gives corporations 7% of the Trump tax cut, so there is no need to raise prices if a portion of that tax cut is clawed back.

This is just more Republican fear tactics. See thread on "Why do Republicans lie". Keeping money out of the hands of working people is a goal of Republicans everywhere, so of course they're lying about this.

The wealthy don't really have W2 income.

It is nearly impossible to hide income from capital gains.

And there is a reason we don't have a "wealth tax" it'd because the income of the middle class will always always always be larger in the aggregate than all the net worth of the wealthy combined.

Which is why the income tax is the worst tax of all for the working class

The wealth of the middle class is declining - biggly. A successful first world economy is dependent on a thriving and healthy middle class. The American middle class was built by unions. Reagan's destruction of the unions was just the first step in Republican dismantling of the New Deal, that had made the US economy the most powerful and richest in the world.

Why the middle class is shrinking

Fewer millennials in 2019 are middle class compared to baby boomers when they were in their 20s.

The American Middle Class Is No Longer the World’s Richest (Published 2014)

After three decades of slow growth, middle-class incomes in the U.S. appear to trail those of Canada. Poor Americans now make less than the poor in several other countries.

Michael Farr: The problem with the U.S. economy is there are too many poor people

It's easy to hate the rich for all that they have and all that you don't, but the rich aren't the problem.

We Killed the Middle Class. Here’s How We Can Revive It.

By helping one another reach our full potential, we’ll help the whole country get its swagger back.

Congratulations. Republican policies have returned the US tax code to the Guilded Age. Wages as a percentage of costs are now the lowest they've been since the day of the Robber Barons.

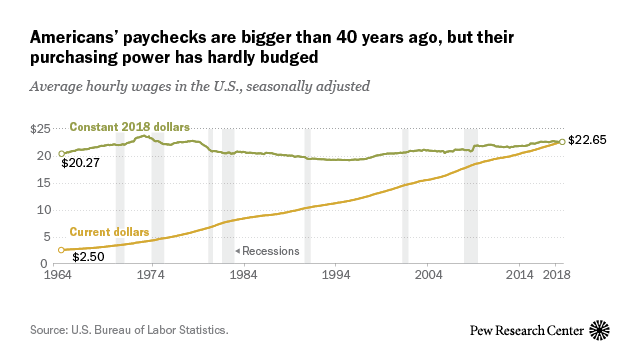

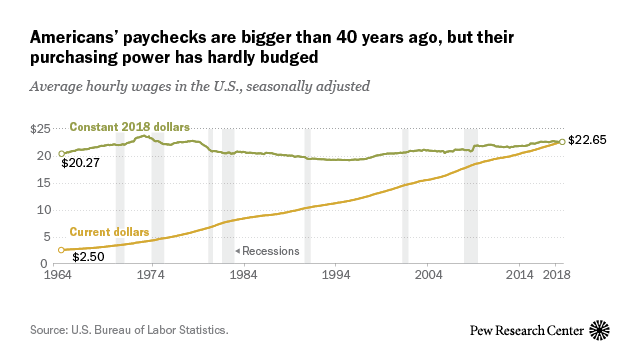

For most U.S. workers, real wages have barely budged in decades

Adjusted for inflation, today's average hourly wage has about as much purchasing power as it did in 1978. Most wage increases have gone to the highest earners.

The Top 1% of Americans Have Taken $50 Trillion From the Bottom 90%—And That's Made the U.S. Less Secure

A report shows that a $50 trillion redistribution of income to benefit the richest has made America less healthy, resilient, and secure

Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

- 1,530

Wealth and income are 2 entirely different thingsThe wealth of the middle class is declining - biggly. A successful first world economy is dependent on a thriving and healthy middle class. The American middle class was built by unions. Reagan's destruction of the unions was just the first step in Republican dismantling of the New Deal, that had made the US economy the most powerful and richest in the world.

Why the middle class is shrinking

Fewer millennials in 2019 are middle class compared to baby boomers when they were in their 20s.www.marketwatch.com

The American Middle Class Is No Longer the World’s Richest (Published 2014)

After three decades of slow growth, middle-class incomes in the U.S. appear to trail those of Canada. Poor Americans now make less than the poor in several other countries.www.nytimes.com

Michael Farr: The problem with the U.S. economy is there are too many poor people

It's easy to hate the rich for all that they have and all that you don't, but the rich aren't the problem.www.cnbc.com

We Killed the Middle Class. Here’s How We Can Revive It.

By helping one another reach our full potential, we’ll help the whole country get its swagger back.www.theatlantic.com

Congratulations. Republican policies have returned the US tax code to the Guilded Age. Wages as a percentage of costs are now the lowest they've been since the day of the Robber Barons.

For most U.S. workers, real wages have barely budged in decades

Adjusted for inflation, today's average hourly wage has about as much purchasing power as it did in 1978. Most wage increases have gone to the highest earners.www.pewresearch.org

The Top 1% of Americans Have Taken $50 Trillion From the Bottom 90%—And That's Made the U.S. Less Secure

A report shows that a $50 trillion redistribution of income to benefit the richest has made America less healthy, resilient, and securetime.com

Which is why the INCOME tax is designed to take the most from the middle 30% of earners

Did they lower the price of goods when their taxes were reduced by 40% -45% in their last mega corporate tax cut?

NO!

So why would the price of goods go up, with a 10% - 20% tax hike???

Some did lower cost, but there were various other options available. Some gave employees pay increases or bonuses while still others provided shareholders the benefit of a bigger dividend. The tax decrease provided companies the opportunity to pay down debt or buy back stock having affect of increasing the value to shareholders. I suspect that going in the opposite direction companies will find it much easier to pass along costs rather than going to employees, shareholders and banks with hat in hand asking for that money back.

Absolutely

Cut their taxes and they just keep the money

Conversely, if a company could charge higher prices, they already would.

The market will decide

Higher taxes are on profit not operating expenses

So getting to keep more of their own money is a problem for you?

Smart cash is fleeing into purchase of durable goods and everyday goods with long shelf lives.

Nostra

Diamond Member

- Oct 7, 2019

- 62,596

- 53,732

- 3,615

Higher taxes are on profit not operating expensesAbsolutely

Cut their taxes and they just keep the money

Conversely, if a company could charge higher prices, they already would.

The market will decide

Higher taxes are on profit not operating expenses

Hey Dumbass, that's where the IRS takes their cut. The Corp adds the increase in taxes to their cost of doing business and build it into the price of their product/service.

Taxes ARE and operating expense.

Similar threads

- Replies

- 57

- Views

- 517

- Replies

- 90

- Views

- 1K

- Replies

- 0

- Views

- 60

Latest Discussions

- Replies

- 49

- Views

- 172

- Replies

- 5

- Views

- 14

- Replies

- 666

- Views

- 4K

Forum List

-

-

-

-

-

Political Satire 8073

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-