Thanks to ODumbo's failed fiscal policies the countries economy stays in the crapper so we get more Fed. Just what Oblunder wants to take care of his cronies or, in other words, the 1 percent.

Good job Obama

-Geaux

Mark Spitznagel Slams The Fed For Creating The Rich-Poor "Chasm" | Zero Hedge

Mark Spitznagel Slams The Fed For Creating The Rich-Poor "Chasm"

Submitted by Tyler Durden on 12/13/2013 10:22 -0500

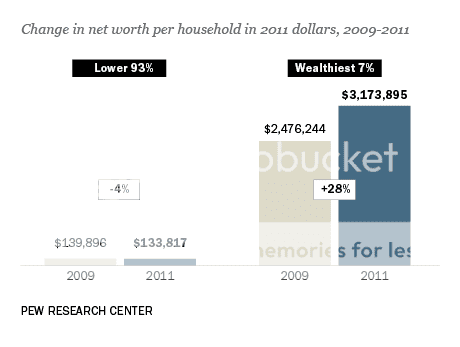

A major issue is the growing disparity between rich and poor, the 1% versus the 99%. While the presidents solutions differ from Republicans, they both ignore a principal source of this growing disparity.

The source is not runaway entrepreneurial capitalism, which rewards those who best serve the consumer in product and price. (Would we really want it any other way?) There is another force that has turned a natural divide into a chasm dun, dun, dun the Federal Reserve. The relentless expansion of credit by the Fed creates artificial disparities based on political privilege and economic power.

David Hume, the 18th-century Scottish philosopher, pointed out that when money is inserted into the economy (from a government printing press or, as in Humes time, the importation of gold and silver), it is not distributed evenly but confined to the coffers of a few persons, who immediately seek to employ it to advantage.

In the 20th century, the economists of the Austrian school built upon this fact as their central monetary tenet. Ludwig von Mises and his students showed that an increase in money supply is beneficial to those who get it first and is detrimental to those who get it last. Monetary inflation is a process, not a static effect. To think of it only in terms of aggregate price levels (Im looking at you Ben Bernanke) is to ignore this pernicious process and the imbalance and economic dislocation that it creates.

As Mises protégé Murray Rothbard explained, monetary inflation is akin to counterfeiting, which necessitates that some benefit and others dont. After all, if everyone counterfeited in proportion to their wealth, there would be no real economic benefit to anyone. Similarly, the expansion of credit is uneven in the economy, which results in wealth redistribution. To borrow a visual from another Mises student, Friedrich von Hayek, the Feds money creation does not flow evenly like water into a tank, but rather oozes like honey into a saucer, dolloping one area first and only then very slowly dribbling to the rest.

The Fed doesnt expand the money supply by uniformly dropping cash from helicopters over the hapless masses. Rather, it directs capital transfers to the largest banks (whether by overpaying them for their financial assets or by lending to them on the cheap), minimizes their borrowing costs, and lowers their reserve requirements. All of these actions result in immediate handouts to the financial elite first, with the hope that they will subsequently unleash this fresh capital onto the unsuspecting markets, raising demand and prices wherever they do.

The Fed, having gone on an unprecedented credit expansion spree, has benefited the recipients who were first in line at the trough: banks (imagine borrowing for free and then buying up assets that you know the Fed is aggressively buying with you) and those favored entities and individuals deemed most creditworthy. Flush with capital, these recipients have proceeded to bid up the prices of assets and resources, while everyone else has watched their purchasing power decline.

At some point, of course, the honey flow stopsbut not before much malinvestment. Such malinvestment is precisely what we saw in the historic 1990s equity and subsequent real-estate bubbles (and what were likely seeing again today in overheated credit and equity markets), culminating in painful liquidation.

The Fed is transferring immense wealth from the middle class to the most affluent, from the least privileged to the most privileged. This coercive redistribution has been a far more egregious source of disparity than the presidents presumption of tax unfairness (if there is anything unfair about approximately half of a population paying zero income taxes) or deregulation.

Pitting economic classes against each other is a divisive tactic that benefits no one. Yet if there is any upside, it is perhaps a closer examination of the true causes of the problem. Before we start down the path of arguing about the merits of redistributing wealth to benefit the many, why not first stop redistributing it to the most privileged?

Good job Obama

-Geaux

Mark Spitznagel Slams The Fed For Creating The Rich-Poor "Chasm" | Zero Hedge

Mark Spitznagel Slams The Fed For Creating The Rich-Poor "Chasm"

Submitted by Tyler Durden on 12/13/2013 10:22 -0500

A major issue is the growing disparity between rich and poor, the 1% versus the 99%. While the presidents solutions differ from Republicans, they both ignore a principal source of this growing disparity.

The source is not runaway entrepreneurial capitalism, which rewards those who best serve the consumer in product and price. (Would we really want it any other way?) There is another force that has turned a natural divide into a chasm dun, dun, dun the Federal Reserve. The relentless expansion of credit by the Fed creates artificial disparities based on political privilege and economic power.

David Hume, the 18th-century Scottish philosopher, pointed out that when money is inserted into the economy (from a government printing press or, as in Humes time, the importation of gold and silver), it is not distributed evenly but confined to the coffers of a few persons, who immediately seek to employ it to advantage.

In the 20th century, the economists of the Austrian school built upon this fact as their central monetary tenet. Ludwig von Mises and his students showed that an increase in money supply is beneficial to those who get it first and is detrimental to those who get it last. Monetary inflation is a process, not a static effect. To think of it only in terms of aggregate price levels (Im looking at you Ben Bernanke) is to ignore this pernicious process and the imbalance and economic dislocation that it creates.

As Mises protégé Murray Rothbard explained, monetary inflation is akin to counterfeiting, which necessitates that some benefit and others dont. After all, if everyone counterfeited in proportion to their wealth, there would be no real economic benefit to anyone. Similarly, the expansion of credit is uneven in the economy, which results in wealth redistribution. To borrow a visual from another Mises student, Friedrich von Hayek, the Feds money creation does not flow evenly like water into a tank, but rather oozes like honey into a saucer, dolloping one area first and only then very slowly dribbling to the rest.

The Fed doesnt expand the money supply by uniformly dropping cash from helicopters over the hapless masses. Rather, it directs capital transfers to the largest banks (whether by overpaying them for their financial assets or by lending to them on the cheap), minimizes their borrowing costs, and lowers their reserve requirements. All of these actions result in immediate handouts to the financial elite first, with the hope that they will subsequently unleash this fresh capital onto the unsuspecting markets, raising demand and prices wherever they do.

The Fed, having gone on an unprecedented credit expansion spree, has benefited the recipients who were first in line at the trough: banks (imagine borrowing for free and then buying up assets that you know the Fed is aggressively buying with you) and those favored entities and individuals deemed most creditworthy. Flush with capital, these recipients have proceeded to bid up the prices of assets and resources, while everyone else has watched their purchasing power decline.

At some point, of course, the honey flow stopsbut not before much malinvestment. Such malinvestment is precisely what we saw in the historic 1990s equity and subsequent real-estate bubbles (and what were likely seeing again today in overheated credit and equity markets), culminating in painful liquidation.

The Fed is transferring immense wealth from the middle class to the most affluent, from the least privileged to the most privileged. This coercive redistribution has been a far more egregious source of disparity than the presidents presumption of tax unfairness (if there is anything unfair about approximately half of a population paying zero income taxes) or deregulation.

Pitting economic classes against each other is a divisive tactic that benefits no one. Yet if there is any upside, it is perhaps a closer examination of the true causes of the problem. Before we start down the path of arguing about the merits of redistributing wealth to benefit the many, why not first stop redistributing it to the most privileged?