Your employer doesn't think so. I guarantee that he looks at those taxes and thinks that he is paying for them. If the darned taxes were lower, he'd have more profit.

Perhaps you are not getting the difference between real and nominal.

"The more debt our government takes on the less valuable our dollar gets."

How do you figure that? What, you read that on some conservative website and now anyone that knows differently must be a lib?

Do explain. Let me help.... NGDP = C + I + G + NX That is the same as MV=PQ.

The Fed Debt is just a number of a computer at the Federal Reserve bank. That is all. And, some one carries that debt. If not the gov then households, firms, or the financial markets. How is the government holding that debt somehow magically different?

The difference is simple. If I, as an individual, go into debt, I, as an individual owe that money. The difference with government is they went into debt with money they had to take from people and who are on the hook for the debt they chose to go into.

The fact is, that "the less valueable our dollar gets." is a statement of nominal prices, inflation. But, inflation has nothing to do with real GDP. Inflation doesn't affect real prices or real income. It can't. The only thing that affects real wages and real prices is employment level and production efficiency. People make stuff, people consume stuff.

Here is what investopedia says, "Unlike nominal GDP, real GDP can account for changes in the price level, and provide a more accurate figure."

The problem is, your thinking of it as an open economy, a household. Inflation is the result of more money in the supply. More money in the supply is both higher prices and higher income. Period. Inflation is always due to more money and nothing else. It has no real effect. Yeah, dude, you earn more to have the same effect.... duh... now your getting it, inflation means more dollars. More dollars means higher prices and higher earnings.

Now, that isn't to say that your not getting screwed by your employer as a wage earner. But it isn't because of inflation, government debt, the money supply, or taxes. It is because the labor market is competative. That is how it works, supply and demand for labor. Fundamentally, wages are driven down to the minimum. That is supply and demand for labor. It's got nothing to do with gov debt or taxes.

They are simple monetaryist notions. They are the result of classical economics, you know, the ones that Republicans subscribe to.

And you haven't presented shit to even imply any notion of not disliking paying any taxes. You have said nothing about an appropriate level of spending, taxes, or debt.

I've repeatedly said, they simply don't matter, neither good or bad, it all depends on what the gov does, not what taxes if collects.

You have consistently avoided the original question, whom should carry that debt? You've consistently avoided the entire notion of investment and leverage. You've avoided any direction except that you don't like the debt and taxes.

The government doesn't have to turn to you for money. The federal government is the fundamental source of all money. The FED marks up reserves, private banks lend it out. That is the monetaryist point.

The FED could increase the money supply by $10,000 per person per week and then the IRS collect and extra $10,000 per person per week. Nothing would change. people would still make as many widgets. People would still buy as many widgets. Real dollar costs would still be exactly the same. The only change would be that prices would be up by that $10,000 per person per week and every person would earn that $10,000 per person per week.

Inflation isn't ever going to be zero. Debt in the economy is required. The gov can carry it. Businesses can carry it. Whatever. The money supply can be $5 trill, the money supply can be $10 trill. It's all the same. It doesn't affect your standard of living.

Other wise, we could just have the Fed and banks increase the money supply to $100 trillion and we'd all be millionairs. We'd be able to own mansions, drive luxury autos, all own a jet.... Oh, yeah, can't because we have to make all those mansions, autos, and jets. It takes labor and capital equipment to do that and all the money that can be printed won't change that.

Just because the things you believe are wrong, doesn't make anyone else a "liberal". MV=PQ and GDP=C+I+G+NX aren't "liberal" concepts, they are simply facts.

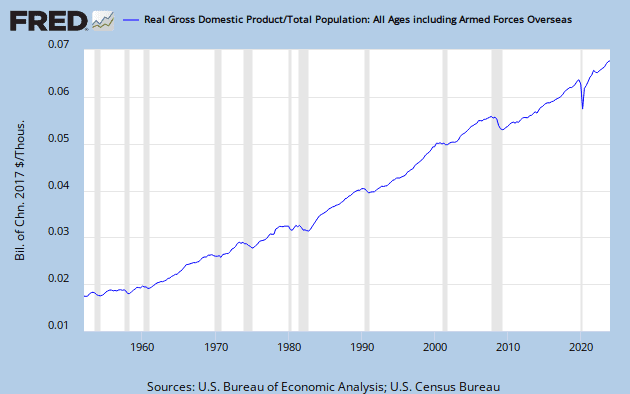

Here is real GDP per capita since 1950.

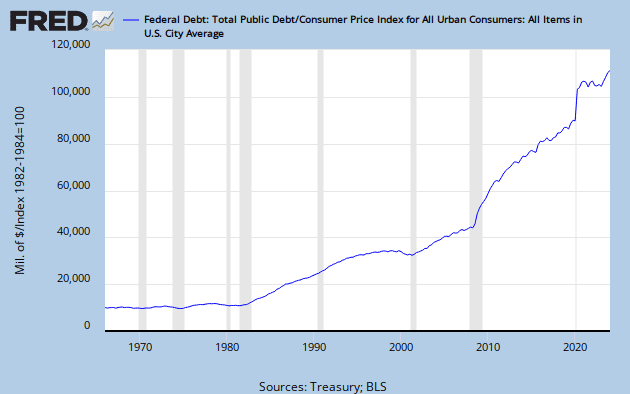

Here is the real dollar value of the government debt since forever.

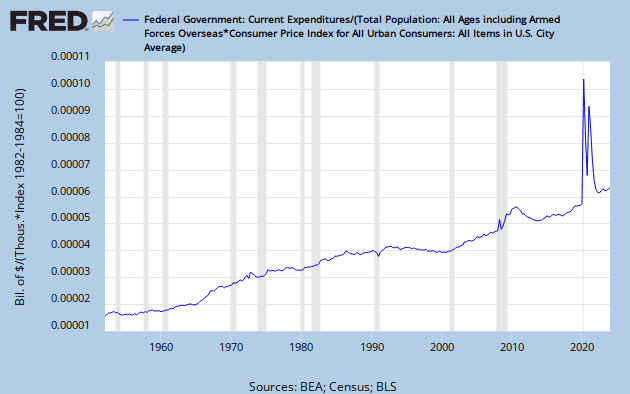

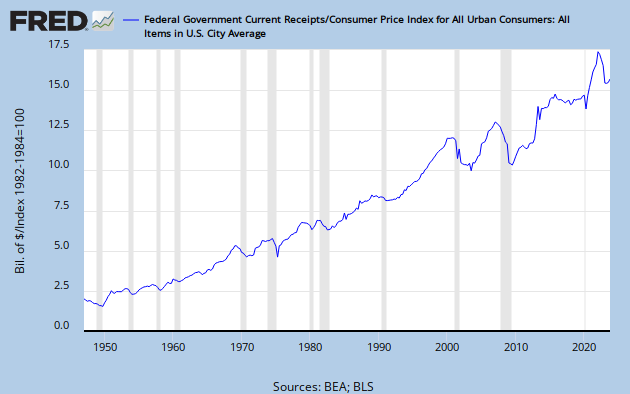

Here is government revenues.

Do them per cap. Do them per worker. The same thing.

Where is that increase in debt or deficit causing the standard of living to go down? Oh, it isn't. It is a straight line to the top, punctuated by recessions. Standard of living has nothing to do with government debt or deficit.

It isn't there, not by any measure, not by any sound macroeconomic examination.

"Common sense" is wrong, as wrong with macro econ as it is with Relativistic Physics.

GTG

None of the facts about inflation and GDP have anything to with the debt either. The fact that those concepts and relationships exist doesn't change the concept of the debt or that it's real or that it needs to be paid at some point. Obviously you know that or you wouldn't be asking me what does it matter who holds it and who 'should' hold it. The answer to that is similar to yours on whether our level of debt is good or bad. Who 'should' hold it, is a nonsensical question. The answer is either the private sector or the public sector and since the public sector's money is obtained from the private sector the answer is defacto, the debt is the private sectors. That's why it's a problem. The public sector made the decision to spend it, but the private sector is the one that has to pay for it at some point. Given that, we really shouldn't be asking why we're in debt. Why wouldn't we be? If you can rack up a credit card bill that you don't have to pay why wouldn't you spend till your heart's content.

If the debt doesn't matter, why doesn't the fed just print the 17 trillion or so and be done with it? We both know the answer to that and we know it means your wrong contending that it doesn't matter. Don't get on me about no answering questions. You're the one who has yet to explain why macro economics and money supply mean the debt isn't a problem.