Grumblenuts

Gold Member

- Oct 16, 2017

- 15,105

- 5,078

- 210

I'm honestly shocked at how many patiently ignore stupid demands like that from idiots like you.color me shocked that no number has been given for "fair share"

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I'm honestly shocked at how many patiently ignore stupid demands like that from idiots like you.color me shocked that no number has been given for "fair share"

I"m not sure that is the right answer. I think we need to look at the entire picture. But the fact remains America by far has largest pay disparity between ceo's and the average worker of any country in the world and it isnt close. Things need to change regarding pay and taxes. Pay for the average worker needs to increase, taxes on such things as cap gains needs to increase, corp taxes need to go back to what they were or slightly less than what they were.We need to return to the tax structure we had for over 70 years before reagan and the republicans changed it in the 80s.

It worked very well and helped create the superpower that the United States became in the 20th century.

If you don't know that tax structure, go look it up.

I'm not going to spoon-feed something to you that you will ignore and have absolutely no interest in knowing.

That seems to be what your dumb ass is saying.Yes. Everything is black and white.

Like Schindler's list without the little dead girl in red.

No nuance. It's in park, or we are going 150 MPH.

GFY dip shit. ignore.I'm honestly shocked at how many patiently ignore stupid demands like that from idiots like you.

Back in the 50s when America was great, it was somewhere around 90%.Which is?

The left constantly uses the term "fair share"

I somehow doubt ANY OF THEM MEAN what you just posted. Its only reasonable to expect a figure to be given for a very vague term given CONSTANTLY by the left.

And I dont need to be spoon fed a damn thing by anyone that voted for this disaster of a Presidency.

What percentage?More and more every year.

Agreed. Only a stupid person would think there are only 2 options.That's their very old ploy to prevent the necessary changes that are needed to properly finance and run our nation.

no you did not. but thanks for trying.Ok so I provide an answer to your question so you go off on something that isn't brought into the conversation and try to change the subject.

so spending had nothing to do with it? this is where liberals are completely FULL OF SHIT.The truth is that before reagan and the republicans slashed our tax rates and made it legal for the filthy rich to not pay taxes, we had a nation that had low debt and properly maintained our nation.

Same here!Musk loves getting the free money but he isn't much on paying for it.

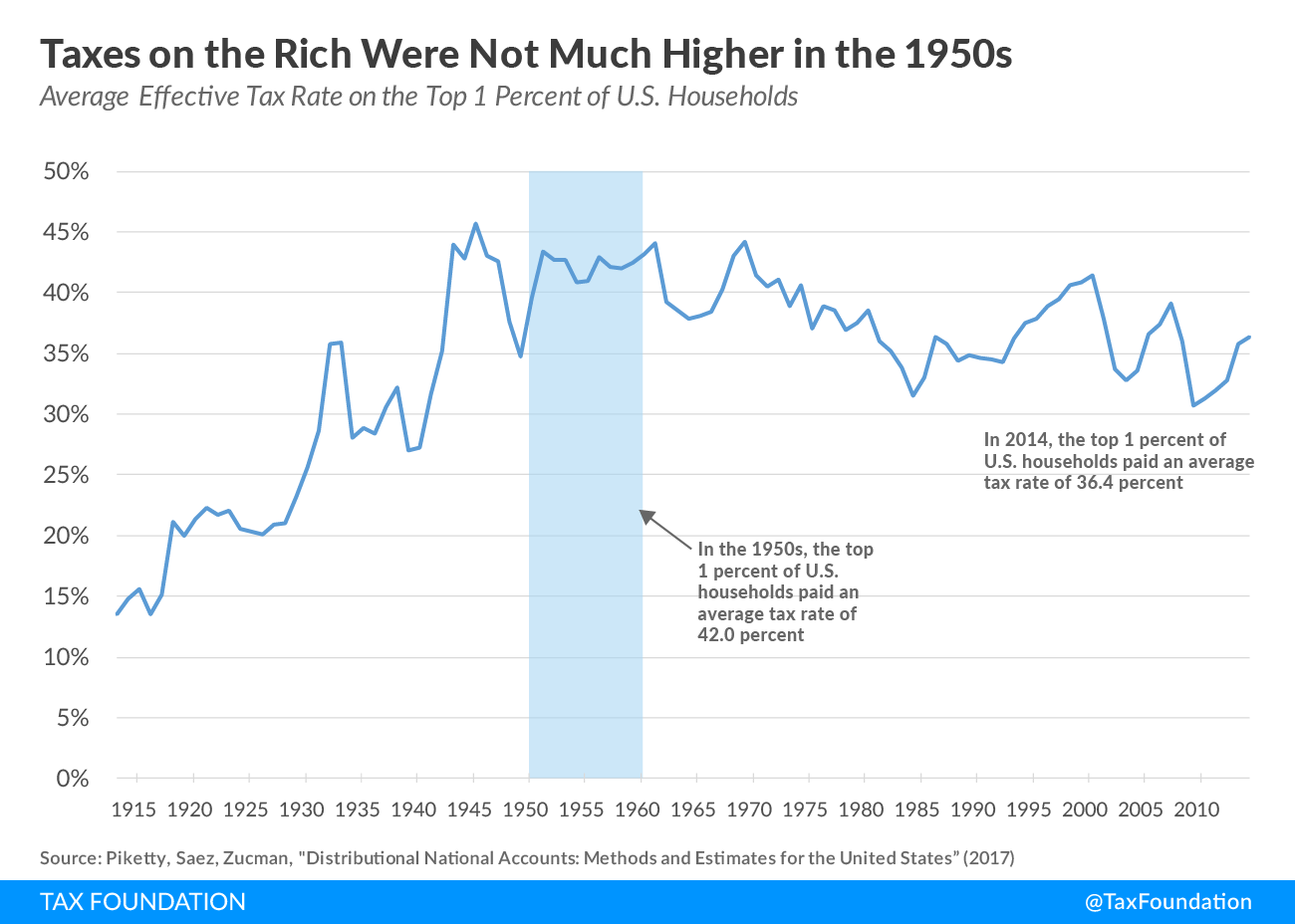

I’m sure the Top 1% would love to go back to that tax code with all the deductions they had. Their effective tax rate is a little over 20% today.Back in the 50s when America was great, it was somewhere around 90%.

Lets start there.

I know you didnt ask me but for one thing, I think cap gains should be taxed the same as your normal tax rate. Why should risk (investment) get a tax advantage over your time (job)?What percentage?

Same here!

But who the fuck is giving him free money and why? That shit should stop.

Link us up to where Reagan made it legal for the rich to not pay taxes.Ok so I provide an answer to your question so you go off on something that isn't brought into the conversation and try to change the subject.

That's not going to work with me.

I gave you an answer.

You don't have to like it, in fact I don't expect you to like it and don't care if you do.

The truth is that before reagan and the republicans slashed our tax rates and made it legal for the filthy rich to not pay taxes, we had a nation that had low debt and properly maintained our nation.

We were able to build a nation wide interstate highway system and send a man to the moon on those tax rates and structure while at the same time keep our national debt low.

We had the best education system in the world and were the leaders of the world.

That all started to change when the republicans slashed taxes so that the filthy rich and big corporations don't pay much if even a penny in federal income taxes.

While at the same time that republican tax structure raised the poverty level so that those who had nothing were all of a sudden also paying federal income taxes. While those who had more money than they can spend in a dozen lifetimes, pay nothing.

The government has been coming after the rest of us ever since reagan while allowing those who have the most accumulate more and pay very little and even nothing in federal income taxes.

Here is one partial answer. I think cap gains should be taxed the same as your normal tax rate. Why should risk (investment) get a tax advantage over your time (job)?anyone else want give us a number? or just pontificate like Dana?

Actually she did, dumbass. She stated EXACTLY what the tax rates should be.no you did not. but thanks for trying.

Why should one person be taxed more than another for his time?Here is one partial answer. I think cap gains should be taxed the same as your normal tax rate. Why should risk (investment) get a tax advantage over your time (job)?

Where were you when trump blew up the deficit? Dont act like overspending is just a dem thing. Otherwise, we'd have to call you a liar.so spending had nothing to do with it? this is where liberals are completely FULL OF SHIT.