SniperFire

Senior Member

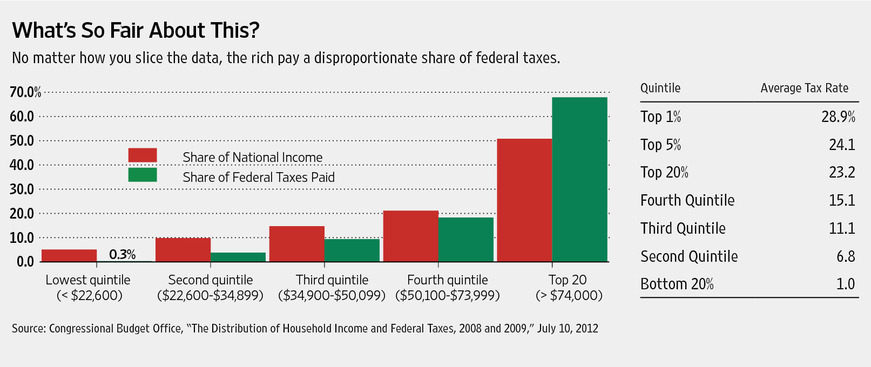

I don't think you know what fair means.Weren't taxes also higher under Clinton?

It isn't about higher taxes any more than it's about lower taxes.

It's about fair taxes.

On all income in excess of $30,000 a year, acquired by any and all means of acquiring money from wages to contracting, through interest earned, capital investments, hustling pool and lottery winnings, everyone should pay 18%. 'Cept for foreigners. Foreigners should have to pay 18% on everything and Citizens should get to earn their first $30k a year tax free. Citizenship should have perks other than voting.

Fair means EVERYONE puts skin in the game.

I mean fucking everyone.

He simply does not get that.

Probably raised as a gubmint dependent.

Whatever dude...

Whatever dude...  The most important issue of our day is fair taxes.

The most important issue of our day is fair taxes.

Legitimate concern? That's for the voters to decide, I suppose.

Legitimate concern? That's for the voters to decide, I suppose.