LoneLaugher

Diamond Member

Every time that a progressive uses the term "fair" it's an excuse to take something from someone else.

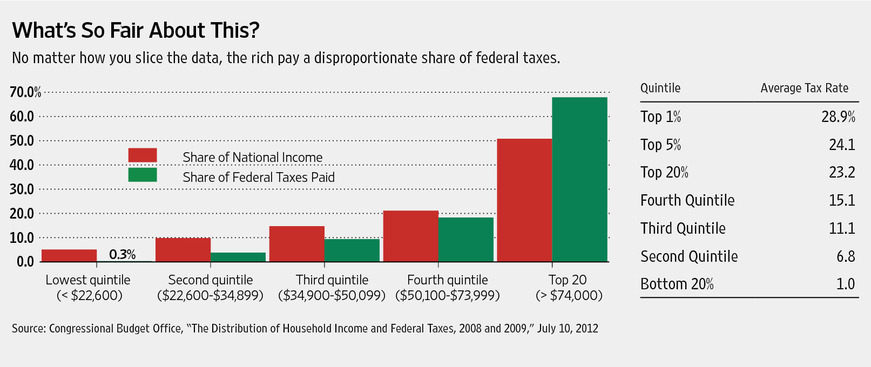

Progressives like Barack Obama would have you believe that the fiscal issues we face can be fixed simply by taxing wealthy people at a higher rate. The truth is even if we taxed the wealthy at a 100% we STILL wouldn't be able to support the entitlements we're obligated to pay. So don't kid yourself into thinking that someone ELSE is going to be picking up the tab for our out of control spending...those entitlements will be paid for by the middle class as well.

No they don't.

The most important issue of our day is fair taxes.

The most important issue of our day is fair taxes.

Legitimate concern? That's for the voters to decide, I suppose.

Legitimate concern? That's for the voters to decide, I suppose.