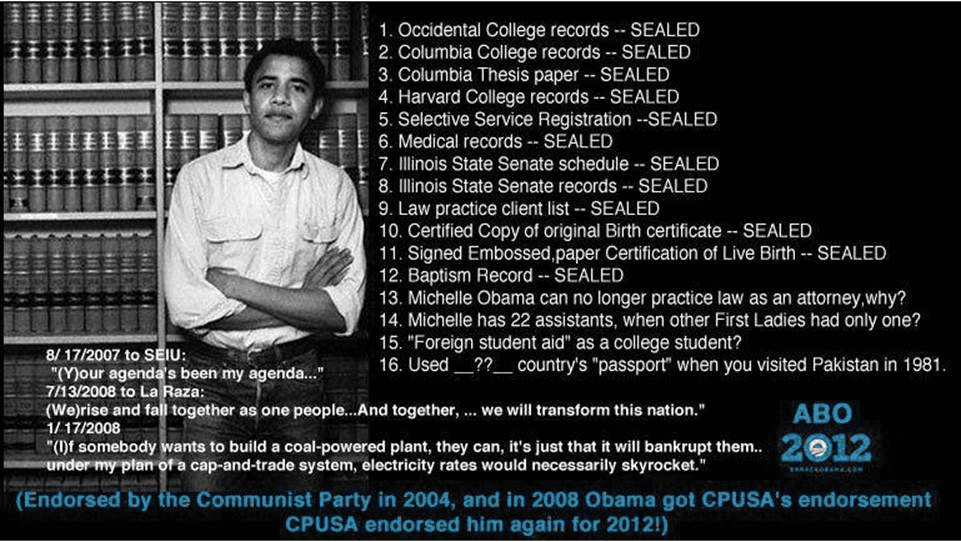

Q: Are Obamas early records sealed?

A: No. Many records that presidential candidates dont ordinarily release do remain confidential, but they are not sealed by a court. The 16 claims in a widely distributed graphic are mostly false or distorted.

FULL ANSWER

This is an example of mostly old baloney in a new casing. It mainly recycles years-old falsehoods and insinuations, most of which we covered long ago, in connection with an earlier viral email.

But with President Barack Obamas reelection campaign heating up, this new graphic has appeared on countless anti-Obama websites and in viral emails like the one weve reprinted here. Very little that it contains is new, and the old falsehoods have not improved with age.

DETAILS: FactCheck.org : Obamas Sealed Records

The most important issue of our day is fair taxes.

The most important issue of our day is fair taxes.