IOW, you don't have any proof to the casual viewer of this site. Nice. I have offered up several sources and you offer up nothing.Yes, there is something else you can help with. I post for others that come to review our debates, folks that aren't necessarily members. They will hit your link and see that they need to download something and ignore it and assume that I am right and you are a liar.

The information you want is at this link. I'm not downloading it.

System Open Market Account Holdings - Federal Reserve Bank of New York

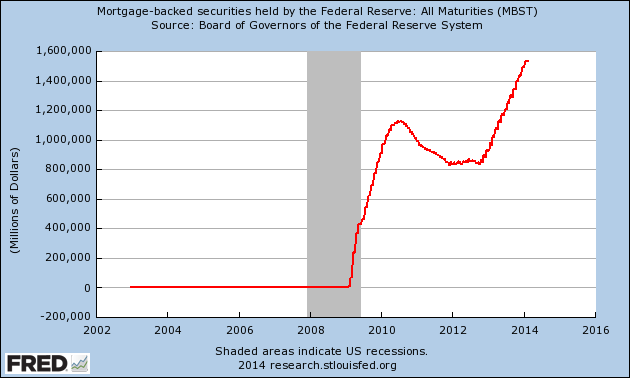

This is that chart, image captured at a blog. The current estimate is at $1.5 trillion.

When the housing market is owned by Fed banks: Federal Reserve went from holding zero in mortgage-backed securities to over $1.5 trillion.

The Fed went from owning zero in MBS all the way to the current $1.5 trillion. The Fed is a massive portion of the market and is buying up nearly 100 percent of all issued MBS. This has also caused massive volatility in the bond market. Yet the end result is that homeownership overall is actually down for Americans because a large portion of the buying is going to Wall Street and big banks.

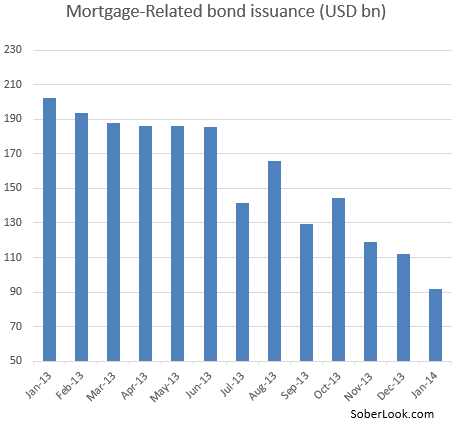

You can even see this on the private side with MBS issuances:

What need is there to grow this portion of the market if the Fed is dominating it so dramatically? There is little incentive to make this more competitive when banks instead of helping American homeowners are actually buying up massive amounts of homes with the corporate financial welfare of the Fed. Driving up prices with no subsequent growth in incomes is not a healthy policy.

Since the Fed has intervened we have seen roughly 30 percent of all home purchase going to investors:

“(NAR) All-cash sales comprised 32 percent of transactions in December, unchanged from November; they were 29 percent in December 2012. Individual investors, who account for many cash sales, purchased 21 percent of homes in December, up from 19 percent in November, but are unchanged from December 2012.”

This has created a new form of a Gilded Age society because inequality continues to rise and home prices rising with no real substantive growth in income is not useful. What does it matter if a regular home buyer has access to a mortgage at a 4 percent interest rate when connected banks can leverage debt at close to zero percent?

The Fed went from owning zero in MBS all the way to the current $1.5 trillion.

Thank God you finally posted some real info.

http://www.sifma.org/uploadedfiles/...iles/sf-us-mortgage-related-sifma.xls?n=02400

This nifty site shows about $7.2 trillion agency MBS outstanding, in addition to $1.4 trillion non-agency MBS.

So your 100% claim was just a bit off.

Let me know if there's anything else you're confused about, I'm always glad to help.

I would please like you to link to something that observers could see as evidence proving me wrong. Otherwise, we will have to assume you are full of crap.

They will hit your link and see that they need to download something and ignore it and assume that I am right and you are a liar.

Like you, they'd be wrong. Clicking the link gives you an Excel file.

It has the proof your 100% claim was wrong. The opposite of right.

You're free to not click and continue to spread your error.

Casual viewers can't click the link? That's awfully sad.

If I bothered to figure out how to copy an Excel spreadsheet, I'd post it.

There are plenty of sources that show the supply of MBS is much, much larger than the $1.744 trillion the Fed owns. If I feel like kicking you while you're down, I'll find another.