- Sep 16, 2012

- 60,939

- 54,888

- 3,605

The Fed bought all the MBS. Watch the video noob. Yes they do.See, this is why that "FED Audit Bill" needed to be passed.

Folks like you and Toddsterpatriot are happier living in denial and ignorance. You think your financial knowledge, or that of your advisers is good enough.

Who cares if the minutes of these meeting came off of the "internet?"

Does it make the knowledge any less valuable? The fact is, a massive deception was undertaken. I seriously doubt either one of you bothered to view that video, either that, or you just didn't like what you saw, so you just blocked it out.

If the folks on main-street, and the independent press knew what was going on, then there would have been a revolution before dawn.

Fuck your IRA's and your 401k's you greedy bitches. When the bank bail-in's come, I hope you are the first to be hit.

CHAIRMAN BERNANKE. Thank you. President Stern.

MR. STERN. Thank you, Mr. Chairman. In thinking about the three issues you raised, I start from the presumption that we don’t need to convince market participants at this stage that we will do what it takes to, if possible, restore stability and to encourage financial and economic health. I think we need to convince them that we have an exit strategy and that we are prepared to execute it in a timely way.

http://www.federalreserve.gov/monetarypolicy/files/FOMC20090624meeting.pdf

Now, I submit to you, they STILL don't have a way to unwind these assets. Those toxic assets still are being held, with no way to be unwound. There IS no exit strategy, there are no loans for small businesses, and the economy still stagnates because of these toxic assets.

If all this were known back then, things would have been entirely different.

And still the rich treat Wall-street like their Casino.

Now, I submit to you, they STILL don't have a way to unwind these assets. Those toxic assets still are being held, with no way to be unwound.

They don't have any toxic assets.

All the MBS? How much would that have been?

AT what point in time?

JHC! I was right, you didn't watch the video. Why are we even having this conversation? We are talking past each other.

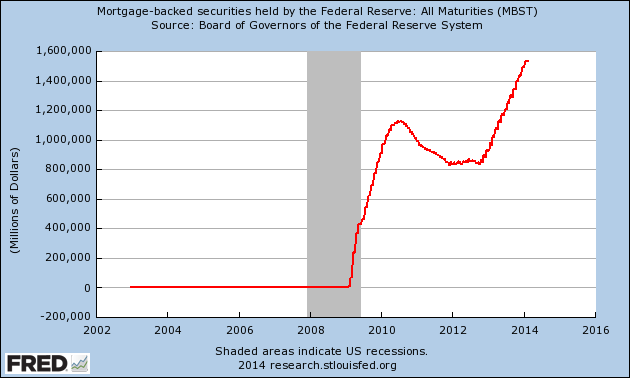

This is an interactive graph. You can pick any point in time, up to and including today.

https://research.stlouisfed.org/images/fredgraph-logo-2x.png

AT what point in time?

You made the claim, you tell me.

I was right, you didn't watch the video.

Which moronic video makes that idiotic claim?

Why are we even having this conversation?

Because you're an idiot making silly claims that you won't back up.

This is an interactive graph. You can pick any point in time, up to and including today.

Great, use it to tell me when the Fed "bought all the MBS". Durr.