The Pander to the rich tax policy of the last 35 years has slowly ruined the middle class and our infrastructure...Typical brainwashed ignorant GOP dupe. You have nothing but idiotic talking points and stupid insults. But thanks for Wrecking the middle class and the country, the stupidest Wars ever and the corrupt world depression. And now the strangest president ever, though I'm still hoping for the best. If he would just change the channel...My plan works just fine, it will take a little while to fix 35 years of GOP Pander to the rich garbage, dingbat.Quite a bit. Quite a bit.

Quite a bit... Quite a bit... Economics is not an exact science and your questions are simply obstructionist and stupid and exactly what the dupes can't get past. But Republicans and Reagan did not ask that these questions when they drop the top rate to 50 and then 28%... It's obvious to any unbrainwashed person that the rich pay too little and the rest are paying too much.Ok - since you seem to be incapable of actually analyzing your proposal, I have taken the opportunity to do that. Keeping in mind that I am forced to use exact income numbers, we found this:Quite a bit. Quite a bit.

Quite a bit... Quite a bit... Economics is not an exact science and your questions are simply obstructionist and stupid and exactly what the dupes can't get past. But Republicans and Reagan did not ask that these questions when they drop the top rate to 50 and then 28%... It's obvious to any unbrainwashed person that the rich pay too little and the rest are paying too much.

1) There are 125.32 million households.

2) Therefore, the top 1% constitutes 1.25 million households.

3) The "average" top 1% taxpayer earned $380,000/year or more. How Much Money Do The Top Income Earners Make By Percentage?

4) Approxiymately 1.1 million (of those 1.25 million households) made between $300K and $999K Beyond the 1 percent

5) If we assume statistical distribution, that means that each of those 1.1 million earned $655K on average.

6) Since those 1.1 million households cover your 40% tax bracket, that means they generated $282 billion in taxes.

7) The remaining 1% ers (125,000) averaged $6 million per year income. Beyond the 1 percent

8) Thus, they would generate $375 billion in taxes.

Therefore, the top two tiers of your proposal would generate $657 billion in revenue.

9) The remaining 124.07 million households populate your final two tax brackets.

10) We know that the average household income in the US is about $53,000/year. Opinion | $250,000 a Year Is Not Middle Class

11) Given that your cutoff was $50K to pay taxes, for estimating purposes, we will simply estimate that one half of the households will pay no taxes (62 million households)

12) The remaining 61 million households will pay taxes at the 25% rate, according to your plan.

13) If you extrapolate, that means that those households will average about $73K in household income, with each paying $18,250 in taxes

Therefore, your third tax rate will generate $1.12 trillion.

Thus, your total tax plan will generate $1.76 trillion - far short of the current $4 trillion budget. If you were to raise the rates to 100% of everything above $1m, 80% of everything between $ 300K and $1M, and 50% of everything between $50K and $300K, you STILL wouldn't generate enough tax revenue.

Guess that didn't work, did it?

Further, that's assuming linear taxation from first dollar to last dollar - not something we do.

By the way, the CURRENT revenue projections say $2.2 trillion in income tax, and $582 billion in corporate taxes - still not enough to meet the proposed budget.

The point isn't that your plan was faulty, or that liberals who call for taxes on the rich as the panacea to fix all things, aren't thinking it through. The simple truth is we are outspending our capacity to generate revenue. We have a spending problem - pure and simple. There is NO way to generate the income needed to operate the government in its current configuration.

Those poor useless democrats.

Sent from my iPhone using Tapatalk

Their was no wrecking the middle class, republicans where trying to save the middle class from the inevitable, the writing was on the wall after WWII was a fluke in history

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Republicans so worried about the debt, yet they cause most of it.

- Thread starter Penelope

- Start date

The Pander to the rich tax policy of the last 35 years has slowly ruined the middle class and our infrastructure...Typical brainwashed ignorant GOP dupe. You have nothing but idiotic talking points and stupid insults. But thanks for Wrecking the middle class and the country, the stupidest Wars ever and the corrupt world depression. And now the strangest president ever, though I'm still hoping for the best. If he would just change the channel...My plan works just fine, it will take a little while to fix 35 years of GOP Pander to the rich garbage, dingbat.Ok - since you seem to be incapable of actually analyzing your proposal, I have taken the opportunity to do that. Keeping in mind that I am forced to use exact income numbers, we found this:

1) There are 125.32 million households.

2) Therefore, the top 1% constitutes 1.25 million households.

3) The "average" top 1% taxpayer earned $380,000/year or more. How Much Money Do The Top Income Earners Make By Percentage?

4) Approxiymately 1.1 million (of those 1.25 million households) made between $300K and $999K Beyond the 1 percent

5) If we assume statistical distribution, that means that each of those 1.1 million earned $655K on average.

6) Since those 1.1 million households cover your 40% tax bracket, that means they generated $282 billion in taxes.

7) The remaining 1% ers (125,000) averaged $6 million per year income. Beyond the 1 percent

8) Thus, they would generate $375 billion in taxes.

Therefore, the top two tiers of your proposal would generate $657 billion in revenue.

9) The remaining 124.07 million households populate your final two tax brackets.

10) We know that the average household income in the US is about $53,000/year. Opinion | $250,000 a Year Is Not Middle Class

11) Given that your cutoff was $50K to pay taxes, for estimating purposes, we will simply estimate that one half of the households will pay no taxes (62 million households)

12) The remaining 61 million households will pay taxes at the 25% rate, according to your plan.

13) If you extrapolate, that means that those households will average about $73K in household income, with each paying $18,250 in taxes

Therefore, your third tax rate will generate $1.12 trillion.

Thus, your total tax plan will generate $1.76 trillion - far short of the current $4 trillion budget. If you were to raise the rates to 100% of everything above $1m, 80% of everything between $ 300K and $1M, and 50% of everything between $50K and $300K, you STILL wouldn't generate enough tax revenue.

Guess that didn't work, did it?

Further, that's assuming linear taxation from first dollar to last dollar - not something we do.

By the way, the CURRENT revenue projections say $2.2 trillion in income tax, and $582 billion in corporate taxes - still not enough to meet the proposed budget.

The point isn't that your plan was faulty, or that liberals who call for taxes on the rich as the panacea to fix all things, aren't thinking it through. The simple truth is we are outspending our capacity to generate revenue. We have a spending problem - pure and simple. There is NO way to generate the income needed to operate the government in its current configuration.

Those poor useless democrats.

Sent from my iPhone using Tapatalk

Their was no wrecking the middle class, republicans where trying to save the middle class from the inevitable, the writing was on the wall after WWII was a fluke in history

The democrats obviously have no problem with it...

Sent from my iPhone using Tapatalk

No they have only been fighting for higher taxes on the rich and giant corporations for 35 years what do you want open Civil War you stupid ignoramus.The Pander to the rich tax policy of the last 35 years has slowly ruined the middle class and our infrastructure...Typical brainwashed ignorant GOP dupe. You have nothing but idiotic talking points and stupid insults. But thanks for Wrecking the middle class and the country, the stupidest Wars ever and the corrupt world depression. And now the strangest president ever, though I'm still hoping for the best. If he would just change the channel...My plan works just fine, it will take a little while to fix 35 years of GOP Pander to the rich garbage, dingbat.

Those poor useless democrats.

Sent from my iPhone using Tapatalk

Their was no wrecking the middle class, republicans where trying to save the middle class from the inevitable, the writing was on the wall after WWII was a fluke in history

The democrats obviously have no problem with it...

Sent from my iPhone using Tapatalk

...change the channel look into what Democrats want and don't be a stupid dupe, dingbat.

Republicans have blocked the Democrats for getting on getting what they want since LBJ. Obama had the 60 votes in 2009 but not enough time. And the middle of another corrupt GOP economic meltdown is not the time to do it. Fox and Rush and the GOP giant propaganda machine tells you he had two years of control but actually it's more like 40 days and they didn't know Scott Brown was coming what a disaster...No they have only been fighting for higher taxes on the rich and giant corporations for 35 years what do you want open Civil War you stupid ignoramus.The Pander to the rich tax policy of the last 35 years has slowly ruined the middle class and our infrastructure...Typical brainwashed ignorant GOP dupe. You have nothing but idiotic talking points and stupid insults. But thanks for Wrecking the middle class and the country, the stupidest Wars ever and the corrupt world depression. And now the strangest president ever, though I'm still hoping for the best. If he would just change the channel...Those poor useless democrats.

Sent from my iPhone using Tapatalk

Their was no wrecking the middle class, republicans where trying to save the middle class from the inevitable, the writing was on the wall after WWII was a fluke in history

The democrats obviously have no problem with it...

Sent from my iPhone using Tapatalk

...change the channel look into what Democrats want and don't be a stupid dupe, dingbat.

No they have only been fighting for higher taxes on the rich and giant corporations for 35 years what do you want open Civil War you stupid ignoramus.The Pander to the rich tax policy of the last 35 years has slowly ruined the middle class and our infrastructure...Typical brainwashed ignorant GOP dupe. You have nothing but idiotic talking points and stupid insults. But thanks for Wrecking the middle class and the country, the stupidest Wars ever and the corrupt world depression. And now the strangest president ever, though I'm still hoping for the best. If he would just change the channel...Those poor useless democrats.

Sent from my iPhone using Tapatalk

Their was no wrecking the middle class, republicans where trying to save the middle class from the inevitable, the writing was on the wall after WWII was a fluke in history

The democrats obviously have no problem with it...

Sent from my iPhone using Tapatalk

...change the channel look into what Democrats want and don't be a stupid dupe, dingbat.

There's a large disconnect between what democrats say they want and what they do. Most functional people understand that.

Sent from my iPhone using Tapatalk

Republicans have blocked the Democrats for getting on getting what they want since LBJ. Obama had the 60 votes in 2009 but not enough time. And the middle of another corrupt GOP economic meltdown is not the time to do it. Fox and Rush and the GOP giant propaganda machine tells you he had two years of control but actually it's more like 40 days and they didn't know Scott Brown was coming what a disaster...No they have only been fighting for higher taxes on the rich and giant corporations for 35 years what do you want open Civil War you stupid ignoramus.The Pander to the rich tax policy of the last 35 years has slowly ruined the middle class and our infrastructure...Typical brainwashed ignorant GOP dupe. You have nothing but idiotic talking points and stupid insults. But thanks for Wrecking the middle class and the country, the stupidest Wars ever and the corrupt world depression. And now the strangest president ever, though I'm still hoping for the best. If he would just change the channel...

Their was no wrecking the middle class, republicans where trying to save the middle class from the inevitable, the writing was on the wall after WWII was a fluke in history

The democrats obviously have no problem with it...

Sent from my iPhone using Tapatalk

...change the channel look into what Democrats want and don't be a stupid dupe, dingbat.

Wow, true believers here. The sad thing is, you sound like you mean it.

Sent from my iPhone using Tapatalk

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #287

I think we could write reasonable exception for unexpected expenses into an amendment. If they become too burdensome we'd need to cut spending or raise more revenue because you can't or shouldn't run deficits forever.

1. If you're making exceptions for deficits, then it's not a balanced budget amendment.

2. Why can't we run deficits forever? What's the reason?

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #288

1) Federal revenue has increased every year. In fact, we have continued to set records on how much money the federal government takes in. (In 2008, it was about $2.5 trillion, rising steadily to about $3.3 trillion in 2016, and expected to exceed $4 trillion this year)

So what? Why are you so fixated on the amount of revenue we bring in? Don't understand your obsession with that. Governments have to run deficits because government doesn't collect revenue all at once and unexpected events/crises come up that require government spending beyond what was already planned. What you're trying to do is limit the amount a government can spend in a year and you're doing so wholly arbitrarily. There is no rhyme or reason behind what you're saying.

2) Federal spending has increased every year, obviously setting records on how much money we spend. (In 2008, we spent $2.98 trillion, increasing every year, and in 2016, $3.84 trillion - expected to surpass $4 trillion this year).

Again, so what? Why are you so fixated on these numbers? For all the spending Obama did, we got; 11,000,000 net private sector jobs, a record stock market, a record low uninsured rate, unemployment rate at half of what it was in January 2009, renewable energy prices that have been cut by more than 50%, and a deficit reduced by 2/3 from where it was in January 2009, among other things. So that's what we have to show for all of Obama's spending. Contrast that with what we had to show for Bush's 8 years of spending; unemployment above 10%, an economic collapse & bailout, 2 unwinnable wars of occupation, a market down to 6,500, unfunded entitlement expansion of Medicare, and a record high uninsured rate.

So it's not about what was spent, but rather what that spending produced. You fixate on the amount spent while ignoring what was produced as a result of the spending. And you do that because it's easier for someone lazy enough like you to make an argument about things of which you have no idea of their relevance or importance or significance. You hate spending - but don't know why. You hate deficits - but don't know why. You hate debt and deficits - but don't know why. You think that debt is debt, but it's not. Government debt is different from individual debt. You understand that, right? We can't have a conversation unless you do.

3) The cumulative deficit has increased every year (obviously, because spending has outpaced income every year) by over $6 trillion dollars in the same time period.

WRONG, WRONG, FUCKING WRONG.

The deficit did not increase each year of Obama. In fact, the deficit declined nearly every year of Obama's term, as illustrated here, in the figures from tax policy center. The only years the deficit went up slightly was 2010-2011 (+$5B) and 2015-16 (+$180B), but it then declined from 2016-17 (-$112B). You mixed up "deficit" with "debt". The cumulative debt increased each year, but not the deficit. Please, please, please tell me you know the difference between a deficit and debt and that was just a mix up on your part because you were furiously typing and not checking your work.

4) In the same period, the national debt has increased by about $7.5 trillion (the difference being, primarily, interest on interest)

So what? At what time does our national debt have to be paid off? What is the exact date? Oh, it never has to be paid off? Ah, so then why are you getting so screechy about the debt if there's no need to pay it all off. nor will it ever be paid off (Because 30-year T-Bills don't get paid off for, wait for it, 30 years). So it's hard to see the urgency behind anything you're saying or the points you're making. Yes, the government operates in debt. So fucking what?

5) Recently, we just passed thru the $20 trillion in total national debt.

So fucking what? Are you simply scared of big numbes? That's the only reason why anyone would be afraid of debt. So our debt is $20T, what's the size of the economy? Oh, also $20T. So then why are you making a big deal about debt? Maybe we shouldn't have passed all your stupid tax cuts that exploded the debt way back in 2001. Because if we hadn't done that, we actually could have paid off the entire National Debt by 2010. But you shitheels cut tsaxes, which produced deficits, which doubled the debt by 2009 instead.

Just curious, where was all your deficit and debt outrage back in 2001? Oh right, it was no where to be found! Because Conservatives just posture about deficits and debt, without knowing anything about either because they're too lazy, stupid, and/or ignorant.

6) About one-third of that national debt is held by foreign countries.

Really? How much exactly by each country? Put your money where your mouth is. Because I'm not going to let you just stupidly spew forth unverifiable and (mostly) inaccurate information without sourcing it.

7) Social Security holds about 15% of the national debt.

So what?

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #289

Overspending your income is called, with a straight face, "deficit spending". It is predicated on the notion that money spent now will generate sufficient income later to pay off the money borrowed to fund the current spending. While a really nice theory, $20 trillion in debt clearly demonstrates that, in the long term, it doesn't work. Borrowing money is okay only if you can pay it off. THAT should be the first priority - not the last.

Well, that's because TAX CUTS DO NOT PAY FOR THEMSELVES, and neither do UNWINNABLE WARS OF OCCUPATION. Those two things alone; tax cuts and war spending, are most of what our debt is. Both were things you fucking twats gave us. Your stupid Bush Tax Cuts and your stupid War on Terror. Throw in the largest unfunded entitlement expansion ever (Medicare Part-D), and you have the bulk of today's debt...all given to us by the same people trying to screech about phony debt concern today. So why the fuck are you even posting? Don't know what sort of credibility you have.

Some posit that we should ignore the national debt - just don't pay it. If, for example, China were to demand payment, the government would have to come up with about $2 trillion that it doesn't have. If that happened, the government wouldn't be able to pay - simple as that. The government would be faced with two options - trade "stuff" for the loans or, go to war. They would have to trade land, natural resources, etc for the debt instruments, or they would have to refuse, which would cause the Chinese economy to crash (and the subsequent reactions throughout the international economy). The Chinese, obviously, cannot allow that to happen, and will show up ready to take what they need. So, ignoring the national debt is NOT a viable option.

First of all, you don't seem to know anything about China. China will never call in the debt they hold (which is how much, by the way?). The reason is because we are China's primary trading partner and if China called in the debt they hold, it would kick off a trade war China won't win. Why won't China win? Simple; demographics. China's demographics right now indicate that the generation about to entire retirement (or already in retirement) is larger than the generation currently in the workforce. That's because of a lot of factors, including the 1-baby/no female policy they had for a while. Because of China's demographic problem, they simply cannot cut off trade to the US or call in the debts because that would result in a drop of exports to the US, which can't be made up by increasing exports to Europe. So China has more to lose by calling in the debt than we do. Also, it's purely a right-wing fantasy that China would ever call in the debt. So once again, we have an instance of a Conservative approaching a real debate with imagined fears and paranoid fantasies about what could happen, even though it's not likely.

Do you spend most of your time worrying about things? Are you a worry-wart?

However, even if they didn't, the immediate reaction of the federal government would be to write off all its debts. The $2 trillion owed to the Social Security fund would be cancelled - payments would stop. The government wouldn't be able to borrow the money (since they have already shown they won't pay), and people will suffer. This will ripple thru all the negative spending entities of the government.

So this is fantasy, not reality. What you're doing here is fear-mongering a nearly impossible scenario in order to get me to accept your paranoid, delusional, fake right-wing outrage. You use fear entirely. Fear of things that will never ever happen. So what do we call someone who uses fear to push through an unpopular ideological agenda of zealotry? A terrorist.

Why is it that every single Conservative argument has to be in the hypothetical or theoretical and is always driven by fear? Because you people are worthless slugs with nothing credible to say. So you try to scare people instead, without even knowing the subject with which you're trying to scare people. You think you can just bullshit me. You can't. I have critical thinking skills, you don't. So you're never going to be able to convince me of your bullshit.

Recently, there was a proposal floated that the US should offer $0.85 on a dollar to retire some of their debt. This, of course, means that the cost of borrowing money in the future would increase. This would make our debt problem worse, not better..

So who proposed that? Oh right, Conservatives who are know-nothings. Why would we retire any debt at a lower rate? Why would you even consider such a stupid thing? The only reason is that you think debt = ???? I don't know what the "????" is you think will happen (or continue to happen) with the debt at the figure it's currently at. To this day, not one of you Conservative shitgibbons has been able to articulate why you think debt is a big deal and why you think it must be paid off right away. The reason is because you don't know what the fuck you're talking about.

Clearly, the only viable answer lies in both increasing federal revenue AND decreasing federal spending. Anything else is economic suicide. In fact, we may have reached the point where it's too late. Time will tell. Given the length of this, I won't directly address your supposition, but will be glad to discuss it further.

We don't need to cut spending at all. Look at what Kansas did this past year...they cut taxes in 2013 which created deficits and debt, didn't produce any of the growth promised, and were eventually repealed this past Spring. Take a look at the below budget with and without the tax cuts (SB 30 = tax cut repeal)...notice how spending doesn't change but miraculously, somehow repealing the tax cuts resulted in budget surpluses. Funny how repealing low taxes suddenly balanced KS' budget. So if that worked for Kansas, why wouldn't repealing low taxes work on the federal level to achieve a budget surplus?

When you look at this orange piece of paper that came directly from the KS State Legislature, what it is you see?

None of you have been able to reconcile that inconvenient fact from just a couple months ago. I doubt any of you ever will.

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #291

"Lowering the deficit" is like saying "I only cheated on my wife twice this year." Creating a deficit is the epitome of fiscal irresponsibility. We create a new deficit every year. There is no reason that it can't stop immediately.

No, the epitome of fiscal irresponsibility is cutting revenue and promising that it will increase revenue.

- Sep 28, 2010

- 56,187

- 16,341

- 2,180

I think we could write reasonable exception for unexpected expenses into an amendment. If they become too burdensome we'd need to cut spending or raise more revenue because you can't or shouldn't run deficits forever.

1. If you're making exceptions for deficits, then it's not a balanced budget amendment.

2. Why can't we run deficits forever? What's the reason?

1. For every exception there could be a plan to recoup the deficit.

2. As long as the deficit is within the possible range that economic growth could compensate, it could. But we are no where near that mark.

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #293

How would you like it if I showed you how a 19 year old, making $25,000 a year (investing $100/month), could earn enough IN 12 YEARS to retire as a millionaire (actually, a millionaire and a half - $1.5 million) at age 65? Then, show you how - at age 31 (19 +12) create an environment that will convert that million dollars into $3.6 million in his retirement portfolio?

You're kidding yourself that someone making $25K can save for anything. Also, without a college degree, that 19 year old will not see themselves be a high-earner, and their income will be capped below that of those with college degrees. You live in a fantasy world.

BTW - someone making $25K a year qualifies for all sorts of income-determinant benefits including SNAP, Medicaid, EiTC, and other forms of welfare.

So, all your whining about not enough to save, and not enough to pay for healthcare, not enough for this, not enough for that is simply three things - 1) fiscal ignorance, 2) a lack of commitment to your responsibilities, and 3) begging for more and more of somebody else's money.

No, you're just refusing to accept the reality of wages of today because you've never had to work for anything in your life.

/—-/ Department stores cut prices to drive more traffic in the store and increase revenue. Lowering taxes increases economic spending which increases employment. More workers = more tax revenue"Lowering the deficit" is like saying "I only cheated on my wife twice this year." Creating a deficit is the epitome of fiscal irresponsibility. We create a new deficit every year. There is no reason that it can't stop immediately.

No, the epitome of fiscal irresponsibility is cutting revenue and promising that it will increase revenue.

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #295

1. For every exception there could be a plan to recoup the deficit.

That "plan" involves higher user fees, excise taxes, and penalties in order to scramble at the last minute to balance a budget. And those all hit the middle class harder than the 1%. Again, we just saw this play out in Kansas. What I don't understand is why if the policy fails in the "laboratory of democracy" known as individual states, are you still advocating this thinking and using these arguments? Are you not aware of the world around you?

Kansas cut taxes, promised growth and the moon and the stars, saw growth below the national average and the erasing of a surplus, then raised taxes 4 years later and -magically, inexplicably- the deficit disappeared!

But but but...how is that possible if we're told higher taxes on the rich reduce revenues and negatively affect the economy? Someone is not being truthful. Is it the actual statistics and facts, or is it the people trying to sell a false bill of goods? Hmmmm...that's a tough one...

2. As long as the deficit is within the possible range that economic growth could compensate, it could. But we are no where near that mark.

In no world, in no reality, have tax cuts ever paid for themselves. Never. Not once. Ever.

/—-/ Letting people keep more of their own money does cost anything1. For every exception there could be a plan to recoup the deficit.

That "plan" involves higher user fees, excise taxes, and penalties in order to scramble at the last minute to balance a budget. And those all hit the middle class harder than the 1%. Again, we just saw this play out in Kansas. What I don't understand is why if the policy fails in the "laboratory of democracy" known as individual states, are you still advocating this thinking and using these arguments? Are you not aware of the world around you?

Kansas cut taxes, promised growth and the moon and the stars, saw growth below the national average and the erasing of a surplus, then raised taxes 4 years later and -magically, inexplicably- the deficit disappeared!

But but but...how is that possible if we're told higher taxes on the rich reduce revenues and negatively affect the economy? Someone is not being truthful. Is it the actual statistics and facts, or is it the people trying to sell a false bill of goods? Hmmmm...that's a tough one...

2. As long as the deficit is within the possible range that economic growth could compensate, it could. But we are no where near that mark.

In no world, in no reality, have tax cuts ever paid for themselves. Never. Not once. Ever.

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #297

/—-/ Department stores cut prices to drive more traffic in the store and increase revenue. Lowering taxes increases economic spending which increases employment. More workers = more tax revenue

Lowering taxes has never, does not, and will never increase revenues by increased consumption. That's the trickle-down argument. Also, cutting taxes has never, ever, ever, ever, ever, ever created a job. Businesses don't hire because of tax rates. They hire because of demand. If there's no demand, then the business has no reason to hire more labor. Tax cuts do not increase demand. Never have, never will.

Time to let it go from your thinking. I know that is gonna be hard for you because it involves admitting you don't know what the fuck you're talking about. But it's OK to say you were wrong. I won't hold you being wrong against you. What I will hold against you is your insistence in policy you know doesn't work. That's where I draw the line.

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #298

/—-/ Letting people keep more of their own money does cost anything

You don't keep more of what you earn after a tax cut because the cost of everything else goes up thanks to a drop in funding by the state. So you cut tax revenue which leaves behind less for things like education. And because education gets cut, that causes an increase in tuition costs for students, which means they have to take out more loans, which means their debt burden increases.

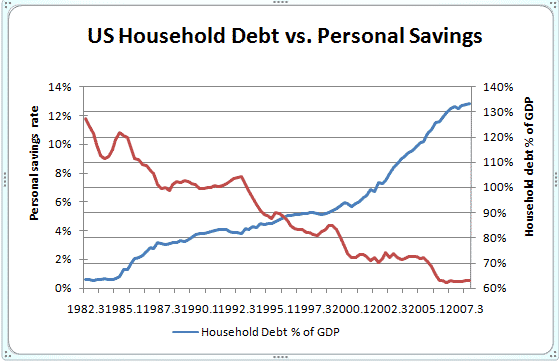

It's no coincidence that every time taxes are cut, household debt increases. That's because you're forcing the middle class to go into savings, or take out a second mortgage on their homes, to pay for the increased costs of education.

Your policies only create debt.

The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #299

/—-/ Letting people keep more of their own money does cost anything

Clearly that's not the case, and we can use the "laboratory of democracy" of Kansas as the example. Here's the budget both with the tax cut and without (SB 30). What is it you see? What do your eyes tell you? You can fool your small mind, but you cannot fool your own eyes:

and yet want to give the rich tax cuts, (how ignorant is that)They must have brain damage.

and what will happen to global terrorism they ask , since they do not want to do anything about gun laws in the US, who by the way most mass shooters are white males and US citizens and even some vets, who in the hell cares.

Wrong. O racked up 8 trillion. More than all previous presidents combined.

Wrong. O racked up 8 trillion.

$9.3 trillion.

Similar threads

- Replies

- 8

- Views

- 145

- Replies

- 11

- Views

- 183

- Replies

- 47

- Views

- 666

- Replies

- 331

- Views

- 5K

Latest Discussions

- Replies

- 63

- Views

- 265

- Replies

- 6

- Views

- 115

- Replies

- 95

- Views

- 838

- Replies

- 34

- Views

- 98

Forum List

-

-

-

-

-

Political Satire 8137

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 472

-

-

-

-

-

-

-

-

-

-