- May 17, 2013

- 67,606

- 32,746

- 2,290

Of course some of it is coming back.............but it sure as hell isn't being circulated into our economy...............Our economy needs this circulation..............the graphs are from the Fed............and they are the lowest in HISTORY on one of them..............That's not good for America.........never has been.............The Velocity Of Money In The U.S. Falls To An All-Time Record LowVelocity of money - Wikipedia, the free encyclopedia

The velocity of money (also called the velocity of circulation of money) refers to how fast money passes from one holder to the next. It can refer to the income velocity of money, which is the frequency at which the average unit of currency is used to purchase newly domestically-produced goods and services within a given time period.[3] In other words, it is the number of times one dollar is spent to buy goods and services per unit of time.[3] Alternatively and less frequently, it can refer to the transactions velocity of money, which is the frequency with which the average unit of currency is used in any kind of transaction in which it changes possession—not only the purchase of newly produced goods, but also the purchase of financial assets and other items.

If the velocity of money is increasing, then transactions are occurring between individuals more frequently.[3] Although once thought to be constant,[citation needed] it is now understood that the velocity of money changes over time and is influenced by a variety of factors.[4]

Money going to another country helps their velocity of money.............even when foreign countries buy their products in a different currency......Those people get paid to build the T.V. and thus circulate the money into their country..............while we LOSE our velocity of money as the currency leaves the country..........

I prefer the money to circulated here instead of China..........didn't see that in the equation.......

You are making a connection, which isn't possible to make. US Dollars can not be used in China. There is not one store, one supplier, one employee, that works for US Dollars in China.

If you are in China, and sell a TV, and I buy it and give you US Dollars... what the heck can you do with those dollars? Nothing. You can't buy materials to build more TVs. You can't pay your workers with them. You can't even keep the lights on at your business. Those dollars are absolutely useless to you, unless you buy something from the US with them.

If money was flowing out of the US.... We'd be completely broke by now.

The US only has $1.4 Trillion dollars currently in circulation. Right now. That's how much PHYSICAL CURRENCY exists.

View attachment 52952

No look at that..... In 1996, the deficit was $100 Billion. It's been up to $750 Billion a year.

What's my point? If all that money was flowing out year over year.... we would have run completely out of cash a decade ago. If money was flowing to China, and not coming back, then we should be in economic collapse by now.

Bottom Line.... the money is coming back. All the money that goes to China, MUST come right back to the US. One way, or another, it ends up back here. The idea that it's going over there, and staying over there, and making them rich, is bonkers, and not supportable.

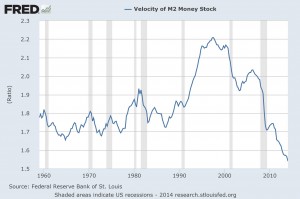

When an economy is healthy, there is lots of buying and selling and money tends to move around quite rapidly. Unfortunately, the U.S. economy is the exact opposite of that right now. In fact, as I will document below, the velocity of M2 has fallen to an all-time record low. This is a very powerful indicator that we have entered a deflationary era, and the Federal Reserve has been attempting to combat this by absolutely flooding the financial system with more money. This has created some absolutely massive financial bubbles, but it has not fixed what is fundamentally wrong with our economy.

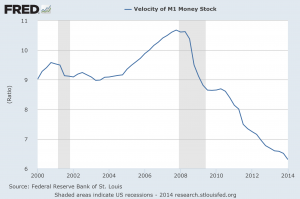

As you can see from the chart posted below, the velocity of M1 normally declines during a recession. Just look at the shaded areas in the chart. But a funny thing has happened since the end of the last recession. The velocity of M1 has just kept falling and it is now at a nearly 20 year low…

In the chart posted below, we can once again see that the velocity of M2 normally slows down during a recession. And we can also see that the velocity of M2 has continued to slow down in the “post-recession era” and has now dropped to the lowest level ever recorded…

Where is that flow of money coming back then? It's not flowing.................Lowest ever recorded..............If it's coming back........then where is it????

It certainly isn't going back into circulation here.................

You don't seem to be grasping this. If the money was flowing out.... and it didn't come back..... there would be no money left in the entire country. None. Zero. No one anywhere in this entire country would have any cash at all.

The fact you have even one single dollar..... proves that the money MUST be coming back.

Nothing you posted changes that. Even the printing of money by the Feds, doesn't account for this. The total amount of trade deficit exceeds all of money in circulation, and printed by the Fed, and several Trillion more.

Now, why is the flow of money slow? That's easy. We've driven up the cost of doing business in America with labor laws and mandates, and taxes. Nothing more complicated than that.

Losing jobs to other countries isn't good for America................Which is why we should negotiate directly with other nations..............INCLUDING QUOTA'S on certain goods that would end industry here......................

It's not good news to lose a lot of our industrial base here...............and that is what is happening..................