Trump gets down to business on 60 Minutes

On Sept 26th, 60 Minutes aired a bit where they interviewed Donald Trump, and one of the things they talked about was Trumps plan for international trade.

The Trump plan is basically that we are going to place a tax on everything imported into the US. That way Ford won't put a manufacturing plant in Mexico, but will place that plant in the US. In essence, we need protectionism. Put heavy tariffs on trade with other countries, so we can have jobs here.

Is that a good plan? Is that what we should do?

To answer that question, we need to first understand the fundamental economics. Trade, or "voluntary exchange", is inherently mutually beneficial. Both parties by nature, are better off from trade. If trade was not beneficial to both sides, then they wouldn't do it.

A simple example: I am selling a TV set. The TV set is $100. You want to buy the TV set. You give me the $100, and I give you the TV. If the TV was not worth more to you, than the $100, you would not have traded. If the $100 was not worth more to me, than the TV, I would not have trade. We are both better off because of the trade. If we were not, then we would not have done the trade.

So both of us mutually benefit from the trade. We're both better off, or we would not have done the trade.

One popular claim is that China is engaging in Mercantilism.

So what is that? Well it's the idea of a government engaging in trade policies that enrich themselves by trade. Of course all countries believe they will enrich themselves by trade.... so that's nothing special.

But they claim that China's policy harms us, while benefiting them. To understand how, we have to back up and explain how trade is supposed to work.

So I live in China, and I am selling the TV. You give me $100, and I give you the TV set. Now I have $100 in US Dollars. Can I pay my employees with US dollars? No. Can I buy parts to make more TVs with US dollars? No. I have to exchange those dollars, for Yuan, the Chinese currency.

So the Central Bank of China, gives me Yuan, and takes the US Dollars. Now as this happens over and over, the Central Bank of China, has tons of US Dollars. This would cause the exchange rate to change, so that 1 Yuan would get more US Dollars... making it cheaper to buy US goods. Thus more people would buy, thus dollars would flow back to the US from China.

Now that's what is 'supposed' to happen.

Under Mercantilism, a country would instead, use the US dollars to exchange them for Gold. If you remember, prior to the early 1970s, you could exchange a US dollar, for gold. So I sell you a TV set from China, take your $100, and give it to the Chinese Central Bank for Yuan, then the Chinese Central Bank, takes the $100 to the US Treasury and exchanges it for Gold.

They get richer, and we get poorer... in theory.

Here's the problem... that kind of Mercantilism can't work anymore, because you can't convert dollars into Gold. The only thing China can do with a US dollar, is buy something with it. Short of that, they can't do jack.

So China is not engaging in Mercantilism.

Another myth is that a trade deficit is debt. Trade deficits cause debt, and we have to deal with the trade deficit, or we'll continue to go into debt.

So again, I am selling a TV, and you want to buy one, and the TV is $100. You give me the $100, and I give you the TV. Where is the debt? I'm in Canada. I give you the TV, and you give me the $100. Where's the debt? I'm in the UK, and I give you the TV, and you give me the $100. Where's the debt? Well there is no debt unless you borrow the $100... but you could do that no matter where you get the TV from, domestically or internationally.

This idea that trade causes debt, comes from China using the US dollars, to purchase US Treasury Bonds. The problem is, if we had zero trade with China at all, and the US government spent more money than it collected in taxes, then there would be debt. Equally, we could triple our trade with China, and if the US Government was spending less money than it collected in taxes, and did not sell any US Treasury Bonds, then there would be no debt, no matter what the trade deficit was.

So trade does not cause debt. Ever. Government spending causes debt.

But then, whats wrong with protecting our economy? What's wrong with taxing imports?

The theory has great appeal on both sides of the political spectrum, but the reality is Protectionism has never resulted in the benefits supporters claim. Protectionism usually has devastating consequences.

http://www.nber.org/digest/may09/w14604.html

Peter Blair Henry and Conrad Miller wrote an article "Tale of Two Islands", which compared Barbados, and Jamaica. The two Islands have similar cultural histories, and people, and both were colonized with imported slave labor, under the British crown.

In the 1970s, Jamaica made a decidedly protectionist turn, in order to foster economic growth, and benefit domestic business. Instead, Jamaica fell into ruin, and became overrun with drugs and crime. Interestingly, Peter Henry's father supported the protectionism, but found after protectionism came into effect, he couldn't find the raw materials for the chemist field he worked in, which resulted in him moving to the US, which is how Peter Henry ended up a US citizen, and an economist.

Take another example, such as India. India engaged in heavy protectionism after independence. But instead of growing domestic jobs, and stimulating growth, it caused stagnation.

The above picture is of the Ambassador, built by Hindustan Motors. In 1956, a small car company in the UK, called Morris Motors, build the Oxford Series III. They ceased production of this car in 1959.

But in 1957, Hindustan Motors of India, purchased the design, and started producing the Oxford, as the Hindustan Ambassador. The design and build of this automobile remained almost completely unchanged for the duration of production. The photo above is not an antique car at a county fair or something. It's not a restore project. The Hindustan Ambassador was built until 2014. The car above is NEW.

From 1957 until 2014, very little changed. In 1979, they slightly improved the design and handling. What happened that caused them to upgrade the Ambassador? Suzuki was allowed to compete in India, and introduced the Maruti 800, to compete with the Ambassador.... and suddenly Hindustan Motors had motivation to upgrade their cars. What a shock.

Then in 1990 to 1992, they upgraded their cars again. This time replacing the 55 Horse Power engine they had been using since 1957, to a newer, more powerful 75 and 88 horse power engine. But did they build it domestically? No, they imported engines from Isuzu. What happened in the 90s? Fiat, Hyundai and Toyota, all started selling cars in India.

Protectionism allowed people to be stuck with a crappy 1956 car, that was absolutely unchanged for 40 years. It wasn't until the end of protectionism, that car companies even attempted to upgrade their products. And by the way, this isn't limited to just this example. Standard Motor company of India, sold the "Standard Herald" which was a Triumph Herald designed in 1959, which they continued to make until 1988, virtually unchanged.

Standard (Indian automobile) - Wikipedia, the free encyclopedia

Hindustan Ambassador - Wikipedia, the free encyclopedia

Far from generating this great economic growth, it generated economic stagnation.

And there are numerous examples. Compare the free-trade Hong Kong, to the protectionism of China prior to 1979. Hong Kong was massively wealthy, while Chinese earned less than $2 a day.

Or compare the protectionism of North Korea, to the Free-Trade of South Korea.

Or compare the Free-Trade Venezuela, to Protectionist Venezuela. Venezuela went from the leading economy in south America, to the worst economy of South America.

Or compare Free-Trade Singapore to the more protectionist neighbors.

Only one country has 100% free trade. You see it there. Now compare Singapore economically to all it's neighbors. If protectionism worked, then Indonesia with 52% protection tariffs on imports, should be the economic power house of the group. But it's not.

But possibly the best example that protectionism does not work, is America itself.

Rustici on Smoot-Hawley and the Great Depression | EconTalk | Library of Economics and Liberty

Economist Thomas Rustici was interviewed on EconTalk, about the Smoot-Hawley tariff of 1930.

In 1928, Hoover was elected on a platform of protectionist tariffs. In 1929, the House was protectionist, but the Senate was free-trade and was blocking the Smoot-Hawley tariff.

On October 21st, 1929, Sixteen Senators rolled. They agreed to pass the tariff, if tariffs were put in place for their states. On that day, the stock market began to slide. The stock market lost almost 1/3rd of it's value, before the Crash of Oct 29th.

But it goes on.... After the Senate passed the tariff, the House and Senate got together to reconcile the two bills, but couldn't. In December, they gave up, and left on winter recess. The bill appeared dead. Even the New York Times claimed the tariff was dead. Between Mid November and April, the stock market had recovered half of the value it had lost. In fact it was within about 10 points of where it was at the start of 1929.

But in May of 1929, Congress started working on the Smoot Hawley Tariff again, and by June they had made an agreement and passed the bill onto the President.

In May 1028 Economists wrote a signed letter to Herbert Hoover, warning that Smoot-Hawley Tariff would have drastic economic and monetary consequences, and told him to veto it.

Hoover received formal complaints by 23 countries, and 36 countries lodged 59 formal protests with the State Department. Spain, Canada and many other countries raised tariffs on US goods in retaliation.

Starting at the end of May, beginning of June, when it was clear the Tariff would pass, the market began to slide. It lost 20% of it's value in the first two weeks of June, and Hoover signed the bill into law June 17th. That slide continued non-stop until about 1933, where it started to very slowly recover until FDR screwed up the economy again in 1936-37, which caused a recession inside the depression.

Now clearly there is a correlation, but how exactly does a tariff cause economic destruction?

Well one example is fairly conclusive to me. In May, before the Smoot-Hawley Tariff is passed, Canada passes a tariff on imported Steel and Iron products from the US. When the Smoot-Hawley Tariff is passed, it places a massive tariff on Iron Ore imported from Canada.

17 Months after the passage of Smoot-Hawley, 11 banks in Pittsburgh go insolvent, and shut their doors. Why?

Well.... Pittsburgh was the central hub of the steel and iron industry. Hence: Pittsburgh Steelers. But the steel companies had two things happen at the same time.... The cost of Iron Ore drastically went up, because most of the ore came from Canada, now had a huge tariff on it. At the same time the demand for Iron and Steel from the US, dropped because other countries, primarily Canada, put a huge tariff on Steel and Iron from the US. Cost of making steel up, price and demand of steel down.

The Steel industry crashed, and when companies start having problems, they start pulling all their money out of the banks. Pull out all the money, and the banks to go bust.

And interestingly, I've seen that the companies I've worked for, most wouldn't exist if we engaged in protectionism.

Many of the products I've built, couldn't be built without imported goods. CPU controller boards made out of the country. Metal parts, supplied by other countries. Imported sensors and electronics.

Moreover, many of our customers are foreign. We sell to Canada, Brazil, Turkey, China, and many others. People have said that we can't compete with these other countries that have lower wages. That is totally false.

"We have to bring back manufacturing to the US!" Completely wrong.

It's amazing how many people don't know that last year, 2014, was a record year in US manufacturing. We produced more product in manufacturing last year, than ever before in US history. More than ever.

We have been competing successfully with low-wage countries for decades. And this idea that a trade deficit (importing more than we export) is so horrible.... you realize when the trade deficit started? In the 1990s. You remember how horrible the economy was in the 90s, with massive unemployment and recession after recession.... during the 90s..... right? You don't remember that? Neither do I.

You remember when we have a balance of trade right? During the amazing 1970s, when the economy was booming, and growth was massive? During the 70s? Right? You don't remember that? You remember Stagflation? Right.

Since the 1900s, there has only been two times where the US had a significant surplus balance of trade. Just twice. The late 1940s after the end of WW2, when Europe was in ruins, there was massive demand for goods, and we were the only ones to supply them. So we had huge exports.

And the other time was...... the 1930s.... the Great Depression.

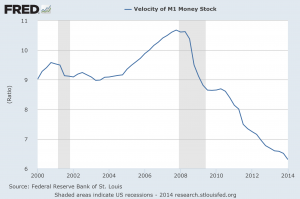

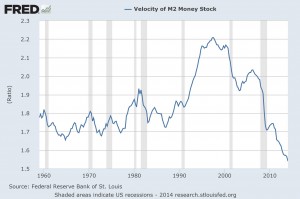

By the way, you'll notice that imports dropped pretty hard in 2000, and 2008, and slightly in 1980. What happened all those years? We had a recession.

Do you know why trade deficits fall during recessions? Do you know why they rise during economic growth periods?

It's actually really simple. Trade deficits rise because.... we have money. When we don't have money, and can't buy things.... trade deficits fall.

Why do we have a trade deficit with China? The Chinese people prior to 1978, 63% of the population earned less than $2 a day. Now between us and them, who can buy more, from the other?

If you earn $100,000 a year, and I earn $20,000 a year, and we both own stores.... who can buy more from the other person? Obviously, between you and me, there is going to be a trade deficit. I can only buy $20,000 worth of goods from you, and you can buy $100,000 worth of goods from me.

A trade deficit is a sign of our wealth. That's why it exists. And curbing trade can only make us worse off. So while Trump may have public support for placing tariffs on trade, it's a bad policy, and it will harm the country, and we shouldn't do it. And that my friends, is the RCC perspective. Thanks.