Dad2three

Gold Member

The binary thinking on display by some people in this thread is shocking.

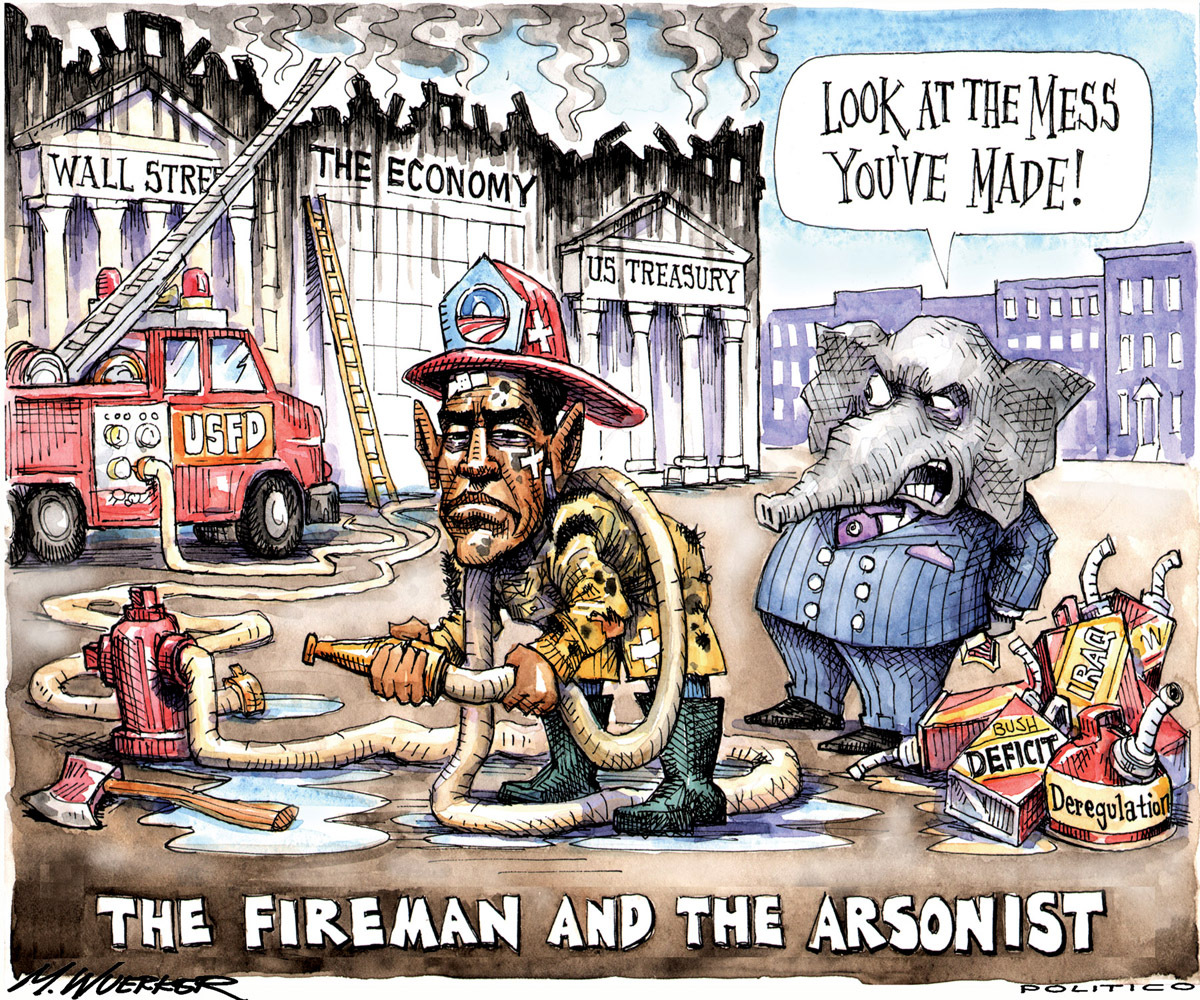

Newsflash for partisan hacks- BOTH PARTIES ARE BOUGHT AND PAID FOR BY SPECIAL INTERESTS

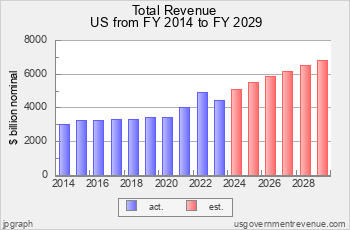

Yep, but weird only ONE party has 98% of their members in Congress signing that Muslim American's tax pledge NOT to get a penny more in new tax revenues for US, yep "both the same"