Iceweasel

Diamond Member

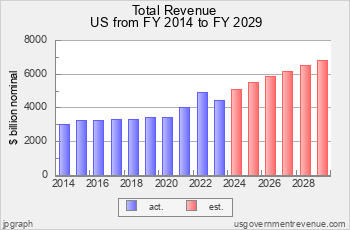

That you have nothing.What do you think you are getting at?What does projected income have to do with deficits?and yet the govt was collecting record revenue ......oooops

ONLY in the right wing bubble Bubba'

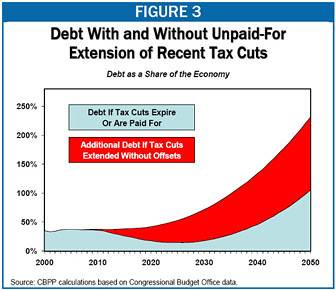

Bush CEA Chair Mankiw: Claim That Broad-Based Income Tax Cuts Increase Revenue Is Not "Credible," Capital Income Tax Cuts Also Don't Pay For Themselves

Bush-Appointed Federal Reserve Chair Bernanke: "I Don't Think That As A General Rule Tax Cuts Pay For Themselves."

Bush Treasury Secretary Paulson: "As A General Rule, I Don't Believe That Tax Cuts Pay For Themselves."

Bush OMB Director Nussle: "Some Say That [The Tax Cut] Was A Total Loss. Some Say They Totally Pay For Themselves. It's Neither Extreme."

Bush CEA Chairman Lazear: "As A General Rule, We Do Not Think Tax Cuts Pay For Themselves."

Bush Economic Adviser Viard: "Federal Revenue Is Lower Today Than It Would Have Been Without The Tax Cuts."

Bush Treasury Official Carroll: "We Do Not Think Tax Cuts Pay For Themselves."

Reagan Chief Economist Feldstein: "It's Not That You Get More Revenue By Lowering Tax Rates, It Is That You Don't Lose As Much."

Feldstein In 1986: "Hyperbole" That Reagan Tax Cut "Would Actually Increase Tax Revenue."

Conservative Economist Holtz-Eakin: "No Serious Research Evidence" Suggests Tax Cuts Pay For Themselves."

Tax Foundation's Prante: "A Stretch" To Claim "Cutting Capital Gains Taxes Raises Tax Revenues."

yes record revenue....and today you are taking in substantially more and still running huge deficits...ooooops

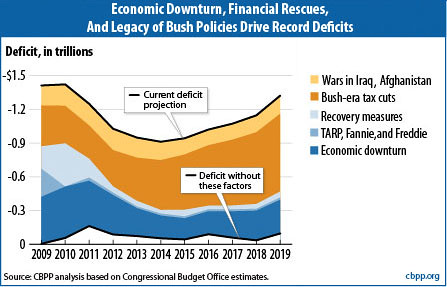

Deficits have been steadily declining....