I'll buy American if I can. I do not go looking for products that are made in the USA. I usually go for the good price on a good product.

I ALWAYS avoid anything that is "Union Made".

I ALWAYS avoid anything that is "Union Made".

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

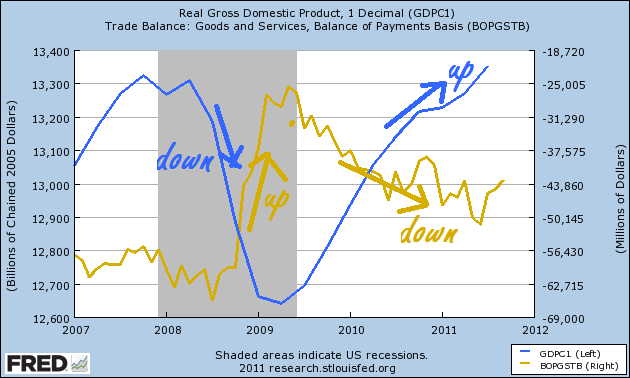

Some people use that interpretation to support their chosen beliefs, and the rest of us first look at reality--...our trade deficit subtracts from GDP. I think the facts are pretty clear.

--and then choose beliefs that fit what is.

No, there's also the part where the GDP can fall even with our improving trade balance adding to it....All you have proved is that GDP can still increase even with our trade deficit subtracting from it...expat_panama said:

If that were true then the GDP would grow more when the trade deficit shrank, and grow less with a growing trade deficit. It doesn't, and that's also how it is in the longer term--...GDP growth is muted by the trade deficit.

No, there's also the part where the GDP can fall even with our improving trade balance adding to it.

If that were true then the GDP would grow more when the trade deficit shrank, and grow less with a growing trade deficit. It doesn't, and that's also how it is in the longer term--

It doesn't have to make sense to be true. Lot's of things are hard to understand and are still the way they are. We can either look at what's happening and learn to live with it, or we can pretend we live in a fantasy.

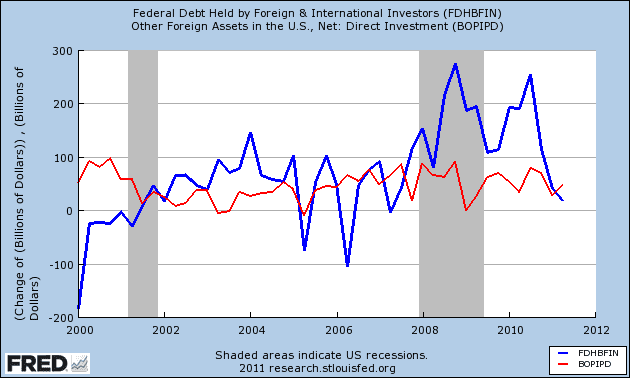

And you mistake capital for trade flows. We have capital inflows. We have goods and services outflows. This must happen. They are directly related. This is another problem with this argument. If the current account is negative (i.e. we have a trade deficit), the capital account must be positive (i.e., we are importing capital). IOW, current and capital accounts were perfectly balanced, and a foreigner decides to invest in a plant in America to invest in a plant, we will - by definition - have a trade deficit. Capital coming into the country without an equal amount of capital going out requires that we will have a trade deficit. This is another reason why it is wrong to say a trade deficit is always bad. A trade deficit can arise if investors think America is a really good place to invest.

Look at the quarterly releases of GDP, and they will usually say that the growing trade deficit subtracts from our GDP growth. You can't argue that this is positive, because higher GDP is a good thing. Net capital outflows caused by the trade deficit does not add to our GDP, it subtracts. It also costs us jobs here at home, because if that extra 50 billion dollars per month was spent on US products vs foreign products, that would increase production here at home and have a higher multiplier effect.

You miss the point.

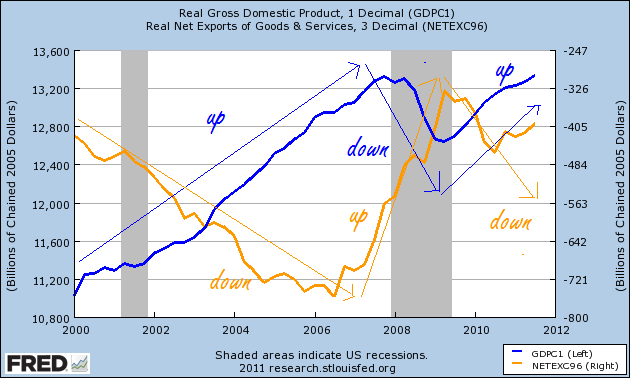

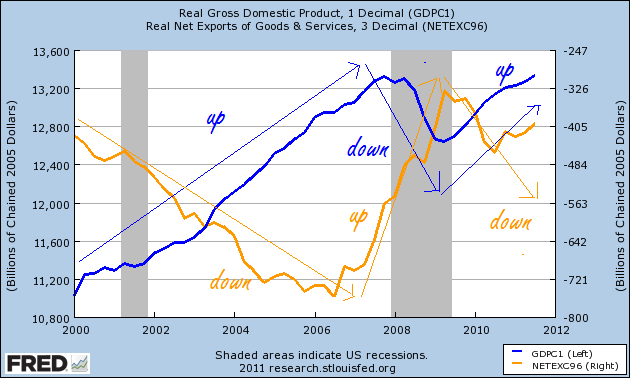

NX does not occur in isolation. Right now, there is a negative correlation between C and NX (net exports) in the American economy (all else being equal). Usually, when NX falls, C rises, and vice versa. NX is, at least partially, an outcome. It is not a driver of GDP. When consumption and income are rising, imports are rising because demand is rising and NX is falling.

And you mistake capital for trade flows. We have capital inflows. We have goods and services outflows. This must happen. They are directly related. This is another problem with this argument. If the current account is negative (i.e. we have a trade deficit), the capital account must be positive (i.e., we are importing capital). IOW, current and capital accounts were perfectly balanced, and a foreigner decides to invest in a plant in America to invest in a plant, we will - by definition - have a trade deficit. Capital coming into the country without an equal amount of capital going out requires that we will have a trade deficit. This is another reason why it is wrong to say a trade deficit is always bad. A trade deficit can arise if investors think America is a really good place to invest.

Look at the quarterly releases of GDP, and they will usually say that the growing trade deficit subtracts from our GDP growth. You can't argue that this is positive, because higher GDP is a good thing. Net capital outflows caused by the trade deficit does not add to our GDP, it subtracts. It also costs us jobs here at home, because if that extra 50 billion dollars per month was spent on US products vs foreign products, that would increase production here at home and have a higher multiplier effect.

You miss the point.

NX does not occur in isolation. Right now, there is a negative correlation between C and NX (net exports) in the American economy (all else being equal). Usually, when NX falls, C rises, and vice versa. NX is, at least partially, an outcome. It is not a driver of GDP. When consumption and income are rising, imports are rising because demand is rising and NX is falling.

And you mistake capital for trade flows. We have capital inflows. We have goods and services outflows. This must happen. They are directly related. This is another problem with this argument. If the current account is negative (i.e. we have a trade deficit), the capital account must be positive (i.e., we are importing capital). IOW, current and capital accounts were perfectly balanced, and a foreigner decides to invest in a plant in America to invest in a plant, we will - by definition - have a trade deficit. Capital coming into the country without an equal amount of capital going out requires that we will have a trade deficit. This is another reason why it is wrong to say a trade deficit is always bad. A trade deficit can arise if investors think America is a really good place to invest.

Toro, the balance of payment accounts are a zero sum of nations’ current and capital accounts. Every entry within all of these accounts is actually or converted to a common monetary currency.

The capital account tracks international transfers of wealth. The current account tracks the global trade of goods and services.

Nations’ capital accounts are NOT factored into the calculation of GDPs.

Nations’ global trade balances, (i.e. the essence of the nations’ current accounts) ARE ALWAYS factored into their GDPs.

Although trade surpluses ALWAYS increase and trade deficits ALWAYS decrease their nations’ GDPs more than otherwise, trade balances are only one of the factors affecting GDP’s. Nations’ GDPs will rise or fall dependent upon the net effect of all factors within the GDP calculating formula.

Respectfully, Supposn

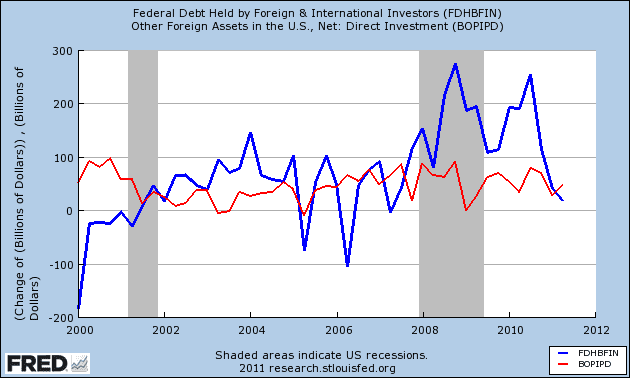

The problem is that foreign investors are not investing in US business, they're investing in US gov't bonds. That's good in one sense,

The problem is that foreign investors are not investing in US business, they're investing in US gov't bonds. That's good in one sense, it keeps our interest payments down on our debt, but it's also bad cuz we don't have the incentive to slow down the borrowing.

Look at the quarterly releases of GDP, and they will usually say that the growing trade deficit subtracts from our GDP growth. You can't argue that this is positive, because higher GDP is a good thing. Net capital outflows caused by the trade deficit does not add to our GDP, it subtracts. It also costs us jobs here at home, because if that extra 50 billion dollars per month was spent on US products vs foreign products, that would increase production here at home and have a higher multiplier effect.

You miss the point.

NX does not occur in isolation. Right now, there is a negative correlation between C and NX (net exports) in the American economy (all else being equal). Usually, when NX falls, C rises, and vice versa. NX is, at least partially, an outcome. It is not a driver of GDP. When consumption and income are rising, imports are rising because demand is rising and NX is falling. ....................

Re: 'Shop Small' November 26Th - a good idea but why not extend it a bit. https://www.facebook.com/SmallBusinessSaturday?extlink=ps-gabmd-2011SBS and Shop Small

I've always felt Americans could solve the jobs problem if they had the will and realized you sometimes need to pay more for a product made by someone who has a decent life. Most people would like a decent life. Instead, you hear whining about taxes and regulation and both have been higher and more stringent in the past. So why do we not ask ourselves why?

So what have you done for America? Lots of whining but do you buy made in the USA? Do you drive a made in the America automobile? Do you support small and large businesses who build here? Do you support a fair wage? Scapegoating is heard too often, it is their fault: government, unions, immigrants, take your pick, history is full of examples, but what do you do for America? Do you support legislation that supports the America worker? The only thing I have seen worked since the 2008 election is talk, running your mouth is easy. Talk is cheap, but what do you do for America and its people? Ideas have power, but ideas should be about people. Time to put up or shut-up, Taxes have been reduced since John F. Kennedy and the economy has oddly performed the miracle many preach. Now is the time to fulfill your pledge given to the America people and to do something meaningful and stop pointing fingers. What have you done for America?

Every day of the year buy American. Google 'made in America.'

A few links:

MadeInUSA - Home- Recycling American Dollars Through Patriotic Spending

How Americans Can Buy American

American Made Products Directory - Made in USA, United States Manufacturers

THE AMERICAN LIST | A Continuous Lean.

Shirts Made in USA : All American Clothing

American and Unionmade Clothing by All USA Clothing

Buy American = "Because Ford, GM and Chrysler conduct far more of their research, design, engineering, manufacturing and assembly work in the U.S. than foreign automakers do, buying a Ford, GM, or Chrysler supports almost three times as many jobs as buying the average foreign automobile. Some comparisons are even more striking. Buying a Ford supports 3.5 times more jobs than buying a Hyundai. Comparing a Honda and a Hyundai? Buying a Honda supports more than 2 times more jobs." The Level Field Institute

Bumper stickers I'd like to see.

Buy American - support all Americans, including yourself.

Our children, our grandchildren, ourselves require we support each other, buy American.

Quality! our Buick is number one.

Buy American and Thumbs up! http://www.usmessageboard.com/economy/128477-did-obama-save-gm-3.html#post2607852

Maybe not--Exactly, it's called the crowding out effect, and it's just one more way our growing govt is choking the private sector.The problem is that foreign investors are not investing in US business, they're investing in US gov't bonds....

Maybe not--Exactly, it's called the crowding out effect, and it's just one more way our growing govt is choking the private sector.The problem is that foreign investors are not investing in US business, they're investing in US gov't bonds....

--this last quarter foreign direct investment was more than foreign T-bill purchases.

Quantum Windbag, the cause of Midcan5s complaints is our trade deficit. I believe its unrealistic to expect that individuals will act contrary to their own immediate interests. (Refer to reply #12).

USAs laws and regulations do nothing to prevent or limit our trade deficit. For this I blame U.S. voters and the legislatures we choose.

I describe the cause and a remedy for significantly reducing USAs trade deficit within the topics:

Refer to the topics:

Warren Buffett's concept to significantly reduce USA's trade deficit,

first posted @ 8:10 PM, August 30, 2009 and last posted @ 1:28 PM, June 15, 2011

Trade deficits are ALWAYS detrimental to their nations GDPs

FIRST POSTED @ 10:25AM, November 30, 2011 and last posted @ 4:34 am, December 6, 2011

and to World Wide Web site USA-Trade-Deficit.Blogspot.Com .

Respectfully, Supposn

Maybe or maybe not; we can't know a 'what-if'. What we do know is that if the government hadn't borrowed the money it would have taxed an equal amount and that that definitely would have hurt private investment "at a time when we most needed it". The problem's not on the revenue side, it's on the spending side....if it weren't for the huge amount of debt being issued by the govt in the last couple years, we would have seen private investment actually grow more at a time when we most needed it...

Maybe or maybe not; we can't know a 'what-if'. What we do know is that if the government hadn't borrowed the money it would have taxed an equal amount and that that definitely would have hurt private investment "at a time when we most needed it". The problem's not on the revenue side, it's on the spending side....if it weren't for the huge amount of debt being issued by the govt in the last couple years, we would have seen private investment actually grow more at a time when we most needed it...