likeabird03

Active Member

Why does anyone want to reduce the 'trade deficit'?

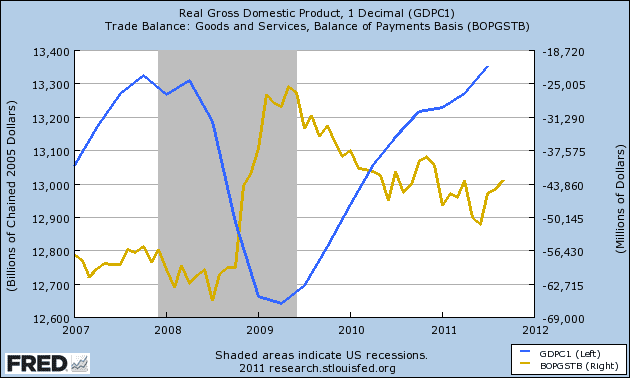

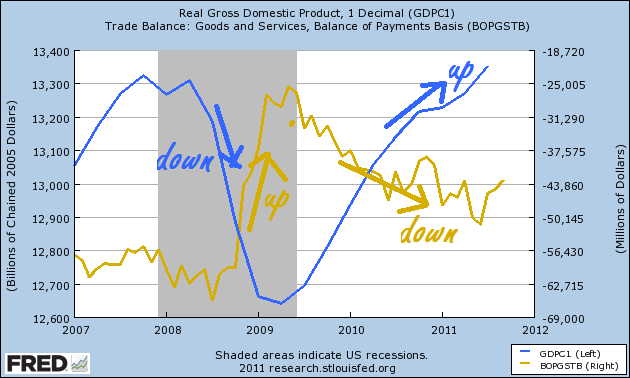

ExPat¬_Panama, because a trade deficit is ALWAYS detrimental to the GDP; the GDP bolsters the median wage; the median wage is indicative of the nations’ quality of life.

The topic “Trade deficits are ALWAYS detrimental to their nations’ GDPs” provides further explanation. It has just been posted.

Respectfully, Supposn

No it's not. A trade deficit can often be a sign of strength, and a trade surplus can be a sign of weakness.

If two countries trade with one another, and one is growing faster than the other, the faster growing economy can run a trade deficit with the slower economy because it's demand for imports is relatively higher.

That may be true in some situations, but that's assuming that the economy is strong in the first place - which it's not, as we all know. Our trade deficit subtracts from GDP growth, so in times that the economy is strong with a deficit, it means that the economy is only growing at a decent rate despite the trade deficit.

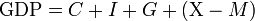

And if you need proof - here's what GDP is made of:

GDP = private consumption + gross investment + government spending + (exports − imports)

Gross domestic product - Wikipedia, the free encyclopedia

What this means is that during times when our imports are more than our exports - trade as a whole subtracts from our GDP.

Last edited: