Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

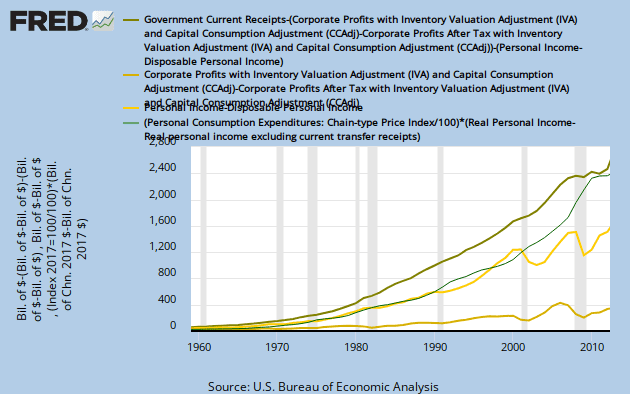

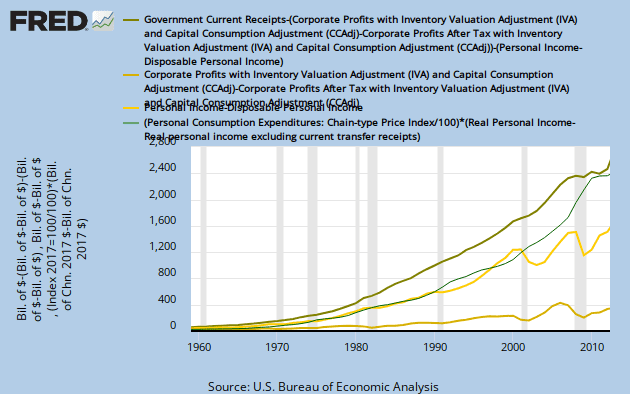

In aggregate, the US public now receives $1T / year more in welfare, than paid in taxes. Since 2008, the US public has been a net drain, on the rest of the economy (e.g. domestic businesses, foreign lenders).

Specifically, from the 1960s, and throughout the 1970s-80s, total public welfare tracked total public taxes. I.e. for a generation, the US public paid no net taxes. Since 2001 & 2008, total public welfare has sky-rocketed above total public taxes, to about $1T / year today.

The following figure (attempts to) plots:

Specifically, from the 1960s, and throughout the 1970s-80s, total public welfare tracked total public taxes. I.e. for a generation, the US public paid no net taxes. Since 2001 & 2008, total public welfare has sky-rocketed above total public taxes, to about $1T / year today.

The following figure (attempts to) plots:

- sales taxes (top line)

- business taxes (bottom line)

- personal taxes

- personal welfare