JonKoch

VIP Member

- May 14, 2017

- 1,779

- 151

- 65

Depends on what your goal is. If you want money going into the treasury then you tax each as much as you can until revenue drops. You can get away with a higher rate on labor. Obama acknowlegded this back during the primaries (from here):...less convinced that there is any reason to tax labor income at higher rates than capital gains...

Then again, if the goal is simply revenge against cap. gains receivers, then taxing doesn't make as much sense as say, revolution and mass executions.GIBSON: And in each instance, when the rate dropped, revenues from the tax increased; the government took in more money. And in the 1980s, when the tax was increased to 28 percent, the revenues went down.

So why raise it at all, especially given the fact that 100 million people in this country own stock and would be affected?

OBAMA: Well, Charlie, what I've said is that I would look at raising the capital gains tax for purposes of fairness.

You meant they asked a false premise and he answered inaccurately right?

The premise must be at what rate is CG taxes not bring in more revenues.

CBO says for the top 1% it's between 31%-34%

"The implied revenue-maximizing flat-rate tax of between 31 percent and 34 percent is within the sample range of tax rates for the top 1 percent."

"For the bottom 99 percent, the estimates are much less precise. In all four equations, the tax rate effect is negative, but it is not significantly different from either zero or the estimated effect for the top 1 percent."

https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/84xx/doc8449/88-cbo-007.pdf

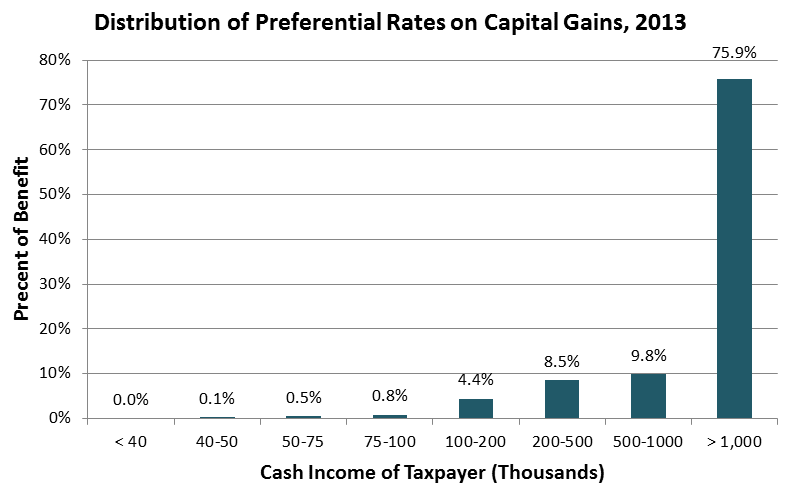

The Tax Break-Down: Preferential Rates on Capital Gains