I know the US treasure is responsible in printing US money.

And we say that we are in debt and the debt ceiling is still going up here and their.

But what is stopping the treasure just from printing more money...

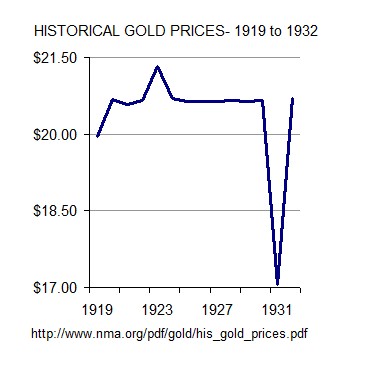

I mean now that money is not based on resources like gold what is stopping them from make us all rich in theory?

Is this just a law or do they just regulate the US amount of money to keep everybody at a certain level.... and in line sort of.

Obvious if we made everybody reach it would then be meaningless and cause catastrophic stuff... because most people cann't live with in a means that everybody could live together at.... (some like me have no problem with it)

Very interested in how they come up with how much money we have or when we should print more... obviously this most be based on population , resources , energy ,...social factors ,..etc something to keep people working and at a common goal sort of.

But is their an equation that the US abides to or do couple people en-power just make an educated guess on what it should be.

If I would have to guess it is probably an economic math equation the works or is working currently .... when it fails we must mathematically model another equation for the population and living quality...

And we say that we are in debt and the debt ceiling is still going up here and their.

But what is stopping the treasure just from printing more money...

I mean now that money is not based on resources like gold what is stopping them from make us all rich in theory?

Is this just a law or do they just regulate the US amount of money to keep everybody at a certain level.... and in line sort of.

Obvious if we made everybody reach it would then be meaningless and cause catastrophic stuff... because most people cann't live with in a means that everybody could live together at.... (some like me have no problem with it)

Very interested in how they come up with how much money we have or when we should print more... obviously this most be based on population , resources , energy ,...social factors ,..etc something to keep people working and at a common goal sort of.

But is their an equation that the US abides to or do couple people en-power just make an educated guess on what it should be.

If I would have to guess it is probably an economic math equation the works or is working currently .... when it fails we must mathematically model another equation for the population and living quality...

Last edited: