Old Rocks

Diamond Member

- Thread starter

- #41

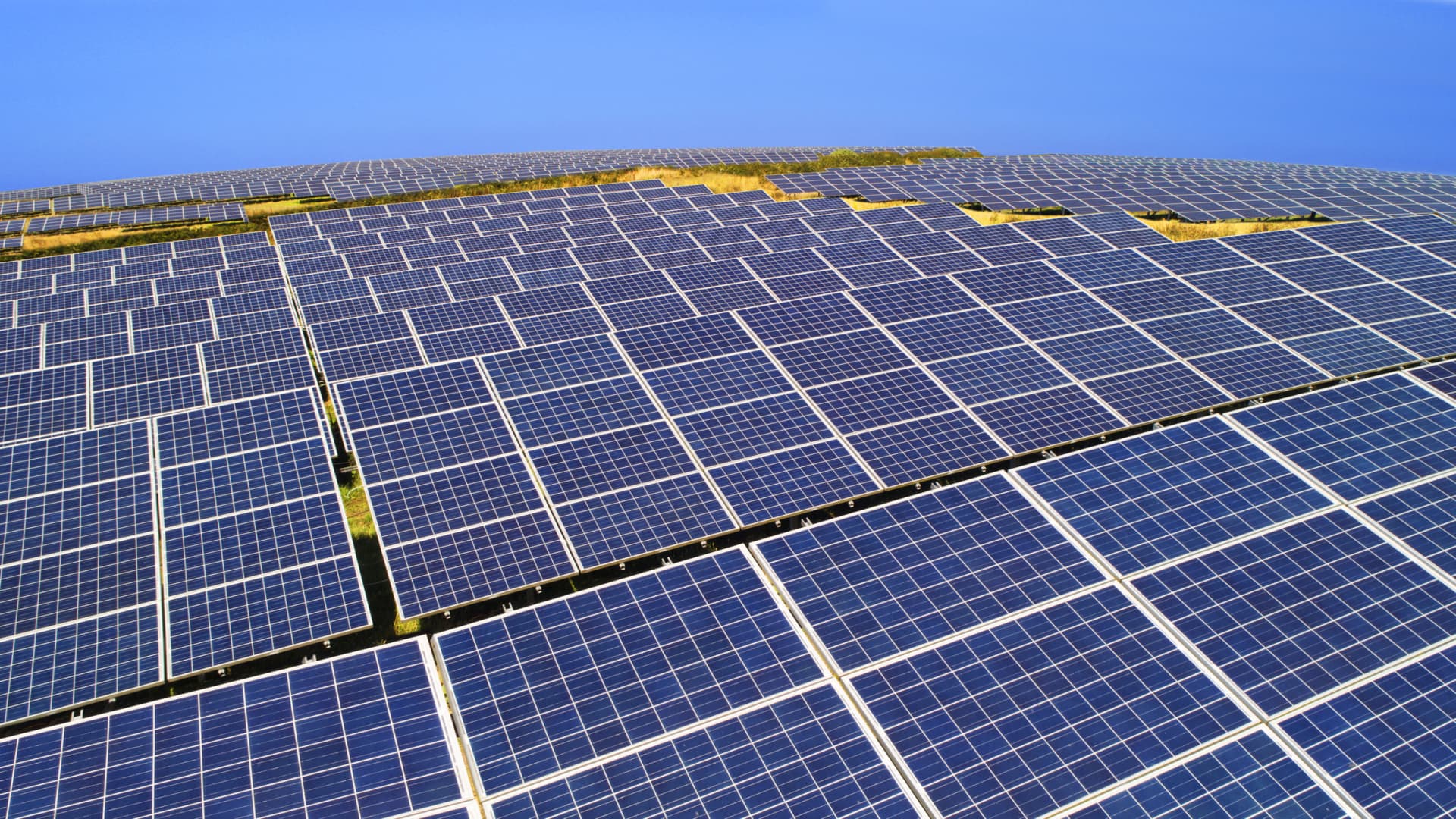

Why should they pay more? Electricity from wind and solar is cheaper than that from fossil fuels, and far, far cheaper than nuclear. That is why utilities are shutting down coal fired plants that have many years of life left, but it is simply cheaper to build wind and solar than continue to burn coal. And now they are starting to replace gas peaker plants with grid scale storage, batteries and other forms.

costs fall

|

Advancements in battery storage pose a significant risk to natural gas as the rapid growth of renewable power erodes market share for the fossil fuel in the decades ahead.

In independent system operator territories across the U.S., wind power has become the single largest threat to market share for gas as a cleaner power source as coal and nuclear generation retires. At less than $30/MWh, the levelized costs of wind and solar power have fallen dramatically in recent years, with both technologies continuing to undercut even the cheapest gas-fired generation.

Growth in renewable power has created a supporting role for gas as a backup fuel, balancing the intermittency of wind and solar generation. But rapid advances in lithium-ion battery storage technology have dramatically altered the green-energy landscape.

For years, fast-ramping batteries capable of replacing gas as a grid-balancing resource were out of the money. According to a recent analysis of global battery-storage projects by BloombergNEF, however, lithium-ion batteries are now cheaper than gas peaking plants in much of the world.

At an all-in cost of $132/MWh, a four-hour utility-scale battery is now priced below the global gas-peaker plant average at $173/MWh. Even within the U.S., where gas prices are significantly lower than elsewhere, batteries are now cost-competitive with gas-fired power due in part to state-level clean energy goals and federal tax credits.

Such policies have boosted the competitiveness of renewables in recent years and threaten to undermine the economic viability of new gas-fired power investments, according to Morris Greenberg, S&P Global Platts Analytics senior manager for North American power.

Natural gas in transition: Grid-balancing tactics in flux as battery costs fall

Even in the U.S., where natural gas prices are low, batteries are now cost-competitive with gas-fired power due in part to state-level clean energy goals and federal tax credits.