Admiral Rockwell Tory

Diamond Member

The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

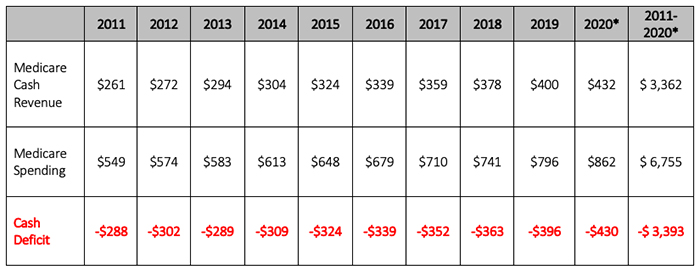

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

You are implying that it is even possible to "pay for it".

With or without Covid-19, with or without the economic down turn, whether Democrats or Republicans are in office....

You can't pay for socialism. It never works. Never. Not one time in all human history, has taking from group A, to pay for group B, worked.

If Social Security and Medicare were possible to have working, then we would never have the concept of a Ponzi scheme, because both of those are ponzi schemes.

In the end, my guess is that health care in the US will end up run by the government, and thus will end up declining in quality to meet the ability of the government to pay.

Social Security will equally need to be cut to the ability of the government to pay. The way they will do this, is by cutting the retirement age, meaning raise the retirement age to 75 or something.

Now there are a few alternatives that the nation could go down, that will be absolutely devastating.

One is a drastic increase in taxes, which will cause capital flight and economic decline. That would be much like what we saw in Greece.

The other option is that government just keeps spending, until they destroy themselves. Again, much like Greece.

Given the recent rise of incompetence, like AOC who is exceedingly popular, even after saying things as utterly mindless as she's going to "spend" the money from a tax cut on schools and health care.....

I see the Greece result as more and more a real possibility.

There is no way to "pay" for Social Security and Medicare/Medicaid. These programs, were never, and are not, sustainable. We have only been able to out-grow our spending thus far, but that can't continue forever.

You want 75 year-old truck drivers on the road? You want 75 year-old roofers working on your house? You want a 75 year-old nurse assisting your doctor?

You really have not thought this through, have you?