jreeves

Senior Member

- Feb 12, 2008

- 6,588

- 319

- 48

The Risk of Debt - Megan McArdle

So why should we worry about the ability of the government to borrow? For the past decade, at least, the American government has been able to borrow pretty much all the money it wanted without seeming to pay much of a price in terms of higher interest rates. Bush's deficits were worrying in a number of ways, but they certainly didn't crowd out private investments, and we got a good deal on the money.

But Obama's spending plans are extraordinarily ambitious. His projected deficits for the rest of his possibly presidency are higher than the "runaway" deficits that plagued most of the Bush administration--and after the first few years, that's not stimulus, that's ordinary spending outstripping revenue. For a while now, I've been asking people at conferences, on and off the record, what America's sovereign debt risk is? That is, how long until people stop treating treasuries as the "risk free" securities, and start demanding a premium for the risk that we might default.

The answer from the right has been a nervous (perhaps hopeful) 2-3 years. The answer from the left, and professional Democratic wonks, is some unspecified time in the future. Probably, there will be a Republican in charge. Markets hate Republicans.

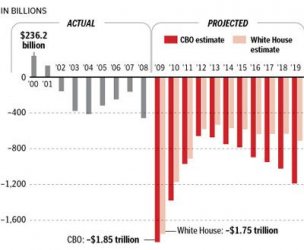

But the problems faced by Clinton were modest--moderately higher interest rates, possibly, for ordinary borrowers. The Obama administration is trying to borrow 13% of GDP this year. If bond markets think future deficits are a problem, they can rapidly push up rates to the point where that borrowing becomes unaffordable. And if they do, it will be clear that they are pricing in that ugly, ugly CBO graph:

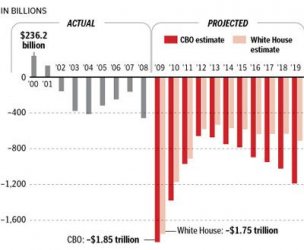

Obama can assure voters that he inherited these deficits. But bond markets pay closer attention to the fact that Obama has already increased the projected deficit he inherited by 50%:

The White House raised the 2009 budget deficit projection to a staggering $1.8 trillion today. For context, it took President Bush more than seven years to accumulate $1.8 trillion in debt. It also means that 45 cents of every dollar Washington spends this year will be borrowed.

President Obama continues to distance himself from this "inherited" budget deficit. But the day he was inaugurated, the 2009 deficit was forecast at $1.2 trillion -- meaning $600 billion has already been added during his four-month presidency (an amount that, by itself, would exceed all 2001-07 annual budget deficits). And should the president really be allowed to distance himself from the $1.2 trillion "inherited" portion of the deficit, given that as a senator he supported nearly all policies and bailouts that created it?

The president also talks of cutting the deficit in half from this bloated level. But even after the recession ends and the troops return home, he'd still run $1 trillion deficits -- compared to President Bush's $162 billion pre-recession deficit. In other words, the structural budget deficit (which excludes the impacts of booms/recessions) would more than quintuple.

After the recession, Americans can look forward to out of control inflation.

With a $1.8 trillion budget deficit, is there anyone else that thinks Obama should be cutting more than $17 billion?

So why should we worry about the ability of the government to borrow? For the past decade, at least, the American government has been able to borrow pretty much all the money it wanted without seeming to pay much of a price in terms of higher interest rates. Bush's deficits were worrying in a number of ways, but they certainly didn't crowd out private investments, and we got a good deal on the money.

But Obama's spending plans are extraordinarily ambitious. His projected deficits for the rest of his possibly presidency are higher than the "runaway" deficits that plagued most of the Bush administration--and after the first few years, that's not stimulus, that's ordinary spending outstripping revenue. For a while now, I've been asking people at conferences, on and off the record, what America's sovereign debt risk is? That is, how long until people stop treating treasuries as the "risk free" securities, and start demanding a premium for the risk that we might default.

The answer from the right has been a nervous (perhaps hopeful) 2-3 years. The answer from the left, and professional Democratic wonks, is some unspecified time in the future. Probably, there will be a Republican in charge. Markets hate Republicans.

But the problems faced by Clinton were modest--moderately higher interest rates, possibly, for ordinary borrowers. The Obama administration is trying to borrow 13% of GDP this year. If bond markets think future deficits are a problem, they can rapidly push up rates to the point where that borrowing becomes unaffordable. And if they do, it will be clear that they are pricing in that ugly, ugly CBO graph:

Obama can assure voters that he inherited these deficits. But bond markets pay closer attention to the fact that Obama has already increased the projected deficit he inherited by 50%:

The White House raised the 2009 budget deficit projection to a staggering $1.8 trillion today. For context, it took President Bush more than seven years to accumulate $1.8 trillion in debt. It also means that 45 cents of every dollar Washington spends this year will be borrowed.

President Obama continues to distance himself from this "inherited" budget deficit. But the day he was inaugurated, the 2009 deficit was forecast at $1.2 trillion -- meaning $600 billion has already been added during his four-month presidency (an amount that, by itself, would exceed all 2001-07 annual budget deficits). And should the president really be allowed to distance himself from the $1.2 trillion "inherited" portion of the deficit, given that as a senator he supported nearly all policies and bailouts that created it?

The president also talks of cutting the deficit in half from this bloated level. But even after the recession ends and the troops return home, he'd still run $1 trillion deficits -- compared to President Bush's $162 billion pre-recession deficit. In other words, the structural budget deficit (which excludes the impacts of booms/recessions) would more than quintuple.

After the recession, Americans can look forward to out of control inflation.

With a $1.8 trillion budget deficit, is there anyone else that thinks Obama should be cutting more than $17 billion?