I

Itsthetruth

Guest

Bush Says Retirement Benefit Growth Not Realistic

By REUTERS

February 15, 2005

WASHINGTON (Reuters) - President Bush said on Tuesday that limiting the growth of future retirement benefits for Americans would be an ``adjustment to reality.''

Bush said in an interview with local newspapers that he was not expressing a preference for one idea that would link benefit growth to increases in prices rather than wages. That idea, backed by some White House officials, would effectively slow the growth of the benefits.

``Benefits are scheduled to grow at a certain rate, and one of the suggestions, for example ... was they grow ...they grow, but not at a rate as fast as projected. You can call it anything you want. I would call it an adjustment to reality,'' he said.

http://www.nytimes.com/reuters/politics/politics-retire...

Economic Policy Institute

Snapshot for February 9, 2005

Proposed Social Security price indexing would slash benefits.

The Bush Administration has spoken favorably about substituting price indexing for wage indexing, a change that was a centerpiece of Plan 2 of the President's Social Security commission. Under this change, benefits would no longer reflect improvements in the country's standard of living, but would just be indexed to prices. It is hard to overstate the effect of that substitution on hypothetical future benefits.

Recent research by the non-partisan Congressional Research Service (CRS) sheds light on this issue. The CRS estimated what the effect on current Social Security retirees' benefits would have been if initial benefits had been calculated based on increases in pricesusing the consumer price indexinstead of increases in average national wages.1

Figure 1 shows that, with a price indexation formula, retiree benefits would have been cut substantially. Under the current wage indexation, the Social Security benefit for a person with average earnings over one's lifetime and retiring in 2005 would be $15,336 per year, replacing 42% of the average worker's income. If, however, price indexing had been used instead of wage indexing, that same 2005 retiree would receive only $6,180 per year, replacing just 17% of income. In other words, as the figure shows, a change from wage indexation to price indexation would have meant a 60% cut in Social Security benefits for today's retirees.

http://www.epinet.org/content.cfm/webfeatures_snapshots_20050209

Leaked White House Memo Proposes Social Security Price Indexing

White House Memo Admits Individual Accounts Would Do Nothing to Close the Shortfall

In a White House memo to conservative allies that leaked in early January, Peter Wehner, the White House Director of Strategic Initiatives, acknowledged that individual accounts themselves would do nothing to close the projected Social Security shortfall and that the White House is looking to price indexing to close all of the shortfall. Wehner wrote: If we borrow $1-2 trillion to cover transition costs for personal savings accounts and make no changes to wage indexing, we will have borrowed trillions and will still confront more than $10 trillion in unfunded liabilities.

http://www.cbpp.org/12-17-04socsec.htm#_ftnref2

Center On Budget And Policy Priorities

Revised January 28, 2005

SO-CALLED "PRICE INDEXING" PROPOSAL WOULD RESULT IN

DEEP REDUCTIONS OVER TIME IN SOCIAL SECURITY BENEFITS<*>

by Robert Greenstein

This proposal is now in the news. In comments shortly after the election, President Bush said the plans that his Social Security Commission produced, the principal one of which includes this proposal, are a good place to start the debate. On December 2, the chairman of the Presidents Council of Economic Advisers, N. Gregory Mankiw, criticized wage indexing the shorthand term used to describe the current approach in a speech, while stating that the Commissions proposals are consistent with the Presidents principles for reform. Most recently, White House Director of Strategic Initiatives, Peter Wehner, explicitly endorsed shifting to price indexing in a memo to Administration supporters that leaked in early January. It also may be noted that a Social Security bill introduced last year by Senator Lindsey Graham (R-S.C.), which essentially turns the principal Commission plan into legislation, includes this proposal; the Graham plan reportedly was developed with the help of White House staff. These developments strongly suggest that the proposal to change the Social Security benefit formula by lowering the replacement rates is receiving serious White House consideration.

The Effect on Social Security Benefits

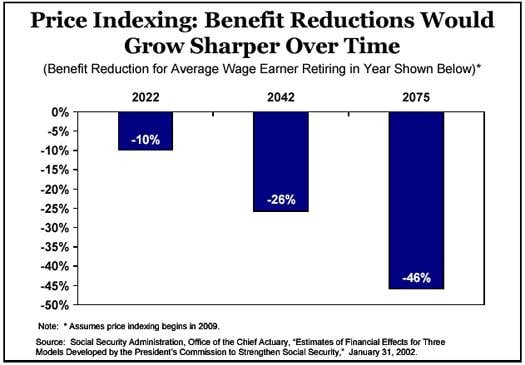

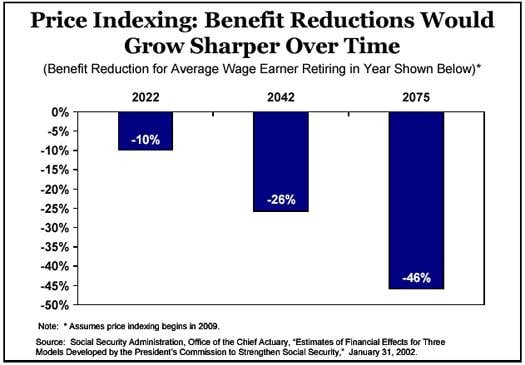

Advocates of this proposal have sometimes sought to portray it as not representing a benefit reduction and as simply curbing excessive growth in Social Security benefits. But the change would, in fact, represent a substantial reduction in benefits, as compared to the benefits payable under the current benefit structure. According to estimates from the Social Security Administrations Office of the Chief Actuary:

Under the proposal, a worker born in 1977 who earned average wages throughout his or her career and retired at age 65 in 2042 would receive monthly Social Security benefits 26 percent lower than under the current benefit structure. Instead of this workers annual benefit being $19,423, the benefit would be $14,432, a $4,992 reduction. (These figures are in 2004 dollars)

http://www.cbpp.org/12-17-04socsec.htm

By REUTERS

February 15, 2005

WASHINGTON (Reuters) - President Bush said on Tuesday that limiting the growth of future retirement benefits for Americans would be an ``adjustment to reality.''

Bush said in an interview with local newspapers that he was not expressing a preference for one idea that would link benefit growth to increases in prices rather than wages. That idea, backed by some White House officials, would effectively slow the growth of the benefits.

``Benefits are scheduled to grow at a certain rate, and one of the suggestions, for example ... was they grow ...they grow, but not at a rate as fast as projected. You can call it anything you want. I would call it an adjustment to reality,'' he said.

http://www.nytimes.com/reuters/politics/politics-retire...

Economic Policy Institute

Snapshot for February 9, 2005

Proposed Social Security price indexing would slash benefits.

The Bush Administration has spoken favorably about substituting price indexing for wage indexing, a change that was a centerpiece of Plan 2 of the President's Social Security commission. Under this change, benefits would no longer reflect improvements in the country's standard of living, but would just be indexed to prices. It is hard to overstate the effect of that substitution on hypothetical future benefits.

Recent research by the non-partisan Congressional Research Service (CRS) sheds light on this issue. The CRS estimated what the effect on current Social Security retirees' benefits would have been if initial benefits had been calculated based on increases in pricesusing the consumer price indexinstead of increases in average national wages.1

Figure 1 shows that, with a price indexation formula, retiree benefits would have been cut substantially. Under the current wage indexation, the Social Security benefit for a person with average earnings over one's lifetime and retiring in 2005 would be $15,336 per year, replacing 42% of the average worker's income. If, however, price indexing had been used instead of wage indexing, that same 2005 retiree would receive only $6,180 per year, replacing just 17% of income. In other words, as the figure shows, a change from wage indexation to price indexation would have meant a 60% cut in Social Security benefits for today's retirees.

http://www.epinet.org/content.cfm/webfeatures_snapshots_20050209

Leaked White House Memo Proposes Social Security Price Indexing

White House Memo Admits Individual Accounts Would Do Nothing to Close the Shortfall

In a White House memo to conservative allies that leaked in early January, Peter Wehner, the White House Director of Strategic Initiatives, acknowledged that individual accounts themselves would do nothing to close the projected Social Security shortfall and that the White House is looking to price indexing to close all of the shortfall. Wehner wrote: If we borrow $1-2 trillion to cover transition costs for personal savings accounts and make no changes to wage indexing, we will have borrowed trillions and will still confront more than $10 trillion in unfunded liabilities.

http://www.cbpp.org/12-17-04socsec.htm#_ftnref2

Center On Budget And Policy Priorities

Revised January 28, 2005

SO-CALLED "PRICE INDEXING" PROPOSAL WOULD RESULT IN

DEEP REDUCTIONS OVER TIME IN SOCIAL SECURITY BENEFITS<*>

by Robert Greenstein

This proposal is now in the news. In comments shortly after the election, President Bush said the plans that his Social Security Commission produced, the principal one of which includes this proposal, are a good place to start the debate. On December 2, the chairman of the Presidents Council of Economic Advisers, N. Gregory Mankiw, criticized wage indexing the shorthand term used to describe the current approach in a speech, while stating that the Commissions proposals are consistent with the Presidents principles for reform. Most recently, White House Director of Strategic Initiatives, Peter Wehner, explicitly endorsed shifting to price indexing in a memo to Administration supporters that leaked in early January. It also may be noted that a Social Security bill introduced last year by Senator Lindsey Graham (R-S.C.), which essentially turns the principal Commission plan into legislation, includes this proposal; the Graham plan reportedly was developed with the help of White House staff. These developments strongly suggest that the proposal to change the Social Security benefit formula by lowering the replacement rates is receiving serious White House consideration.

The Effect on Social Security Benefits

Advocates of this proposal have sometimes sought to portray it as not representing a benefit reduction and as simply curbing excessive growth in Social Security benefits. But the change would, in fact, represent a substantial reduction in benefits, as compared to the benefits payable under the current benefit structure. According to estimates from the Social Security Administrations Office of the Chief Actuary:

Under the proposal, a worker born in 1977 who earned average wages throughout his or her career and retired at age 65 in 2042 would receive monthly Social Security benefits 26 percent lower than under the current benefit structure. Instead of this workers annual benefit being $19,423, the benefit would be $14,432, a $4,992 reduction. (These figures are in 2004 dollars)

http://www.cbpp.org/12-17-04socsec.htm