Doc7505

Diamond Member

- Feb 16, 2016

- 15,718

- 27,674

- 2,430

The Biden Blitzkrieg Bop!

10 Red Flags Point To Looming Recession Under Bidenomics

The Biden Blitzkrieg Bop! 10 Red Flags Point To Looming Recession Under Bidenomics

Call Bidenomics a new name: The Biden Blitzkrieg Bop since the administration launched a blitzkrieg attack on America’s middle class and low wage workers through bad energy policies and soari…

confoundedinterest.net

confoundedinterest.net

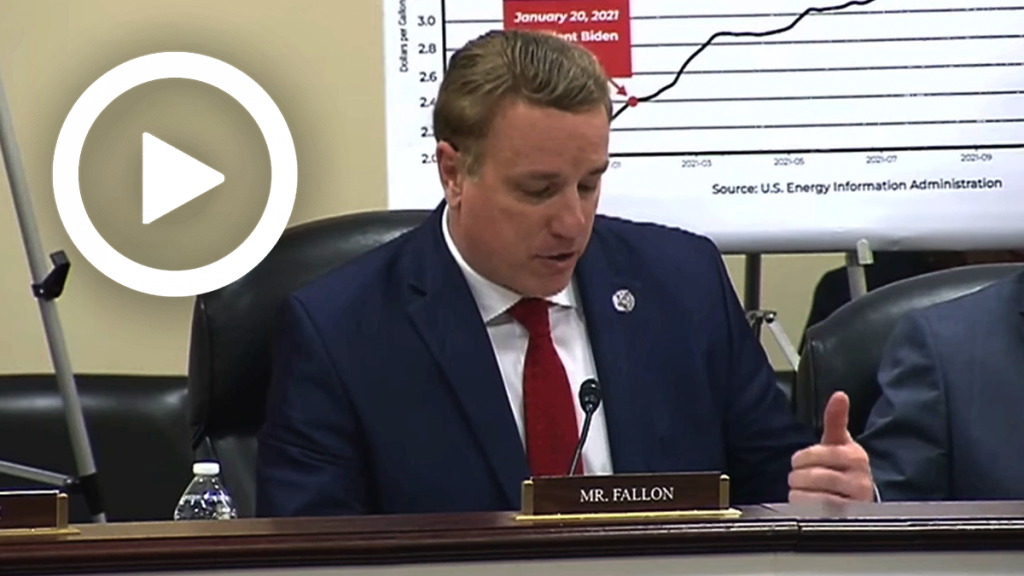

Call Bidenomics a new name: The Biden Blitzkrieg Bop since the administration launched a blitzkrieg attack on America’s middle class and low wage workers through bad energy policies and soaring inflation.

Clearly, economists were wrong earlier this year when they forecast an economic contraction that has yet to manifest. Could they be wrong now?

To be sure, economic growth, the labor market and consumer spending have proven unexpectedly resilient in the face of rising interest rates and elevated inflation. But there are still plenty of signs a recession might still be on its way.

1. An “uncertain outlook” from leading indicators

Many mainstay economic indicators measure the past. So-called leading indicators reflect what likely lies ahead.2. Consumer confidence is just a hair above recessionary levels

The Conference Board’s consumer confidence index came in at 80.2 in August, hovering just above 80, the level that often signals the U.S. economy is headed for a recession in the coming year.3. Consumers are foregoing big-ticket purchases

Retailers report that their customers have shifted their purchasing habits, spending less on furniture and other big ticket items in favor of necessities. They have also been trading down on grocery items, ditching pricier cuts of beef and buying chicken.4. Credit cards are getting maxed out

U.S. consumers ran up their credit card debt past the $1 trillion mark for the first time last month, according to a report on household debt from the Federal Reserve Bank of New York.5. Banks are increasingly reluctant to lend

The latest Senior Loan Officer Opinion Survey by the Federal Reserve reports tightening credit conditions across the board, from business loans to home mortgages and consumer credit.6. Corporate bonds are maturing and refinancing them will be costly

7. Manufacturing remains in a prolonged post-pandemic slump

8. ‘Cascading crises’ could tip the balance of a slowing global economy

9. The yield curve, a classic recessionary signal, is still inverted

10. Inflation is sticky, and the Fed isn’t done

Policy makers are still waiting to see what happens next after raising rates to their highest level in 22 years. Perhaps those actions have already sent the economy on a path of contraction. Or perhaps they haven’t done enough to continue slowing inflation.Sticky inflation presents on ongoing risk of a recession.

“I believe we must proceed gradually,” Dallas Fed President Lorie Logan said last week, “weighing the risk that inflation will be too high against the risk of dampening the economy too much.”

Commentary:

Bidenomics aka BBB is NOT Build Back Better, but Biden's Blitzkrieg Bop, an all out attack on America's middle class and low wage worker.

This is not a recession but a preamble to a Long Economic Depression. It will make the depression of the 1930's