Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax the Rich: Fix Jobs and Deficits

- Thread starter georgephillip

- Start date

Lars

Member

It isn't.How much more are the richest 1% of Americans entitled to, in your opinion?

Your acting like it isn't their money to begin with.

Well, I suppose it is technically owned by the Federal Reserve, as it was issued into existence by the Federal Reserve at some point. But wealth people attain through labor and/or through voluntary exchange is theirs if you accept the premise of self-ownership of the individual and reject the notions of arbitrarily implemented notions of communally owned property.

Am I to assume that you are pro-democracy? Thus, you support the notion that all property is held in common and it's use and distribution can be voted upon? I hope you realize this is an inherently communist notion. Are you willing to admit you are a communist?

daveman

Diamond Member

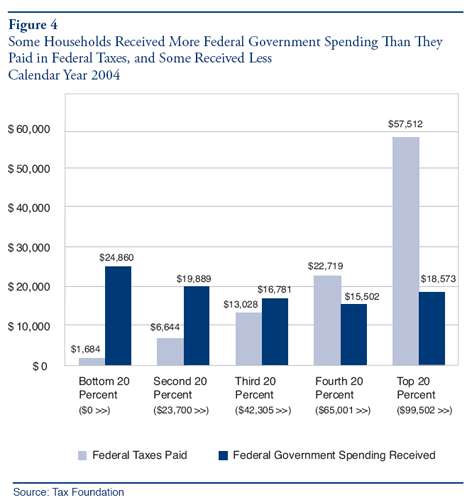

How about we make it commensurate with the benefits received from government?Since the 50% who pay no federal income taxes donate a far higher percentage of their total income to taxes of all kinds, would you think it "fair" to ask the richest 1% to donate the same percent of their total income to taxes as the 50% do?First you said you want their taxes raised, now you say you don't. Then you say you do.

Which is it?

Thought my post was pretty clear. I'll clarify just for you NYC.

If the taxes on the high earners get raised then everyones taxes should be raised. That includes the 50% who pay for nothing. Pretty simple really.

After all. Fair is Fair.

daveman

Diamond Member

It isn't.How much more are the richest 1% of Americans entitled to, in your opinion?

Your acting like it isn't their money to begin with.

- Thread starter

- #145

"Virtually every economics Ph.D. who has worked in a prominent role in the Bush Administration acknowledges that the tax cuts enacted during the past six years have not paid for themselves--and were never intended to."By 2003, Mr. Bush grasped this lesson. In that year, he cut the dividend and capital gains rates to 15 percent each, and the economy responded. In two years, stocks rose 20 percent. In three years, $15 trillion of new wealth was created. The U.S. economy added 8 million new jobs from mid-2003 to early 2007, and the median household increased its wealth by $20,000 in real terms."In response to the first question: A Lot. And the corollary lesson: It's The Spending, Stupid.

As the Wall Street Journals Stephen Moore illuminates in his 2008 book The End of Prosperity (Threshold Editions), Mr. Bushs 2001 tax cuts failed to revive an economy still staggering from the bursting of the dot-com bubble. Mr. Bushs strategy had been to adopt a demand-side, Keynesian stimulus, hoping that putting a few extra dollars in Americans pockets would jump-start the economy through increased consumption. This approach faltered, not just because Americans opted to save their rebates, but because it neglected the importance of business investment to overall growth. Predictably, the economy lagged and government revenues stagnated. What the United States needed then (and needs now) was to stimulate investment, not consumption.

By 2003, Mr. Bush grasped this lesson. In that year, he cut the dividend and capital gains rates to 15 percent each, and the economy responded. In two years, stocks rose 20 percent. In three years, $15 trillion of new wealth was created. The U.S. economy added 8 million new jobs from mid-2003 to early 2007, and the median household increased its wealth by $20,000 in real terms.

But the real jolt for tax-cutting opponents was that the 03 Bush tax cuts also generated a massive increase in federal tax receipts. From 2004 to 2007, federal tax revenues increased by $785 billion, the largest four-year increase in American history. According to the Treasury Department, individual and corporate income tax receipts were up 40 percent in the three years following the Bush tax cuts. And (bonus) the rich paid an even higher percentage of the total tax burden than they had at any time in at least the previous 40 years. This was news to the New York Times, whose astonished editorial board could only describe the gains as a surprise windfall.

Unfortunately, Mr. Bush allowed Congress to spend away those additional tax revenues. The fact is that the increase in tax revenues that flowed from the 03 tax cuts could have paid for the wars in Afghanistan and Iraq and then some but for rampant discretionary domestic spending. ...

DWYER: Bush tax cuts boosted federal revenue - Washington Times

In other words, Bush's base used their 2003 tax cuts to gamble in Wall Street's casino, and their trillions in losses were covered by those who lost the 8 million new jobs?

"Median household wealth" doesn't seem like a particularly useful economic barometer to use on the eve of the greatest economic downturn since the Great Depression.

Are you economically challenged?

How much more are the rich entitled to?

DWYER: Bush tax cuts boosted federal revenue - Washington Times

You are a blithering moron. The Bush tax cuts didn't cause the financial meltdown...and I bet you have no understanding as to what actually did.

"Harvard professor Greg Mankiw, chairman of Bush's Council of Economic Advisers from 2003 to 2005, even devotes a section of his best-selling economics textbook to debunking the claim that tax cuts increase revenues...

In other words, the Bush tax cuts were meant to create big deficits.

Tax Cuts Don't Boost Revenues - TIME

- Thread starter

- #146

By virtue of a $13 trillion bailout, the richest 2% of Americans now control nearly 75% of all returns to wealth (rent, interest, capital gains and dividends) which is nearly double what they held a generation ago.It isn't.Your acting like it isn't their money to begin with.

Well, I suppose it is technically owned by the Federal Reserve, as it was issued into existence by the Federal Reserve at some point. But wealth people attain through labor and/or through voluntary exchange is theirs if you accept the premise of self-ownership of the individual and reject the notions of arbitrarily implemented notions of communally owned property.

Am I to assume that you are pro-democracy? Thus, you support the notion that all property is held in common and it's use and distribution can be voted upon? I hope you realize this is an inherently communist notion. Are you willing to admit you are a communist?

Do you attribute that to their labor or was it a voluntary exchange with the US taxpayer?

Maybe it had something to do with funding the political campaigns of Republicans AND Democrats?

I consider communism and capitalism equally enslaving.

What about you?

Lars

Member

Capital attained through government redistribution is clearly a form of illegitimate ownership, as it was not attained through voluntary exchange or through labor. That is an incredibly stupid question, and an unnecessary one if you even bothered to read my post, which you clearly didn't in full. Seems like you are just trying to throw out accusations at me and assume I support things I don't because you are intellectually unable to have an in-depth discussion on political economy.By virtue of a $13 trillion bailout, the richest 2% of Americans now control nearly 75% of all returns to wealth (rent, interest, capital gains and dividends) which is nearly double what they held a generation ago.It isn't.

Well, I suppose it is technically owned by the Federal Reserve, as it was issued into existence by the Federal Reserve at some point. But wealth people attain through labor and/or through voluntary exchange is theirs if you accept the premise of self-ownership of the individual and reject the notions of arbitrarily implemented notions of communally owned property.

Am I to assume that you are pro-democracy? Thus, you support the notion that all property is held in common and it's use and distribution can be voted upon? I hope you realize this is an inherently communist notion. Are you willing to admit you are a communist?

Do you attribute that to their labor or was it a voluntary exchange with the US taxpayer?

Maybe it had something to do with funding the political campaigns of Republicans AND Democrats?

I consider communism and capitalism equally enslaving.

What about you?

Why do the bank bailouts happen you ask? Because the people vote for them, if they didn't want politicians who did those things, they wouldn't vote for them, so obviously they either support the bailouts or don't find the issue relevant enough to have it be a deciding factor in casting their vote.

But you are a communist, you believe property is held in common by all be and can thus it use and distribution can be voted upon, so you support by your own standards, but i agree, communism is slavery to the collective. Freedom is the opposite of slavery, so no free markets by definition are the opposite of slavery, as exchanges of labor and capital are made on a mutual and voluntary basis.

- Apr 1, 2011

- 170,137

- 47,290

- 2,180

Well, I suppose it is technically owned by the Federal Reserve, as it was issued into existence by the Federal Reserve at some point. But wealth people attain through labor and/or through voluntary exchange is theirs if you accept the premise of self-ownership of the individual and reject the notions of arbitrarily implemented notions of communally owned property.

Am I to assume that you are pro-democracy? Thus, you support the notion that all property is held in common and it's use and distribution can be voted upon? I hope you realize this is an inherently communist notion. Are you willing to admit you are a communist?

Georgie is a communist. There's no doubt about that.

- Apr 1, 2011

- 170,137

- 47,290

- 2,180

Stephanie

Diamond Member

- Jul 11, 2004

- 70,230

- 10,864

- 2,040

Since the 50% who pay no federal income taxes donate a far higher percentage of their total income to taxes of all kinds, would you think it "fair" to ask the richest 1% to donate the same percent of their total income to taxes as the 50% do?First you said you want their taxes raised, now you say you don't. Then you say you do.

Which is it?

Thought my post was pretty clear. I'll clarify just for you NYC.

If the taxes on the high earners get raised then everyones taxes should be raised. That includes the 50% who pay for nothing. Pretty simple really.

After all. Fair is Fair.

wtf is this DONATE SHIT. you are a real joker and a scary commie idiot to boot.

Last edited:

daveman

Diamond Member

All hail the glorious Revolution! Worker of the world, unite! You have nothing to lose but your chains! Eat the rich! Hope! Change!

Revolution we can believe in!

Since DC Democrats and Republicans are tone deaf to anything that doesn't ring of corporate cash, it falls on workers to demand a massive public works program which can be funded by taxing corporations and the richest Americans at pre-Reagan levels.

"And it makes complete sense because the growing inequalities in wealth over the past three decades has meant a spectacular concentration of wealth at the top.

"The rich have plenty of money to spare."

Spare me the brain-dead conservative vomit about how hard the rich have "worked" for all their money.

The rich have the money because Republicans AND Democrats threw money at Wall Street banks and hedge funds instead of prosecuting the executives responsible for the biggest economic downturn since the Great Depression.

The rich have the money because their chief enabler, The Federal Reserve, has fueled a major commodity bubble "that may be in the midst of bursting, possibly triggering a double dip recession."

Throw in high unemployment which allows the rich to work remaining employees harder and thus increase profits and combine it with commodity speculation and you have the entire basis for a corporate recovery which both major parties tout as "proof" of economic "recovery."

It's another lie the rich tell.

When the Fed stops purchasing 60% of US Treasury bonds, a new creditor will have to step up. One that will probably demand significantly higher interest rates before loaning anymore money to the US Government.

Surprise, surprise - the rich win again!

They got all that free bail-out money which increased the deficit.

None of them went to prison for their crimes.

Their bottom lines are being enhanced by commodity speculation and high unemployment.

And now the rich want higher interest rates for investing in US Treasury Bonds.

"In (all) instances working people pay the bills."

The Rich Are Destroying the Economy | Common Dreams

Its not about defending the "rich", I just want to hear how taxing them and giving the money to the government is going to help the poor and unemployed. Because the government does nothing to help them.

Mr. GeorgePhilip:

Can't reach you with logic or reason.. How about this?

What is your beef with Oprah Winfrey? Do you really want to punish Venus/Serena Williams and all the other "first generation rich"? Did the S.F. Giants steal from you?

Gee I can understand Bill Gates -- his crap has cost me countless hours of grief. But even your most leftist orgs have pointed out that 40% of the folks on the Forbes Richest list came from modest means or LESS. What does that tell you about economic mobility in this country?

So when you put faces to the ENEMY in this war. I want you to see Justin Bieber (a guy who was panhandling at bus stations a few years back) , the heart surgeon who's gonna save your sorry ass someday and George Soros. Because THEY are your sworn rich enemies that you want to rape and pillage.

I know -- that's ruins the whole dam mood of this thread. I'm SOOO tired of this crap. I just want to GIVE BACK the Bush tax cuts just to shut these mothers up. They would then have NO IDEA of what to do next. And the result to the economy would be like chemotherapy gone wild. Let's just blow the sucker up and GIVE THEM what they want..

Can't reach you with logic or reason.. How about this?

What is your beef with Oprah Winfrey? Do you really want to punish Venus/Serena Williams and all the other "first generation rich"? Did the S.F. Giants steal from you?

Gee I can understand Bill Gates -- his crap has cost me countless hours of grief. But even your most leftist orgs have pointed out that 40% of the folks on the Forbes Richest list came from modest means or LESS. What does that tell you about economic mobility in this country?

So when you put faces to the ENEMY in this war. I want you to see Justin Bieber (a guy who was panhandling at bus stations a few years back) , the heart surgeon who's gonna save your sorry ass someday and George Soros. Because THEY are your sworn rich enemies that you want to rape and pillage.

I know -- that's ruins the whole dam mood of this thread. I'm SOOO tired of this crap. I just want to GIVE BACK the Bush tax cuts just to shut these mothers up. They would then have NO IDEA of what to do next. And the result to the economy would be like chemotherapy gone wild. Let's just blow the sucker up and GIVE THEM what they want..

Last edited:

Mr. GeorgePhilip:

Can't reach you with logic or reason.. How about this?

What is your beef with Oprah Winfrey? Do you really want to punish Venus/Serena Williams and all the other "first generation rich"? Did the S.F. Giants steal from you?

Gee I can understand Bill Gates -- his crap has cost me countless hours of grief. But even your most leftist orgs have pointed out that 40% of the folks on the Forbes Richest list came from modest means or LESS. What does that tell you about economic mobility in this country?

So when you put faces to the ENEMY in this war. I want you to see Justin Bieber (a guy who was panhandling at bus stations a few years back) , the heart surgeon who's gonna save your sorry ass someday and George Soros. Because THEY are your sworn rich enemies that you want to rape and pillage.

I know -- that's ruins the whole dam mood of this thread. I'm SOOO tired of this crap. I just want to GIVE BACK the Bush tax cuts just to shut these mothers up. They would then have NO IDEA of what to do next. And the result to the economy would be like chemotherapy gone wild. Let's just blow the sucker up and GIVE THEM what they want..

Its just hilarious that Dems owned the House, Senate, and White House yet chose to extend the Bush tax 'cuts'. Yet all they can do is blame Republicans.

NYcarbineer

Diamond Member

How much increased revenue have the Bush tax cuts produced?You are an economic illiterate. Tax cuts increase revenue. This has been happened consistently due to the resulting economic growth.

How much debt?

Who got rich(er)?

In response to the first question: A Lot. And the corollary lesson: It's The Spending, Stupid.

As the Wall Street Journals Stephen Moore illuminates in his 2008 book The End of Prosperity (Threshold Editions), Mr. Bushs 2001 tax cuts failed to revive an economy still staggering from the bursting of the dot-com bubble. Mr. Bushs strategy had been to adopt a demand-side, Keynesian stimulus, hoping that putting a few extra dollars in Americans pockets would jump-start the economy through increased consumption. This approach faltered, not just because Americans opted to save their rebates, but because it neglected the importance of business investment to overall growth. Predictably, the economy lagged and government revenues stagnated. What the United States needed then (and needs now) was to stimulate investment, not consumption.

By 2003, Mr. Bush grasped this lesson. In that year, he cut the dividend and capital gains rates to 15 percent each, and the economy responded. In two years, stocks rose 20 percent. In three years, $15 trillion of new wealth was created. The U.S. economy added 8 million new jobs from mid-2003 to early 2007, and the median household increased its wealth by $20,000 in real terms.

But the real jolt for tax-cutting opponents was that the 03 Bush tax cuts also generated a massive increase in federal tax receipts. From 2004 to 2007, federal tax revenues increased by $785 billion, the largest four-year increase in American history. According to the Treasury Department, individual and corporate income tax receipts were up 40 percent in the three years following the Bush tax cuts. And (bonus) the rich paid an even higher percentage of the total tax burden than they had at any time in at least the previous 40 years. This was news to the New York Times, whose astonished editorial board could only describe the gains as a surprise windfall.

Unfortunately, Mr. Bush allowed Congress to spend away those additional tax revenues. The fact is that the increase in tax revenues that flowed from the 03 tax cuts could have paid for the wars in Afghanistan and Iraq and then some but for rampant discretionary domestic spending. ...

DWYER: Bush tax cuts boosted federal revenue - Washington Times

None of that proves the Bush tax cuts caused the increase in revenue.

You could as easily say that the explosion of deficit spending from 2001 on stimulated the economy and caused the increased revenue.

NYcarbineer

Diamond Member

How much increased revenue have the Bush tax cuts produced?You are an economic illiterate. Tax cuts increase revenue. This has been happened consistently due to the resulting economic growth.

How much debt?

Who got rich(er)?

In response to the first question: A Lot. And the corollary lesson: It's The Spending, Stupid.

As the Wall Street Journals Stephen Moore illuminates in his 2008 book The End of Prosperity (Threshold Editions), Mr. Bushs 2001 tax cuts failed to revive an economy still staggering from the bursting of the dot-com bubble. Mr. Bushs strategy had been to adopt a demand-side, Keynesian stimulus, hoping that putting a few extra dollars in Americans pockets would jump-start the economy through increased consumption. This approach faltered, not just because Americans opted to save their rebates, but because it neglected the importance of business investment to overall growth. Predictably, the economy lagged and government revenues stagnated. What the United States needed then (and needs now) was to stimulate investment, not consumption.

By 2003, Mr. Bush grasped this lesson. In that year, he cut the dividend and capital gains rates to 15 percent each, and the economy responded. In two years, stocks rose 20 percent. In three years, $15 trillion of new wealth was created. The U.S. economy added 8 million new jobs from mid-2003 to early 2007, and the median household increased its wealth by $20,000 in real terms.

But the real jolt for tax-cutting opponents was that the 03 Bush tax cuts also generated a massive increase in federal tax receipts. From 2004 to 2007, federal tax revenues increased by $785 billion, the largest four-year increase in American history. According to the Treasury Department, individual and corporate income tax receipts were up 40 percent in the three years following the Bush tax cuts. And (bonus) the rich paid an even higher percentage of the total tax burden than they had at any time in at least the previous 40 years. This was news to the New York Times, whose astonished editorial board could only describe the gains as a surprise windfall.

Unfortunately, Mr. Bush allowed Congress to spend away those additional tax revenues. The fact is that the increase in tax revenues that flowed from the 03 tax cuts could have paid for the wars in Afghanistan and Iraq and then some but for rampant discretionary domestic spending. ...

DWYER: Bush tax cuts boosted federal revenue - Washington Times

The stock market was lower in January 2009 than it was in January 2001. Citing 'investment' as an accomplishment of the Bush tax cuts is hilarious.

NYcarbineer

Diamond Member

Part of the reason the myth of tax cuts increasing revenues fools so many people is that historically revenues increase year over year about 80% of the time,

whether you have tax cuts, tax increases, or neither.

In fact, between 1970 and 2009, revenues have only fallen year over year 7 times. 7 out of 39 years.

That helps the myth immensely because if you do cut taxes, the 80% chance of revenues rising anyhow already shifts the odds in favor of revenues rising and making it appear that the tax cuts caused it. The fallacy of B follows A, therefore A caused B.

Here's how you could construct the opposite myth. Clinton RAISED taxes in 1993. Revenues increased every year thereafter for 7 years...

...therefore, tax increases increase revenue.

whether you have tax cuts, tax increases, or neither.

In fact, between 1970 and 2009, revenues have only fallen year over year 7 times. 7 out of 39 years.

That helps the myth immensely because if you do cut taxes, the 80% chance of revenues rising anyhow already shifts the odds in favor of revenues rising and making it appear that the tax cuts caused it. The fallacy of B follows A, therefore A caused B.

Here's how you could construct the opposite myth. Clinton RAISED taxes in 1993. Revenues increased every year thereafter for 7 years...

...therefore, tax increases increase revenue.

Last edited:

- Thread starter

- #159

What if raising taxes on the super rich and their corporations funds a 21st century WPA?

What if raising taxes on the super rich and their corporations funds a 21st century WPA?

That might help somewhat, GP.

But raising taxes on the winners of capitalism is a bandade solution.

Were I king of the economy, I'd be looking at modest changes in the social contract that would insure that the working classes gained some of the cash that is currrently mostly now going to the capital class.

For instance, the 40 hour week is probably too long, now. More workers working less hours at living wages is the goal.

For instance, forcing the working classes to pay for the education they'll need to be productive workers in the 21st century is a foolish way to educate the people given that changes in the way stuff is made and done is happening far faster than most workers can retrain for those changes.

For instance, the current way we handle health care problems is the most inefficient system imaginable.

For instance, allowing US capital to fund foreign investments that come back at us in the form of goods that transfer still more cash into foreign economies is foolish policy.

For instance, giving some people access to cheap capital (read insider banks) while forcing the people to borrow from them at an even higher interest is CLASSISM written right into our economic social contract.

For instance, granting tax breaks on investments which actually means that workers must pay still MORE taxes is foolish policy.

For instance giving WELFARE without also DEMANDING that people get the training they need to GET off welfare is a mistake,

For instance, funding a bloated military with missions that do NOT serve this nation, but SO make some in this nation very very wealthy at the cost to the American taxpayer is foolish.

We cannot SOLVE this economy merely by foisting its cost onto a new VICTIM CLASS of taxpayers.

We've got to look at how people make money in a way that insures that every American can find a job that makes them economically viable.

We have to stop telling outselves that we separate economy policies from social policies and pretend that they don't impact one another.

Similar threads

- Replies

- 75

- Views

- 567

- Replies

- 275

- Views

- 3K

- Replies

- 269

- Views

- 4K

- Replies

- 2

- Views

- 98

Latest Discussions

- Replies

- 38

- Views

- 107

- Replies

- 43

- Views

- 424

- Replies

- 352

- Views

- 2K

Forum List

-

-

-

-

-

Political Satire 8304

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 478

-

-

-

-

-

-

-

-

-

-