healthmyths

Platinum Member

- Sep 19, 2011

- 29,738

- 11,142

- 900

Written into the Affordable Care Act legislation was a provision to establish the Small Business Health Options Program (SHOP) marketplace, which ACA proponents said would help small businesses compete with larger employers. In November 2015, Kaiser Health Newsreported, “Employers with fewer than 50 full-time workers are eligible to buy coverage on SHOP.

The federal government even offers businesses an incentive, a tax credit worth up to half of an employer’s share of their workers’ premiums.

Among the conditions: The firm must employ fewer than 25 workers and their average salary cannot exceed $50,000.”

According to the Kaiser Health News story, only 85,000 people from 11,000 small businesses had coverage through SHOP.

This is significantly less than the 1 million people

the Congressional Budget Office expected to be enrolled in SHOP by the end of 2015.

Susan Wilson Solovic, a New York Times bestselling author and former ABC News business analyst, says to avoid any potential penalties associated with the 50-employee rule, small businesses are choosing to outsource many of their jobs to online freelancers, rather than hiring more staff.

Prior to 2016, many of the time-consuming regulations for small businesses with fewer than 100 employees but more than 49 employees were not enforced in order to give businesses more time to prepare for the rules.

Now that many small businesses are going to be forced to comply with myriad health care rules and regulations they have been able to avoid in the past, many experts are expecting the number of Department of Labor audits to increase, adding to the growing confusion and costs being imposed on small businesses.

Justin Haskins - Survey Shows Small Businesses Suffering Under Obamacare

So not only is Obamacare directly affecting the hiring of more people which would mean more business which would be more people paying taxes, meaning more people buying more consumer goods... we

see Obamacare DISCOURAGING small businesses!

Then look at rules and regulations!

Small Business Facts

Small businesses create two-thirds of the net new jobs annually, employ more than half of the private-sector workforce, and generate nearly 50 percent of annual GDP. America’s small businesses are the backbone of our economy and engines of job creation.

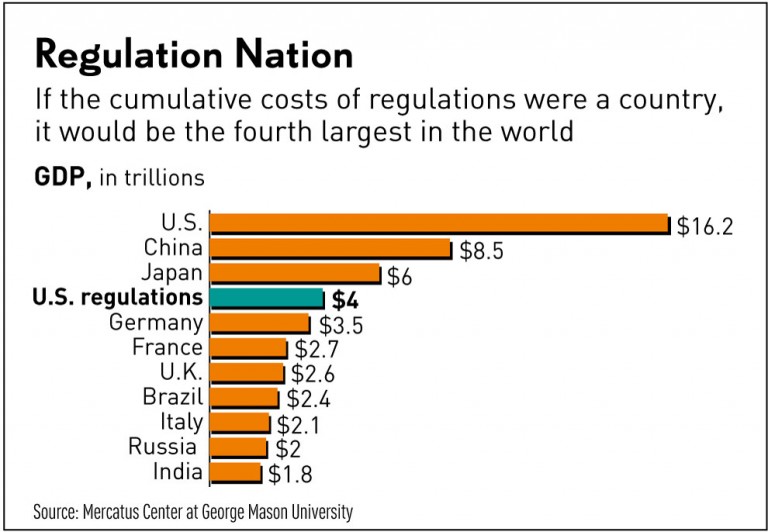

Regulations by the numbers

Today, there are 3,348 federal regulations in the pipeline, with nearly 1/3 impacting small business directly. (Source: The Office of Information and Regulatory Affairs, Unified Agenda 2013)

According to the NFIB Small Business Optimism Index, small business owners have cited regulations as a top impediment to conducting business for over 65 months in a row. (Source: NFIB Small Business Optimism Index)

Need for Regulatory Reform

283,615 full-time government employees were dedicated to drafting and enforcing regulations in 2012, while fewer than 50 employees at OMB are responsible for reviewing the new regulatory mandates to ensure they are justified and accurate prior to implementation (Source: “Growth in Regulators’ Budget Slowed by Fiscal Stalemate: An Analysis of the U.S. Budget for Fiscal Years 2012 and 2013,” The George Washington University and Washington University in St. Louis)

From 2003-2010, one-third of major rules, costing $100 million or more, did not go through public review and input, despite federal requirements for public comment. (Source: GAO Report)

Quick Facts - Small Businesses for Sensible Regulations

The cost of federal regulation neared $2 trillion in 2014, according to a new report by the Competitive Enterprise Institute (CEI).

Report: Cost of Federal Regulation Reached $1.88 Trillion in 2014

The federal government even offers businesses an incentive, a tax credit worth up to half of an employer’s share of their workers’ premiums.

Among the conditions: The firm must employ fewer than 25 workers and their average salary cannot exceed $50,000.”

According to the Kaiser Health News story, only 85,000 people from 11,000 small businesses had coverage through SHOP.

This is significantly less than the 1 million people

the Congressional Budget Office expected to be enrolled in SHOP by the end of 2015.

Susan Wilson Solovic, a New York Times bestselling author and former ABC News business analyst, says to avoid any potential penalties associated with the 50-employee rule, small businesses are choosing to outsource many of their jobs to online freelancers, rather than hiring more staff.

Prior to 2016, many of the time-consuming regulations for small businesses with fewer than 100 employees but more than 49 employees were not enforced in order to give businesses more time to prepare for the rules.

Now that many small businesses are going to be forced to comply with myriad health care rules and regulations they have been able to avoid in the past, many experts are expecting the number of Department of Labor audits to increase, adding to the growing confusion and costs being imposed on small businesses.

Justin Haskins - Survey Shows Small Businesses Suffering Under Obamacare

So not only is Obamacare directly affecting the hiring of more people which would mean more business which would be more people paying taxes, meaning more people buying more consumer goods... we

see Obamacare DISCOURAGING small businesses!

Then look at rules and regulations!

Small Business Facts

Small businesses create two-thirds of the net new jobs annually, employ more than half of the private-sector workforce, and generate nearly 50 percent of annual GDP. America’s small businesses are the backbone of our economy and engines of job creation.

Regulations by the numbers

Today, there are 3,348 federal regulations in the pipeline, with nearly 1/3 impacting small business directly. (Source: The Office of Information and Regulatory Affairs, Unified Agenda 2013)

According to the NFIB Small Business Optimism Index, small business owners have cited regulations as a top impediment to conducting business for over 65 months in a row. (Source: NFIB Small Business Optimism Index)

Need for Regulatory Reform

283,615 full-time government employees were dedicated to drafting and enforcing regulations in 2012, while fewer than 50 employees at OMB are responsible for reviewing the new regulatory mandates to ensure they are justified and accurate prior to implementation (Source: “Growth in Regulators’ Budget Slowed by Fiscal Stalemate: An Analysis of the U.S. Budget for Fiscal Years 2012 and 2013,” The George Washington University and Washington University in St. Louis)

From 2003-2010, one-third of major rules, costing $100 million or more, did not go through public review and input, despite federal requirements for public comment. (Source: GAO Report)

Quick Facts - Small Businesses for Sensible Regulations

The cost of federal regulation neared $2 trillion in 2014, according to a new report by the Competitive Enterprise Institute (CEI).

Report: Cost of Federal Regulation Reached $1.88 Trillion in 2014