DrLove

Diamond Member

Why? Are you saying they don't want to have billionaires pay their "fair share"? Link that WVA and AZ are against that. Manchin and Sinema aren't holding it up for that.

Yes they are - Joe says NO

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Why? Are you saying they don't want to have billionaires pay their "fair share"? Link that WVA and AZ are against that. Manchin and Sinema aren't holding it up for that.

Yes they are - Joe says NO

Apologies. I took "change the laws" to mean cleaning up the tax code, not merely adjusting the rates.You are moving the goal posts. You asked why didn't the GOP change the laws? They did. Democrats have a disparate belief system in terms of taxes so why aren't they changing the laws?

OK, thats fine but in my example the man paid $8bn!!! The man paying $300k will never get to even $10mil in his LIFE of paying taxes and our fist man paid $8Bn in one year. Why should they pay more and how much more? Honestly?

GOP likes what they have. Democrats do not. So why aren't they changing stuff instead of wearing Tax the Rich dresses? They control Congress and the WH? What specifically is stopping them? I am genuinely asking.Apologies. I took "change the laws" to mean cleaning up the tax code, not merely adjusting the rates.

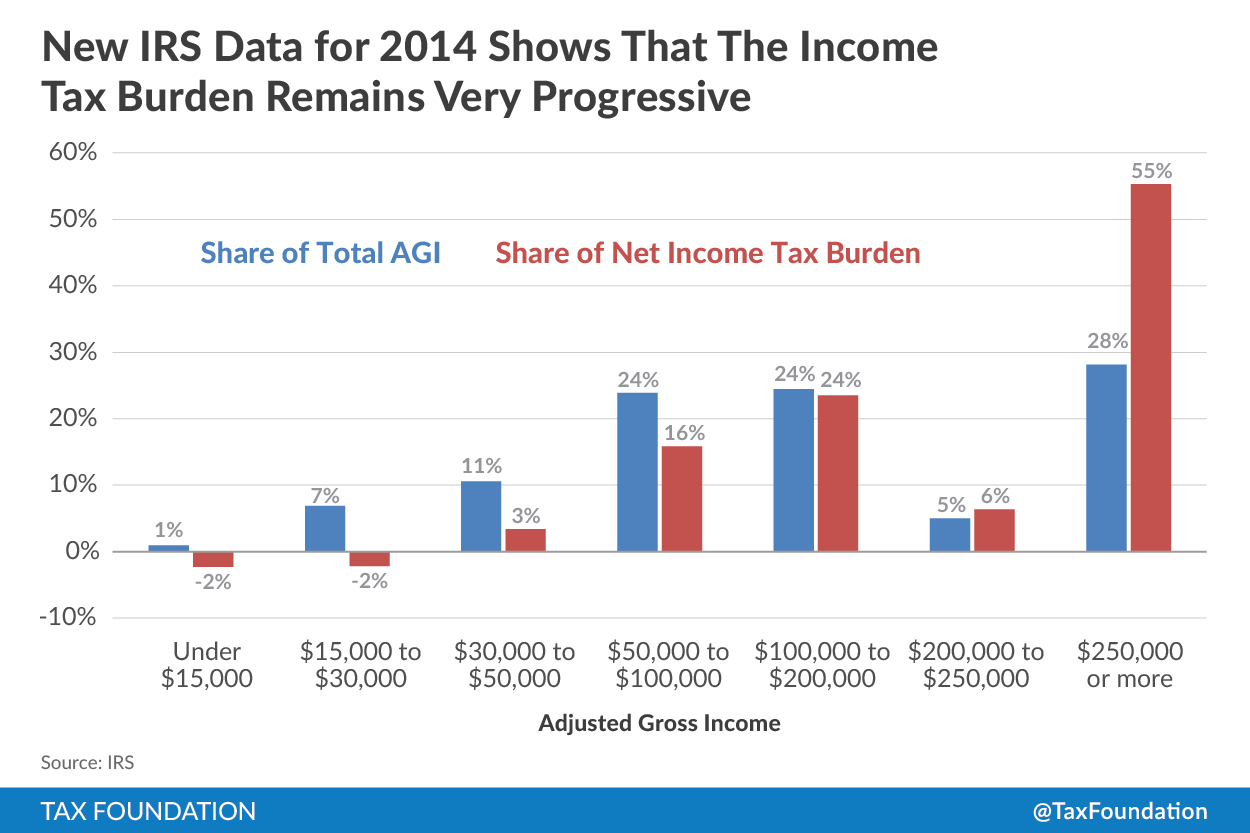

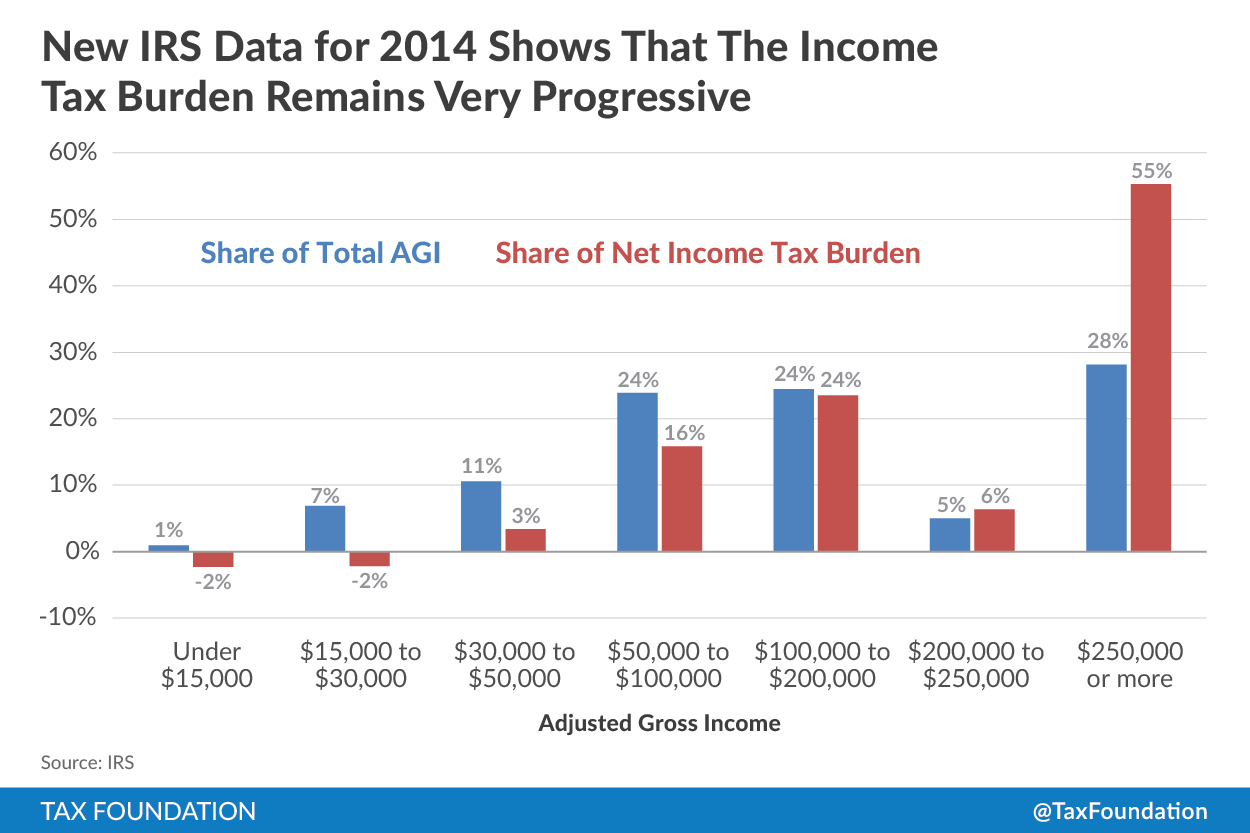

View attachment 557474

Pretty sure the "wealthy" pay more than their fair share based on the above exhibit.

View attachment 557475

Many of these tax credit programs, such as the child tax credit, also benefit middle-income taxpayers but typically don’t erase their tax liability. However, as is evident in the chart, taxpayers in the $30,000 to $100,000 range have effective tax rates in the single digits.

New IRS Data: Wealthy Paid 55 Percent of Income Taxes in 2014

The IRS recently released preliminary data for TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Year 2014. The data shows that the U.S. income tax...taxfoundation.org

Stop whining, leftists.

View attachment 557476

I am not saying Billionaire's tax. I am saying change the tax code so there are fewer loopholes. Why add new taxes?

I am less defending them but the concept. If someone pays $8bn in taxes that is pretty significant? Yes or no? Why are we so obsessed with percentages? I am also not saying I am right. I am just wondering why the vitriol is spent on them versus Congress who spends like drunken sailors?An appropriate amount would be the right amount. Why do you defend billionaires who don't f'n need more money and won't hire any more people with the extra billions you hand them carte blanche?

Trump pushed his agenda through? How did he do it? He didn't have 60%?Because changing the current tax code would never happen with McTurtle in total control of his caucus.

GOP likes what they have. Democrats do not. So why aren't they changing stuff instead of wearing Tax the Rich dresses? They control Congress and the WH? What specifically is stopping them? I am genuinely asking.

lies.So when will you support a minimum tax for Bezos, Musk and Buffett who currently pay around 1% or slightly more while small businesses pay up to 35?

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

ProPublica has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing.www.propublica.org

If you endorse the economic collapse of the United States, then a billionaire tax is aproposYes, the tax laws have to be changed .. PRONTO. In the meantime, a billionaire tax is apropos

It was both and I appreciate your honest answer. Thank you.Are you asking why they don't just raise the rates? Or why they don't clean up the code?

They don't raise the rates because they know it would cause significant economic damage. They'll probably push for it right before the 2022 elections, to ensure the effects won't occur until after.

They won't clean up the code because the byzantine mess of exemptions/incentives/rebates/penalties/etc gives Congress lots of power. Congress likes power.

Nah, that's a very Centrist idea in any other Civilized Nation.View attachment 557474

Pretty sure the "wealthy" pay more than their fair share based on the above exhibit.

View attachment 557475

Many of these tax credit programs, such as the child tax credit, also benefit middle-income taxpayers but typically don’t erase their tax liability. However, as is evident in the chart, taxpayers in the $30,000 to $100,000 range have effective tax rates in the single digits.

New IRS Data: Wealthy Paid 55 Percent of Income Taxes in 2014

The IRS recently released preliminary data for TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Year 2014. The data shows that the U.S. income tax...taxfoundation.org

Stop whining, leftists.

View attachment 557476

Many...most pay a lot more.Cool - and which billionaire or mega-corp is paying 8%?

Not a damn one!

I am on the extreme right? LOLNah, that's a very Centrist idea in any Civilized Nation. But in this one we have people like you who are extreme right, who think they are anywhere near the center.

In certain ways, yes, absolutely. In other ways, no. The only reason you think youvarent is because you live in the United States, which has a light of far right folks, when it comes to economics. Of course, you all think you are just"nornal", and any idea that doesn't please you is "far left". It's part of your coping mechanism.I am on the extreme right? LOL

You have lost your mind, leftist.

BullshitMany...most pay a lot more.

If you endorse the economic collapse of the United States, then a billionaire tax is apropos